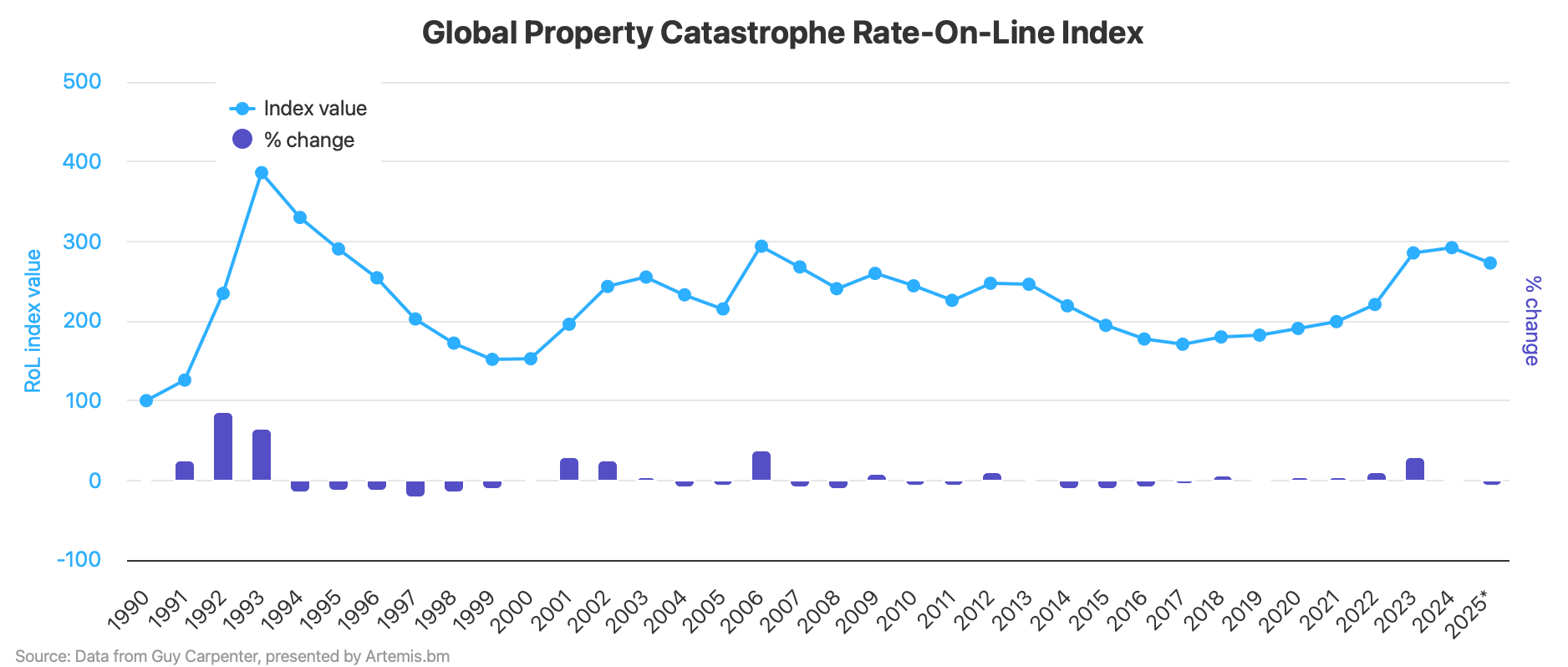

Property catastrophe reinsurance rates declined across the globe at the January 1st 2025 reinsurance renewals, with broker Guy Carpenter’s rate-on-line indices for the world, US, Europe and Asia Pacific all falling to start the new year.For the majority of the indices, it is the first decline in property catastrophe reinsurance rates-on-line seen since 2017, which was the bottom of the last soft market.Since then, reinsurance rates have risen steadily at property catastrophe renewals.

But fortunes reversed at 1/1 2025, as excess capacity and strong reinsurer and ILS market appetites to capitalise on still historically high rates, resulted in a softening market.The one exception is Asia Pacific, where after a rebasing and re-evaluation of the data for the rate-on-line (RoL) Index for that region, Guy Carpenter’s data now shows a decline occurred there in 2024 as well.First, the Guy Carpenter Global Property Rate on Line Index, which is a proprietary index of global property catastrophe reinsurance Rate-on-Line movements, on brokered excess of loss placements, that has been maintained by Guy Carpenter since 1990.

The Global Property Rate on Line Index fell by 6.6% at January 1 2025 renewals, its first decline since 2017.The pace of change for the Global property catastrophe reinsurance index had slowed considerably in 2024.It had gained 29.3% in 2023, then for full-year 2024 the gain was just 2.3%, as the reinsurance market stabilised.

Now, after declining 6.6% at January 2025, this index remains at its highest level since 2007, apart from the last two years.In fact, notably, this Index of global property catastrophe reinsurance pricing remains up by 60% since its last low in 2017, reflecting still strong pricing in reinsurance.Alongside still elevated attachments and tighter terms, this does imply another year of strong returns is possible in 2025, catastrophe loss activity allowing.

You can : In the United States, property catastrophe reinsurance rates-on-line moved slightly less than the global measure, although it should be remembered that the January reinsurance renewals don’t see as much US activity as the mid-year contract signings, so this next index will also be updated then.The Guy Carpenter U.S.Property Rate on Line Index, which measures US property catastrophe reinsurance Rate-on-Line movements, on brokered excess of loss placements, and tracks the data back to 1990 as well, fell by 6.2% at 1/1 2025.

Again, for the U.S.Index, this is the first decline since 2017, as it had recorded rate increases every year since then.US property catastrophe reinsurance rates remain at a historically very attractive level, as the only two years where the index value was higher were 2024 and 2023.

Since 2017, the cumulative increase of the US property catastrophe reinsurance rate-on-line (RoL) Index is around 94.4%, even after this decline seen at January 2025.This indicates a near-doubling of property catastrophe reinsurance rates-on-line for US buyers since that time and still profitable underwriting conditions for reinsurance firms and capital market or ILS fund players.You can : Guy Carpenter has also updated its Europe and Asia Pacific property catastrophe reinsurance rate-on-line indices, with both of these also declining at the 1/1 2025 renewals.

Continental European property catastrophe reinsurance rates-on-line decreased by 5.3% at the January 2025 renewal season, while in Asia Pacific (APAC), property catastrophe reinsurance rates fell by 7.2% at January 1st 2025.As we said, the APAC index has been rebased and also re-calculated with the latest data, now showing it declined for full-year 2024 as well.The Continental European property cat RoL Index remains up by 65% cumulatively since the soft catastrophe reinsurance market bottomed out in 2017.

While the APAC RoL Index is only up 32% since the market bottomed out in 2018 for this region.You can : With the property catastrophe reinsurance market having softened widely at January 1st 2025, the market will now be watching closely how these indices move at the remaining renewals this year.Markets will be looking for some stabilisation or a slowing of these declines as the year progresses.

Although, at this stage and watching how pricing has been moving in the insurance-linked securities (ILS) market, it does seem some further declines may be possible for each of the regions and global indices, if capital continues to build-up in the marketplace.Property catastrophe reinsurance rates-on-line remain at very attractive levels, which combined with the changes to attachments and terms, can make for a very profitable environment to enter this area of reinsurance, which could continue to attract capital as we move through 2025...

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis