Catastrophe bonds and insurance-linked securities are one of the “very few genuinely, structurally diversifying asset classes,” according to the Neuberger Berman Insurance-Linked Strategies team, who give the asset class a positive outlook for 2021.Writing in a white paper, the Insurance-Linked Strategies team of global asset manager Neuberger Berman explain that they also believe catastrophe bonds remain attractively valued and as an asset class is set to continue growing.Catastrophe bonds, among the ILS universe, are particularly attractive to institutional investors, given they enable access to the returns of “a fundamentally uncorrelated asset class (natural catastrophe risk) in a form that is typically more liquid than most reinsurance contracts and vehicles,” the Neuberger Berman ILS team states.

The white paper paints a positive view of ILS market returns, highlighting the fact that on a risk-adjusted bases a basket of catastrophe bonds typically outperforms relevant benchmarks over the last two decades, but also highlights the prospects for catastrophe bonds going forwards.Here, the Neuberger Berman ILS team say to expect further growth, as the dynamics in insurance and reinsurance markets suggest the need for capital, while sponsors are expanding in variety and number as well.The reason the capital markets are needed in insurance and reinsurance remains fundamentally the same as it did when the first cat bonds came to market, that losses could in the future “exceed the current capital capacity of the reinsurance industry as a whole,” the white paper says.

Which the Neuberger Berman ILS team says means “there is significant scope for further growth,” of cat bonds.On top of this they highlight the entry of more “idiosyncratic” market participants, in the form of sponsors looking to find protection for well-defined risks to which they are exposed.“Given that the catastrophe bond market can be used to structure protection for a range of risks, we believe that this demand for idiosyncratic coverage could grow significantly,” the Neuberger Berman (NB) team writes.

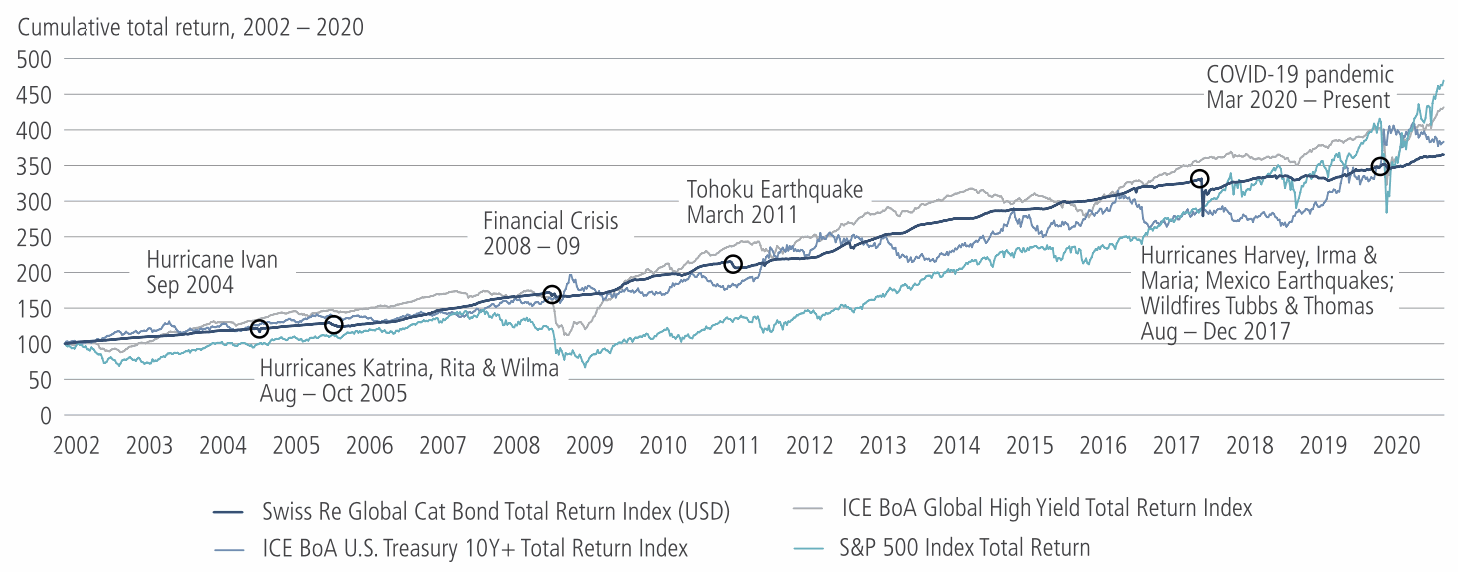

On the performance of catastrophe bonds and why they make attractive investments, the NB ILS team explain that, “The Swiss Re Cat Bond Index posted an annualized return of 7%.While this is slightly lower than high yield bonds or equities, CAT bonds have delivered significantly better risk-adjusted returns, with a Sharpe Ratio of 1.8.Correlation with other asset classes has also been low, indicating CAT bonds’ potential effectiveness as a portfolio diversifier.” The chart below is taken from the Neuberger Berman white paper, which you can access a copy of .

While the chart above shows evidence of the catastrophe losses that investors in the cat bond market have faced over the year, the NB ILS team believe investors have been “well compensated” for this.“While U.S.wind risk remains the dominant exposure in the universe, investors are increasingly able to diversify across peril, region and trigger.

This helps limit the impact of one catastrophe event on the entire index and has allowed solid performance through large loss events and high loss years such as 2017,” they further explained.Looking ahead, after a year of insurance and reinsurance market catastrophe and COVID losses in 2020, the NB ILS team says that the effects of this on pricing could now be magnified.“Several new issues over the summer of 2020 came to market with spreads at all-time highs, suggesting potential for wider CAT bond spreads to persist into 2021,” they suggest.

“The structural growth story for CAT bond issuance remains strong,” the NB ILS team believes, suggesting the high number of maturities coming up will be largely renewed, while continued market expansion into new sponsors and perils will be ongoing.These renewals of maturing bonds may also be at better pricing and terms and conditions, the investment team also noted.The future looks bright for catastrophe bonds, the NB ILS team believes, leading them to conclude that, “Entering 2021, we believe that the combination of attractive pricing following several years of high insurance losses and structural supply-and-demand dynamics will sustain CAT bond spreads at attractive levels.

Moreover, as the market continues to grow, it offers more scope for diversification and portfolio customization via different regional, peril and trigger-mechanism exposures, as well as supporting market liquidity.” You can access a copy of the full white paper .———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis