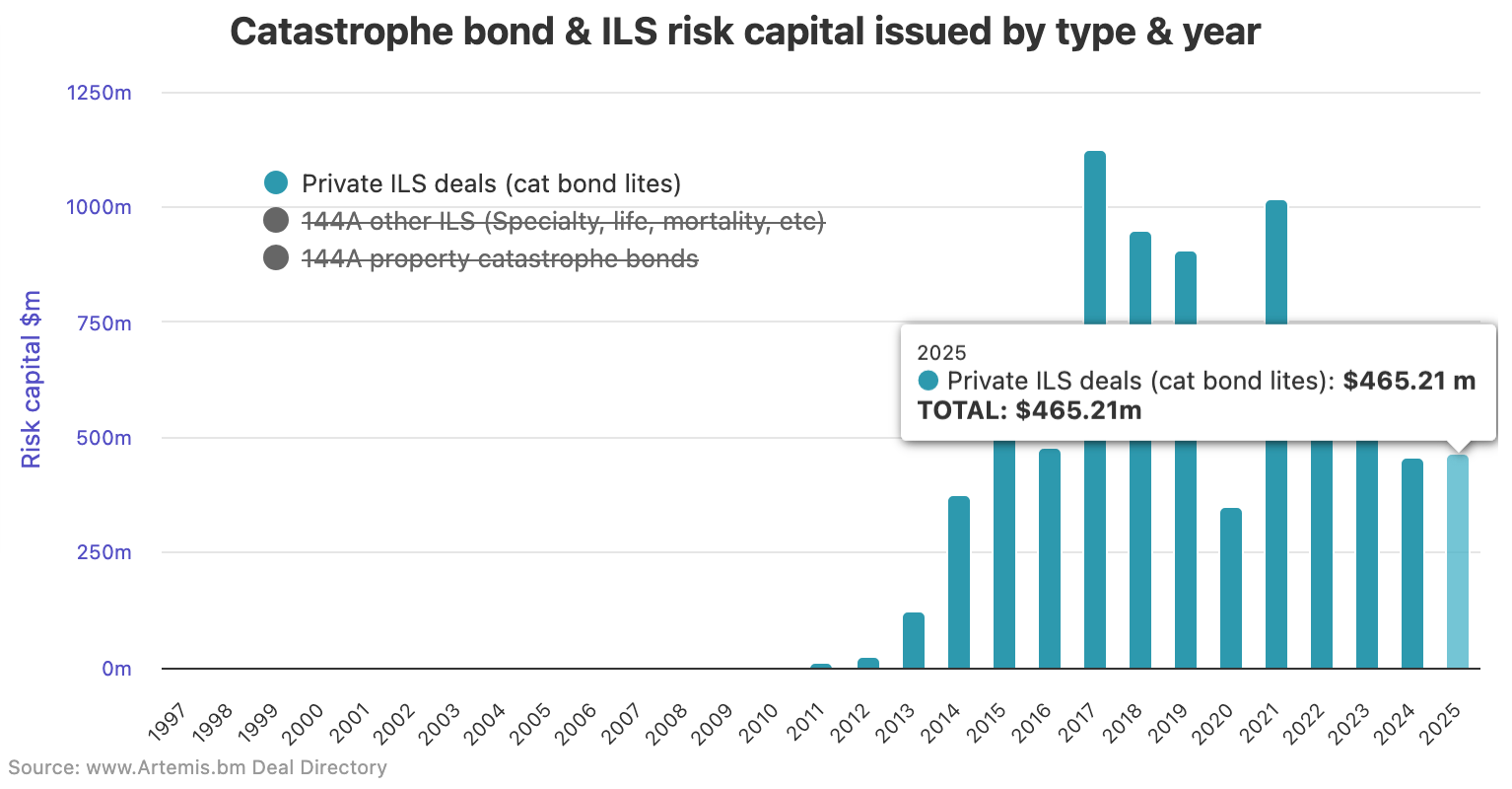

has now surpassed the full-year total from 2024, as three new series of notes issued by the Eclipse Re Ltd.transformer vehicle have come to light and taken this year’s figure to over $465 million.2024 saw a dip in the volume of issuance coming from private catastrophe bonds, or cat bond lite structures, that we recorded during the year.That doesn’t reflect full issuance of these types of insurance-linked securities (ILS) deals though, as we can only report on those we see details of and a lot of these smaller ILS issuances are very privately transacted and placed with investors.

The full-year 2024 total for private cat bonds tracked by Artemis was $455.52 million.But, thanks to a resurgence in the number of deals we’ve seen in 2025 and three new cat bond lites from Eclipse Re, .You can view the details of every private cat bond issuance we’ve tracked .

Boosting the private cat bond total for 2025 to a higher level than the prior year, we’ve seen three new series of notes totalling $24.4 million from the Eclipse Re Ltd.private insurance-linked securities (ILS) and collateralized reinsurance transformer and issuance platform.Eclipse Re Ltd.

is a Bermuda domiciled special purpose insurer (SPI) and segregated account platform, which is owned and operated by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions.Eclipse Re enables the efficient issuance of private catastrophe bonds, typically to help sponsors access the capital markets by providing a function as a risk transformation structure, operating on behalf of ILS fund managers and investors.These can be specific cedent focused risk transfer deals, slices of reinsurance tower participations being securitized, or even the securitization of ILS fund hedges.

Details are limited, given the private nature of these cat bonds so we can’t be certain of the motives or exact structures featuring in these deals., which we assume cover some type of property catastrophe reinsurance or retrocessional perils for an unknown cedent.The $4.7 million of Series 2025-3A notes have been issued on behalf of Eclipse Re’s Segregated Account EC0069.

, which again we expect cover some type of property catastrophe reinsurance or retrocessional perils for an unknown cedent.The $14.7 million of Series 2025-5A notes have been issued on behalf of Eclipse Re’s Segregated Account EC0074.In addition, , which we make the assumption cover similar property catastrophe risks for an unknown counterparty.

The $5 million of Series 2025-7A notes have been issued on behalf of Eclipse Re’s Segregated Account EC0076.All $24.4 million of private cat bond notes across the three series issued by Eclipse Re have the same final maturity date of May 31st 2026.Given the maturity date, we anticipate all three series represent a securitization of a one year or less duration reinsurance or retrocession arrangement by Eclipse Re, likely a transaction or slices or reinsurance tower participation from around the mid-year renewal season.

As is typical, we presume these issuances feature a reinsurance or retrocession arrangement that has been transformed using the Eclipse Re structure, to create and issue a series of investable, securitized catastrophe bond notes, normally for an ILS fund manager or investor portfolio.Information is not available as to what the underlying trigger(s) or peril(s) are for private catastrophe bonds like this, but we suspect they represent some kind of property catastrophe related risk.The proceeds from the sale of the $24.4 million of private cat bond notes across the three series of private ILS notes issued by Eclipse Re will likely collateralize a related reinsurance or retrocession contract, with funds held in a trust, enabling the risk transfer and the creation of investable catastrophe-linked securities.

As said, including these latest $24.4 million of private catastrophe bond from Eclipse Re, .Private cat bond issuance has been climbing through recent months, now lifting the 2025 total to a level that surpasses the prior year.But, cat bond lites in 2025 still lag behind bigger years such as 2021 and 2017, when private cat bond issuance tracked by Artemis had surpassed the billion dollar mark.

.2017 was the record year for private cat bonds tracked by Artemis, at just .View the details of every private cat bond issuance we’ve tracked .

.You can ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis