Novarica’s annual report profiles 250 InsurTechs with focus on opportunities to partner, learn, and create value Boston, MA (Sept.8, 2020) – With time horizons shortened to reflect uncertainty about the future, insurance carriers investing in or partnering with InsurTech startups appear to be focusing on tactical initiatives that can produce more immediate results than some of the more speculative R&D efforts more common in the pre-pandemic era.In its fourth annual report, InsurTech for Insurers: 250 Startup Profiles, research and advisory firm Novarica outlines the InsurTech landscape for insurers, focusing on two key questions: Does this matter to my company? And what can we learn from it? “One lesson that emerges from the 250 InsurTech startups Novarica has profiled in this report is that the insurance industry should rethink its consumer experience from every angle,” said Jeff Goldberg, Executive Vice President of Research and Consulting and co-author of Novarica’s new report.

“Across all lines of business and across all sizes, insurers will feel the impact as InsurTech startups shift customer expectations and point the way for more effective, insightful operations.” Among the key findings of the reports are: AI messaging is everywhere. Everyone’s talking about AI, but real AI is less clear.Even so, adoption of AI technologies like machine vision and natural language processing is growing across lines of business and use cases.Insurance is going beyond direct online. Many startups are rethinking distribution, bringing products to consumers rather than simply enabling a direct online purchase.

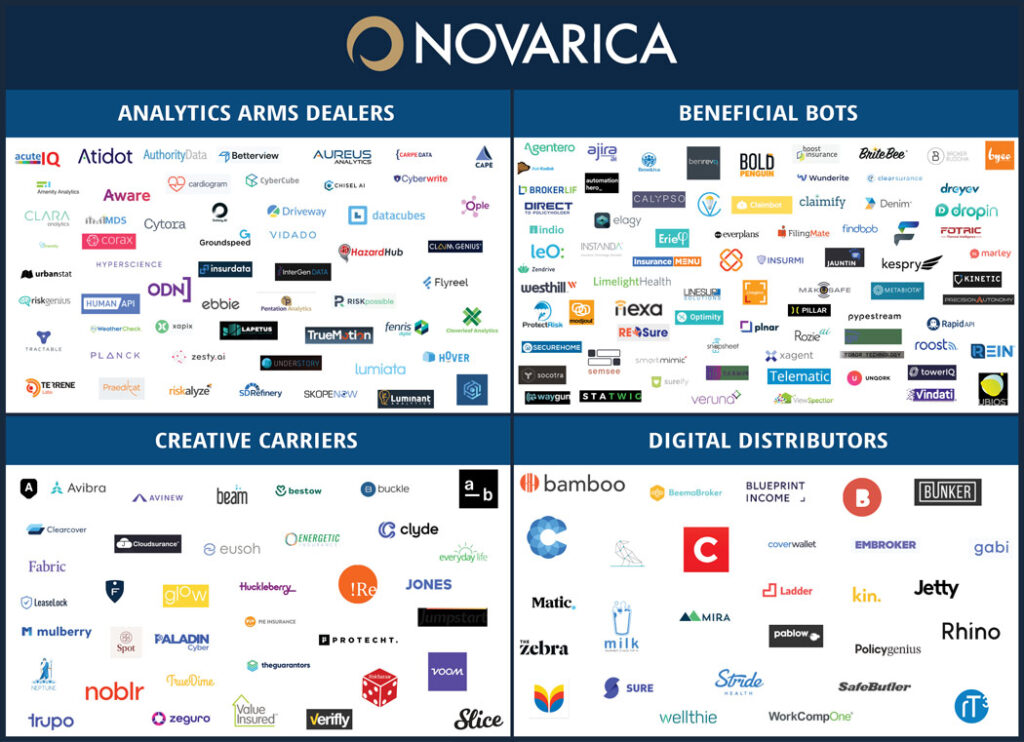

Startups previously positioned as competitors are becoming partners. Many startup “carriers” are licensing their platforms to allow insurers to develop niche products and branch into new lines of business, though the effectiveness of this pivot is yet to be proven.Click here for the table of contents or to access the report.Report Summary This report profiles 250 InsurTech startups—including Analytics Arms Dealers, Beneficial Bots, Creative Carriers, and Digital Distributors—from the point of view of their value to insurers as partners or suppliers.

While most research and media focused on InsurTech startups is written for innovators and investors, this report for insurers focuses on two key questions: Does this matter to my company? And what can we learn from it? Topics: Types of InsureTechs.Novarica categorizes the startup environment for easy classification.Engaging with InsurTech.

Additional approaches to InsurTech involvement exist for companies that are not ready to invest in a startup or startup fund.InsurTech Profiles.The 250 vendors in this report serve as a starting point for insurers learning about InsurTech.

Click here for the table of contents or to access the report.About Novarica Novarica helps more than 100 insurers make better decisions about technology projects and strategy through retained advisory services, published research, and strategy consulting.Its knowledge base covers trends, benchmarks, best practices, case studies, and vendor solutions.

Leveraging the expertise of its senior team and more than 300 CIO Research Council members, Novarica provides clients with the ability to make faster, better, more informed decisions.Its consulting services focus on vendor selection, custom benchmarking, project checkpoints, and IT strategy.For more information, visit www.novarica.com.

Tags: coronavirus, customer experience (CX), epidemic, InsurTech, market dynamics, Novarica, startup

Publisher: Insurance Canada