More insurers are using data, AI, predictive analytics, and business rules to make better underwriting/pricing decisions: Aite-Novarica Group Boston, MA (July 27, 2021) – With growth as a primary objective, commercial lines insurers are differentiating themselves with distribution management improvements, expansion into new geographies, and growing their underwriting appetites.In a new report, Business and Technology Trends: Commercial Lines, research and advisory firm Aite-Novarica Group provides an overview of commercial lines insurer business and technology issues, data about the marketplace, and over 15 examples of recent technology investments by commercial lines insurance carriers.“As more business processes become digitized, commercial lines insurers have access to more data they can analyze with more powerful tools,” said Martina Conlon, Executive Vice President of Research and Consulting and co-author of Aite-Novarica Group’s new report.

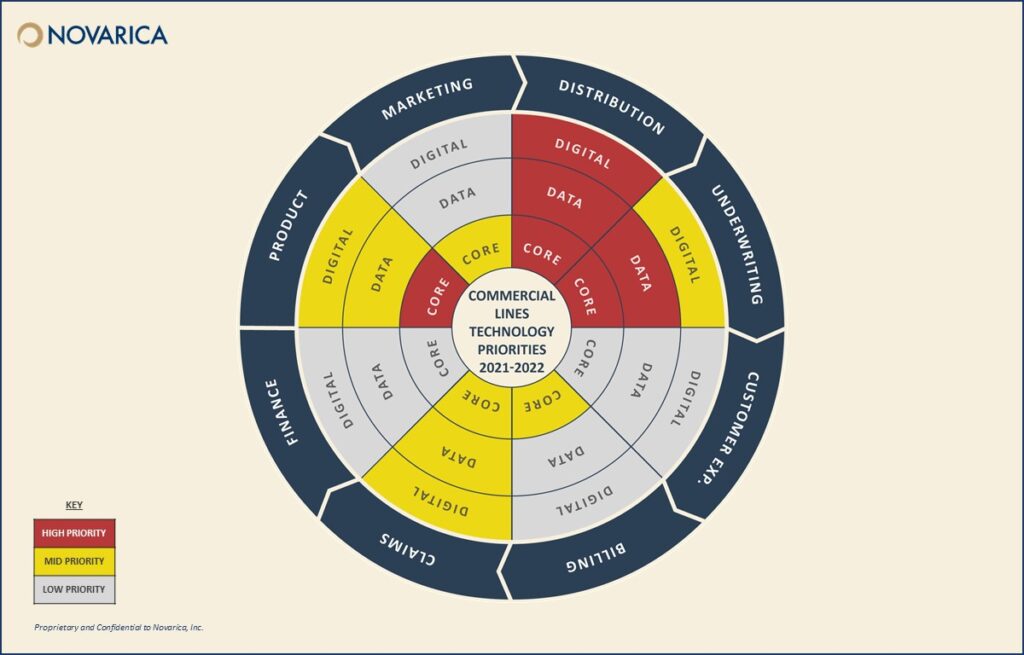

“Once insurers have business intelligence tools in place, they are using models to improve underwriting insights, apply pricing more consistently, and improve claims activities.” Among the key findings of the reports are: Commercial lines insurers continue to invest most heavily in distribution across digital, data, and core. Support for agents remains key to customer acquisition and retention, and direct sales capabilities will grow more important for small business products and program business.Insurers are leveraging new data sources, especially in underwriting and claims. Insurers are obtaining data from drones, IoT, and telematics for automotive and commercial property lines in addition to data from external third-party data providers, including web and social media data aggregators, for all lines of business.Commercial lines insurers are increasingly adopting AI and analytics. Insurers are using them in claims, customer service, and underwriting to improve claims outcomes, augment customer satisfaction, and optimize risk selection and pricing.

Click here for the online summary or to download the table of contents.Report Summary Commercial lines insurers continue to raise rates, seek growth through expanded jurisdictions and new products, and adopt analytics more broadly.Insurers want to drive down the cost of service, refine pricing and underwriting, and pursue growth.

COVID-19 poses revenue and loss risk for certain lines of business, but insurers report limited changes to their business and technology strategies.This report provides an overview of commercial lines insurer business and technology issues, data about the marketplace, and over 15 examples of recent technology investments by commercial lines insurers.Topics: Recent market and financial trends Active insurer landscape Technology issues, priorities, and examples by functional area Top technology priorities for 2021 and beyond Click here to access the report.

About Novarica Novarica helps more than 150 insurers make better decisions about technology projects and strategy.Its research covers trends, best practices, and vendors, leveraging relationships with more than 300 insurer CIO members of its Research Council.Its advisory services provide enterprise phone and email consultations on any topic for a fixed annual fee.

Consulting services range from assessments and strategic roadmaps to vendor evaluations.For more information, visit www.novarica.com.Tags: Aite Group, commercial lines, growth, Novarica, trends

Publisher: Insurance Canada