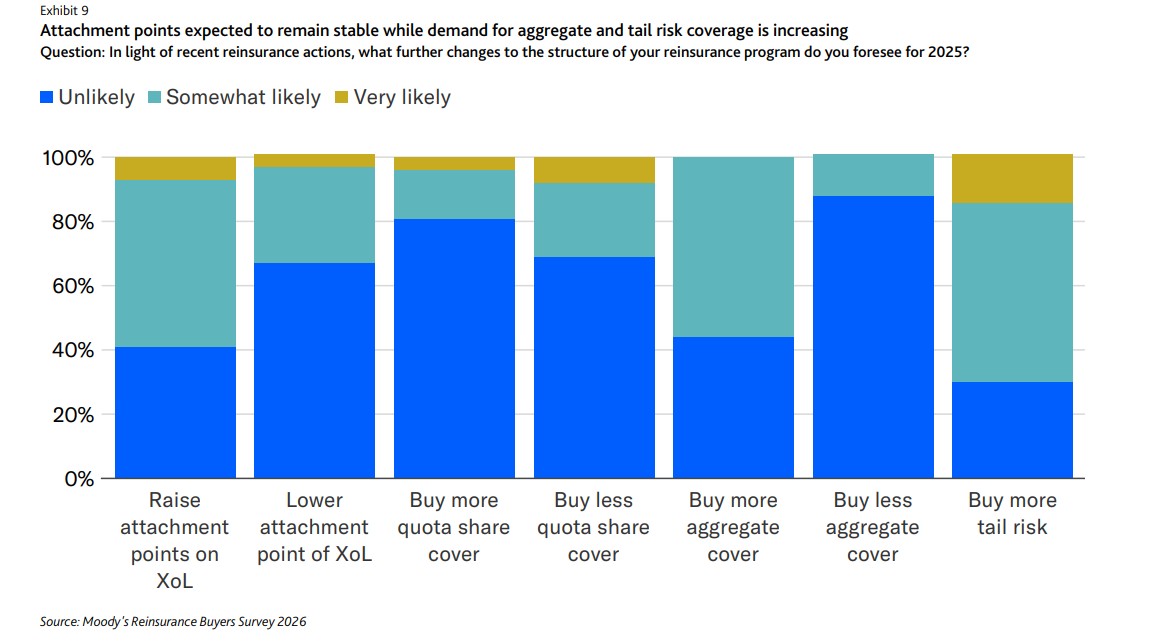

Over the next year, a vast majority of reinsurance buyers expect attachment points for their excess of loss programs to remain stable.Many also indicated interest in purchasing more aggregate reinsurance in 2026 and additional tail-risk coverage during the year, the latest survey by Moody’s Ratings shows.This annual survey conducted by Moody’s, released ahead of the Monte Carlo Rendez-Vous event, provides a key overlook of reinsurance market sentiment ahead of the busy conference season and the key January 2026 renewals.

“Although there are some signs of easing of terms and conditions in the reinsurance market, the majority of our survey participants said they expect attachment points for their excess of loss programs to remain stable in 2026,” the rating agency said.“As a result, primary insurers will continue to largely retain nonpeak losses (high frequency, lower severity catastrophe losses) such as those stemming from convective storms, wildfires and floods.In recent years, these types of events have grown as a share of total annual catastrophe losses for the industry.” As the chart below shows, a significant number of buyers expressed a desire to purchase more aggregate reinsurance protection in 2026, but it remains to be seen how much appetite sellers have for these exposures.

“Over the last few years, reinsurers largely reduced or eliminated their offerings of aggregate reinsurance covers, given substantial losses produced by these covers.Several US insurance companies have been able to secure increased amounts of aggregate reinsurance coverage this year, underscoring the increased competitive environment in the sector,” Moody’s added.As well as this, 71% of respondents also said they were likely or very likely to purchase more coverage for tail risk in 2026, and according to Moody’s, this is in line with the view by most surveyed companies that natural catastrophe risk will continue to increase.

80% of respondents also said they are unlikely to purchase more quota share cover in 2026.However, it is noteworthy that roughly 70% also expressed that they are unlikely to reduce their coverage in the upcoming year as well.Furthermore, Moody’s also revealed that its 2025 reinsurance buyers survey results support broader market signs that property reinsurance pricing has passed its 10-year peak and will continue to soften (in the absence of a major catastrophe loss) following several years of hard market conditions.

Regarding the factors contributing to the anticipated decreases in property lines pricing, 36% of participants ranked increased reinsurance capacity provided by traditional players as the main driver.In addition, 17% of survey respondents highlighted the greater availability of alternative, or third-party reinsurance capital as another contributor to lower pricing in the property space, alongside moderating loss cost trends in property lines, while another 17% feel that prices for property reinsurance coverage have been too high and will come down as a result.“Survey participants also cited moderating loss cost trends in property lines as an important contributor to price reductions.

This follows several years of rising rebuilding costs as a result of higher labor and materials prices,” the rating agency added.It is positive for providers of reinsurance capital, including for those in the insurance-linked securities (ILS) market, that buyers of protection are not anticipating dramatic changes in where attachments currently sit over the coming year..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis