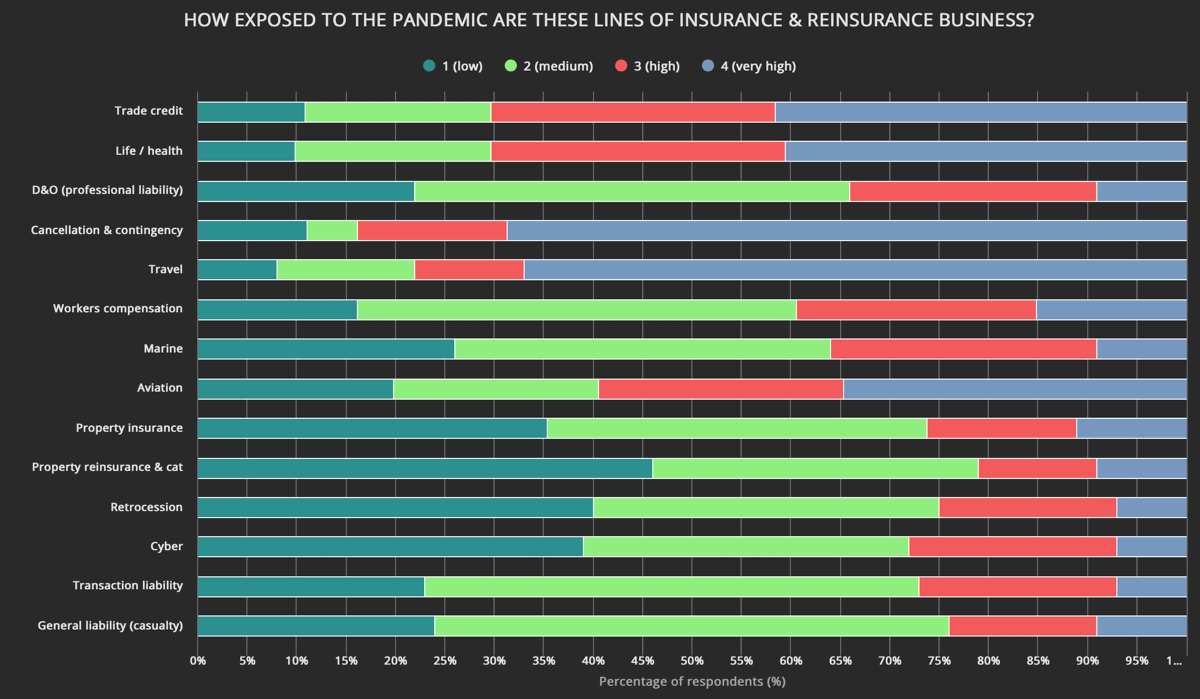

Retrocessional contracts are seen as likely more exposed to any claims that find their way through from the Covid-19 coronavirus pandemic, according to the respondents to .The results are now in from our market survey that we launched recently alongside sister publication Reinsurance News asking the insurance, reinsurance and insurance-linked securities (ILS) industry for its opinion on the market implications of the Covid-19 coronavirus pandemic.As we explained earlier this week, that concerns are particularly high in the sector regarding the ongoing legal action to force pandemic business interruption and shutdown claims related to the coronavirus into property programs.While 41% of respondents said they are a little concerned about the BI issue, .But when you look at concerns on a line of business basis, it appears that the industry would see more potential (stress potential here) exposure for retrocession than for property reinsurance or property catastrophe contracts..The expected few lines that are clearly very exposed came top, of course, led by cancellation & contingency, travel, trade credit, life & health and aviation.While reinsurance and retrocession are seen as having a much lower potential claims exposure to the pandemic, it’s interesting that retrocession is seen as more at-risk than property reinsurance.Some .This result translates well, as some retrocession covers will bundle exposures from across numerous lines of reinsurance, more than just property and catastrophe risks, meaning claims from Covid-19 could actually have a greater chance of hitting some retro program layers than property reinsurance.In addition, some retrocession transactions cover exposures such as strike, riot and commotion, which might be more strictly worded in reinsurance equivalents.In fact wordings in general can be looser in retro it seems, a fact due to the more broad coverage retrocession can provide perhaps.On the other end of the scale though, , with retro coming out a little lower at 7% of respondents, which perhaps reflects the perceived severity of claims should they flow to that line of business in bulk, rather than the risk of it happening.Our features responses from hundreds of identifiable senior insurance and reinsurance industry executives, including 13 CEO’s, 20 CUO’s, 18 COO’s, 38 senior Board members, reinsurance buyers, senior underwriting executives, ILS managers, brokers and a range of other service providers.to our readers and we’re happy to discuss the results with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector.Our global readership reached almost 200,000 individuals across Reinsurance News & Artemis in Feb 2020.

.——————————————————————— of relevance to the insurance-linked securities (ILS), catastrophe bond and reinsurance capital markets.Read Covid-19 coronavirus related news & analysis .

Publisher: Artemis