Underwriting fraud costs the insurance industry billions of dollars per year in lost revenue Boston, MA (Apr.28, 2021) – The full scale of insurance fraud is unknown.By nature, fraud is intended to go undetected, and if fraudulent behavior is not discovered right away, an insurer may never know it occurred.

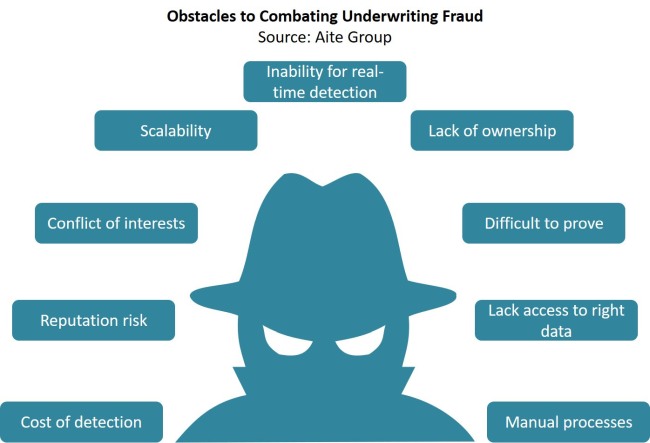

Fraud is prevalent throughout the entire insurance life cycle.Historically, the focus has been on detecting and preventing claims fraud.Today, insurance companies recognize that fraud frequently begins during the initial application process, and they are investing more in technologies to combat underwriting fraud.

This 41-page Impact Report covers the different types of underwriting fraud and the challenges with detecting this problem increasingly plaguing insurance companies.The report can also help carriers evaluate the tools, techniques, and advanced technologies that vendors have developed to prevent underwriting fraud.Clients of Aite Group’s Fraud & AML or Property & Casualty Insurance service can download this report, the corresponding charts, and the Executive Impact Deck. Click here for the online summary or to download the table of contents.

This report mentions BAE Systems, Betterview, Cape Analytics, Carpe Data, CRIF Decisions Solutions, Daisy Intelligence, Fenris Digital, Flyreel, Fraud Sniffr, FRISS, Insurance and Mobility Solutions (IMS), LexisNexis Risk Solutions, Mohawk, Octo Telematics, Quantexa, SAS, Shift Technology, Skopenow, TransUnion, TrueMotion, Verisk, and Zesty.ai. Also from Aite Group this month: Cyber Risk Decisioning: Beyond Measurement This strategy precisely measures and describes the overall costs and business impact of a cyber event Boston, MA (Apr.22, 2021) – Chief information security officers (CISOs) historically addressed cyber challenges by chasing regulatory and industry compliance, erecting defenses based on the latest technology, and quantifying risk using spreadsheets and FAIR techniques and software.

While these approaches are useful, they are not sufficient to address growing cyber risk challenges.CISOs are moving away from cyber strategies driven by compliance requirements and new technical defenses, and instead are turning the conversation to measuring and describing overall business impact.Aite Group interviewed over six CISOs of financial services firms in North America and spoke with five vendors to understand an important new trend Aite Group calls cyber risk decisioning, which measures outcomes of a cyber event in terms of how much it will cost the business.

This 13-page Impact Report contains one figure and one table.Clients of Aite Cybersecurity and Property & Casualty Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.Click here for the online summary or to download the table of contents.

This report mentions ColorTokens, NormShield, RiskLens, SSIC, and Unisys.About Aite Group Aite Group is a global research and advisory firm delivering comprehensive, actionable advice on business, technology, and regulatory issues and their impact on the financial services industry.With expertise in banking, payments, insurance, wealth management, and the capital markets, we guide financial institutions, technology providers, and consulting firms worldwide.

We partner with our clients, revealing their blind spots and delivering insights to make their businesses smarter and stronger.Visit us at www.aitegroup.com.Tags: Aite Group, Cape Analytics, cyber security, fraud, FRISS, Insurance & Mobility Solutions (IMS), LexisNexis Risk Solutions, Octo Telematics, Property/Casualty (P&C) insurance, SAS, Shift Technology, Underwriting, Verisk, Zesty.ai

Publisher: Insurance Canada