Picture this scenario: you arrive at your business one morning, only to find out that it’s been broken into.Oh no! You should call the police to help you out, and you should call your insurer to file a claim.They can help you recover lost goods and money so you can get your business back up and running again.

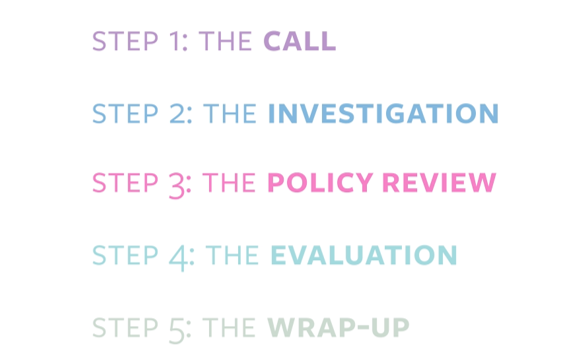

But what happens when you file an insurance claim? Get the inside scoop on what you need to know about the insurance claims process from the video above.You can also check out the steps below.Enjoy! Step 1: Get in touch with us After you’ve dealt with any emergencies, you can go to our claims page to submit a claim online or give us a call.

We’ll ask you to provide us with details on items that have been lost or damaged.If you have receipts, invoices, and photos of the incident, they may be helpful.The more information you can share with us, the better! Step 2: The investigation Once you have filed your claim, a claims adjuster will give you a call to start investigating.

Think of them as your dedicated claims detective.They’ll confirm details about the incident, highlight how the claims process works, and help you determine the damages that are covered by your insurance policy. Step 3: The policy review Once the investigation is complete, your claims adjuster will review your policy with you.They’ll comb through the details and determine what items can be recovered under your current policy. Step 4: The evaluation Your adjuster will evaluate the extent of the damage from the incident.

They may call in an appraiser, engineer, or contractor to provide some expertise.If repairs are needed, your adjuster will provide you with a list of trusted vendors who can help you out.This can save you a lot of time you might have otherwise used to do research. Step 5: The wrap-up Once all the repairs are complete and any lost or damaged items have been replaced, your adjuster will contact you to discuss your settlement and payment.

We’ll make sure you’re satisfied with any repairs before closing your claim.

Need to protect your business? We’re here for you!

It’s important to remember that every claims situation is different.Whether you’re a contractor or a retailer, we can help! The one thing that’s consistent for all of TruShield’s customers is our commitment to ensuring your claim is handled as professionally and fairly as possible.Learn more about TruShield business insurance today!

Folks like you have also read:

Need to file an insurance claim? Here’s what you need to know.

Get rid of stress with express claims!

Getting the right insurance for your small business

Publisher: TruShield Insurance