This week is International Fraud Awareness Week! And, Small Business Saturday is coming up next week! Why not talk about fraud in small business? Genius.Fraud can be devastating to any size of business, especially as fraud schemes and financial matters are becoming more complex and sophisticated with continuous advancements in technology.However, did you know that small businesses lose almost twice as much per scheme as to larger businesses? According to the 2018 ACFE Report to the Nations on Occupational Fraud and Abuse, the median loss for businesses with less than 100 employees is $200,00, while the median loss for businesses with 100+ employees is $104,000.

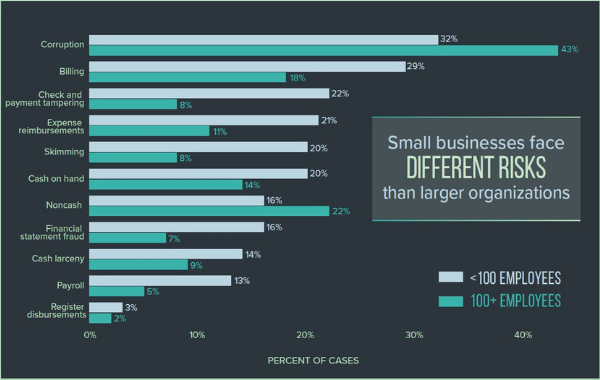

It’s also good to be aware that small businesses face different risks than larger organizations.Here’s a chart to show what type of fraud cases happen more so in small businesses.Small businesses are especially vulnerable because they often have fewer resources to protect themselves or to recover from the impact of fraud. The most cost-effective way to limit fraud losses is to prevent fraud from happening in the first place.

How does your fraud prevention measure up? This checklist below can help you test the effectiveness of your prevention methods:

Is a background check completed on all employees and references checked?

Is there a concise, written code of ethics?

Is ongoing anti-fraud training provided to employees at your organization?

Is an effective fraud reporting mechanism in place?

Is possible fraudulent conduct aggressively sought out or dealt with passively?

Are fraud risk assessments performed to identify the organization’s vulnerabilities to fraud?

Do internal audit personnel have adequate resources and authority to operate effectively?

Are regular anonymous surveys conducted to assess employee morale?

Fraud is a scary thing and can be overwhelmingly expensive for small businesses, but there are ways you can protect your company. You also can always talk to your independent insurance agent about your options for fraud coverage.Resource: https://www.fraudweek.com/resources.aspx

Share this:FacebookTwitterLinkedInMoreEmailPrintLike this:

Related

Publisher: Central Insurance Companies