New report provides an overview of reinsurers’ business and technology issues, and examples of recent technology investments made by reinsurers: Aite-Novarica Group Boston, MA (Mar.8, 2022) – The voluntary benefits market has become more attractive as responsibility has shifted from employer to employee for many non-medical, health-related insurance products.As plan sponsors want to drive out costs, insurance carriers must execute the basics—benefit and policy administration, enrollment, case installation, marketing, and product design—while driving greater efficiency.

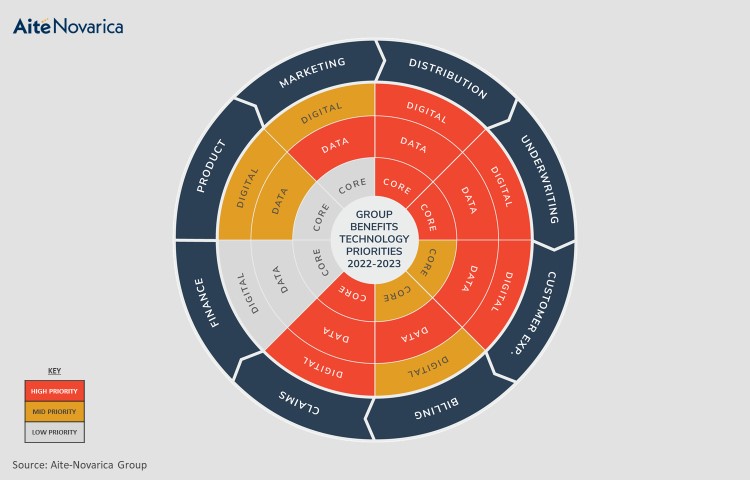

In a new Impact Report, Business and Technology Trends: Group Life and Voluntary Benefits, research and advisory firm Aite-Novarica Group provides an overview of group life and voluntary/worksite carriers’ business and technology issues, data about the marketplace, and more than 10 examples of recent insurer technology investments.“Insurance carriers cannot control which enrollment systems benefits brokers and enrollment specialists support,” said Nancy Casbarro, Senior Principal at Aite-Novarica Group.“Being able to exchange data among brokers, enrollment specialists, carriers, and plan sponsor systems, leveraging AI-related technologies for data extraction, is a potential source of competitive differentiation.” “If insurers prioritize core systems that support analytics across and within groups,” adds Steven Kaye, Head of Knowledge Management at Aite-Novarica Group and co-author of the new report, “then vendors can identify potential opportunities to support data enrichment efforts to help carriers understand plan participant behavior and future-state product development opportunities.” Click here to access the report.

Report Preview Group and voluntary benefits introduce accident, health, disability, and life insurance to many employees, especially younger generations in the workforce who may not purchase coverage through traditional individual market channels.Offering group life, disability, and voluntary/worksite products allows plan sponsors—typically employers or associations—to provide plan members (i.e., employees) with entry-level access to important benefits they might not otherwise purchase as independent offerings.Group and voluntary/worksite insurance carriers must execute the basics and continue to drive greater efficiency.

This report provides an overview of group and voluntary/worksite carriers’ business and technology issues, data about the marketplace, and more than 10 examples of recent insurer technology investments.This report is part of a series on key business and technology trends in specific lines of business in the U.S.insurance industry, and it draws from conversations with Aite-Novarica Group clients and Insurance Technology Research Council members, as well as secondary published sources.

This 42-page Impact Report contains two figures and two tables.Clients of Aite-Novarica Group’s Life, Annuities, & Benefits service can download this report and the corresponding charts.Click here to access the report.

This report mentions Aflac, American Fidelity, Ameritas, Assurity, Bank of America, Beazley Benefits, Beazley plc, Cambia Health Solutions, CareQuest Institute for Oral Health, Centerbridge, Clearwater, CNO, Combined A&H Group, Continental Insurance Group Ltd., Dentist Direct, Direct Access, Ease, Empyrean, Fidelity, FINEOS, Globe Life Inc., HC2 Holdings, Independence Holding Company, Life & Specialty Ventures, LifeMap, MetLife, MG Capital Management Ltd., Mphasis, Mutual of Omaha, Noyo, Ontario Teachers Insurance Plan, Optum, PlanSource, Principal Financial, Prudential Financial, Quadient, Reed, Regence, Reliance Standard Life Insurance Company, Renaissance Life & Health Insurance Company of America, Securian Financial, Sedgwick, The Standard, Standard Security Life Insurance Company of New York, Sun Life Financial, TIAA, Transamerica, Trustmark Voluntary Benefits, Unum, Vitech, Voya, and VSP.About Aite-Novarica Group Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them.Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts.

For more information, visit aite-novarica.com.Tags: Aite-Novarica Group, benefits, commercial lines, Fineos, Quadient, reinsurance, technology investment, trends

Publisher: Insurance Canada