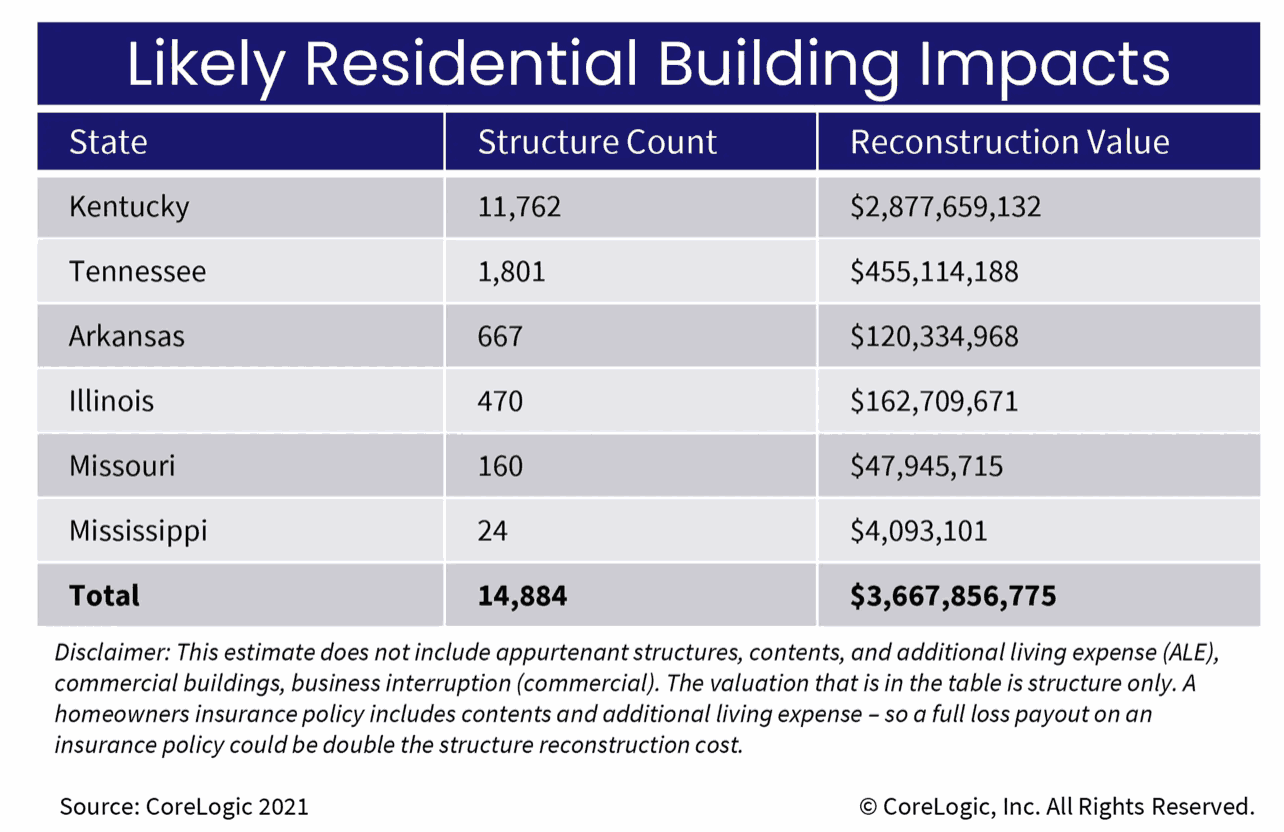

Preliminary data from CoreLogic shows that properties with a reconstruction value of almost $3.7 billion were exposed to the tornado outbreak at the weekend, with $2.9 billion in Kentucky alone.As a result, the company said yesterday that insurance and reinsurance market losses would be in the billions, with the majority in Kentucky.This aligns with .

CoreLogic explained that, “Kentucky had 11,762 residential structures impacted and likely destroyed, with a total reconstruction value of $2.9B.“This valuation, and the values listed in the table below, are for the structure only.A homeowners insurance policy includes contents and additional living expense – so a full loss payout on an insurance policy could be double the structure reconstruction cost.” Add in the commercial insurance impacts, to businesses, factories, warehouses and other facilities damaged by the tornadoes and severe convective storms and it’s easy to see the eventual insurance and reinsurance market loss rising.

After Kentucky, with its $2.9 billion of reconstruction costs exposed, Tennessee is next with $455 million of exposed construction value.CoreLogic noted that December is late in the year for such tornado outbreaks, but that 2021 tornado incidence is now approaching the 3-year trailing average of annual tornado occurrences.“The event this weekend reminds us it is not the frequency of events in a year that drives the loss, but the intensity and the location of the event that drive the loss,” the company explained.

– – – – – – – ———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis