A very strong September return across the group of UCITS catastrophe bond fund’s tracked by the has taken the average return for the year to October 4th to an impressive 10.6%, although hurricane Milton will dent this slightly once the storm is accounted for.Having averaged a 2.15% return for just slightly over the full month of August, the group of UCITS catastrophe bond funds followed that up with continued strong performance, of a 1.88% average return for the period September 6th to October 4th 2024.Across that period, the lower-risk group of catastrophe bond funds delivered an average return of 1.72%, while the higher-risk group delivered a 1.98% average performance.

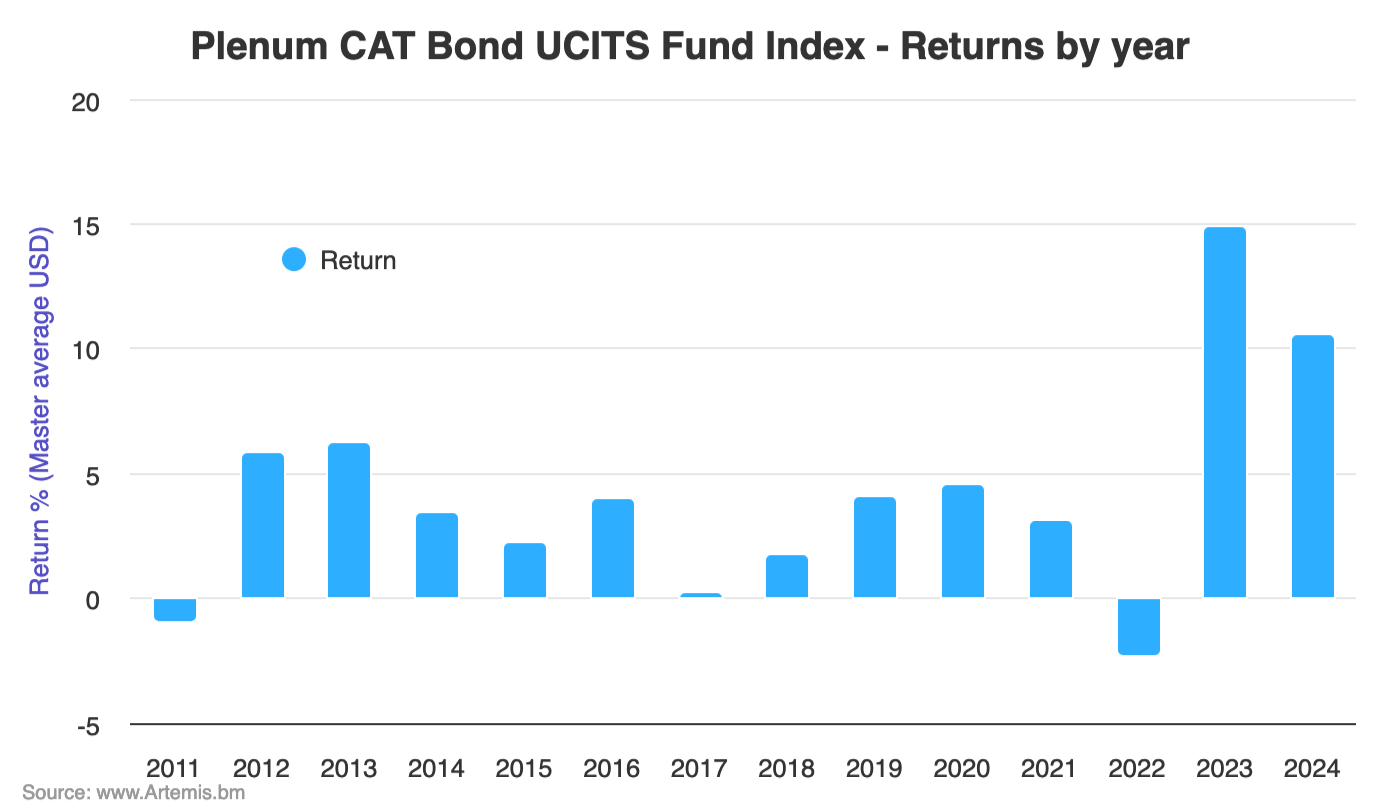

If you extend the period slightly to cover the full month of September, from August 30th’s pricing of the Index to October 4th, as it is priced only weekly, the average return of the UCITS cat bond funds reached an impressive 2.27%.Year-to-date, to October 4th 2024, the average return of the UCITS catastrophe bond funds had reached 10.60% Analyse cat bond fund performance using the , which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies.Click on the chart below for an interactive version and index development by week: The year-to-date return for the low-risk cohort of UCITS cat bond funds has reached 10.35%, while for the high-risk cat bond funds it reached 10.74% at October 4th.

On a rolling twelve-month basis, the performance of the UCITS catastrophe bond funds reached 13.24% on average at that point, while the capital weighted version of the index hit 13.80%.While still running behind the record returns seen in 2023, the performance of the UCITS cat bond funds remains very attractive on a historical basis.Mark-to-market impacts and any losses from hurricane Milton will need to be incorporated into this cat bond fund index over the next month, but even then the performance will remain well-above the historical averages over the 12-month period, it seems.

We expect cat bond funds to mark-down from less than 1% to around 2.5% for the highest-risk and most concentrated strategies, based on and on the specific movements in certain cat bonds exposed to Milton.Given 12-month rolling returns are already running well-ahead of the historical full-year average for the Index, Milton will not dent investor appetite for catastrophe bond investments, we believe..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis