Artemis’ data on the catastrophe bond market shows that excess spreads, so the return available above expected loss, of new issuance so far in 2020 is now back at levels last seen in 2012/13.The market for catastrophe bonds and related insurance-linked securities (ILS) has already broken records in 2020, with more set to fall.Earlier in November, our saw a first record broken as .

Then, just over a week ago, .This issuance is in part being driven by investor demand and appetite, as well as the hardening of traditional reinsurance and retrocession pricing, which together are making catastrophe bonds and other ILS an effective alternative source of capacity for re/insurers and also corporates seeking risk transfer.Of course, rates and pricing in the ILS market for catastrophe bond and other forms of collateralised coverage are also rising, which has now driven excess spreads and, in general, the return potential of the ILS market, back to levels not seen for some years.

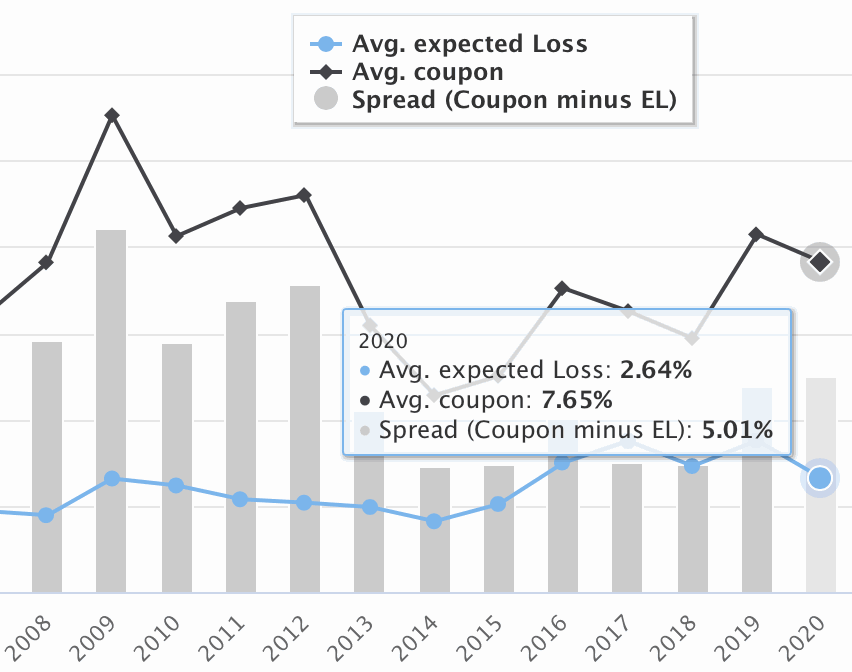

Higher coupons and pricing for issued tranches of notes, while the levels of risk in the market have not risen dramatically, as measured by expected losses, means that the excess spread (or gap between expected loss and coupon) has widened considerably, as the image below shows (click the image, or here, for our interactive chart).These aren’t weighted spreads, just the average coupons (coupon only, no floating rate return included) and expected losses of issued tranches of catastrophe bond notes that we have collected the data on over the years.The excess spread of catastrophe bonds in 2020, or gap between expected loss and coupon, is now back at a level not seen since 2012.

The same effect is visible in our chart displaying the average multiple at market of catastrophe bond issuance by year, with the multiple in 2020 the highest seen since 2013.Higher reinsurance pricing is clearly visible in the data we have tracked on catastrophe bond issuance this year, resulting in some of the best catastrophe bond investment conditions for years.These are just two of .

Stay tuned to Artemis for news of every catastrophe bond and related ILS transaction that comes to market, as well as other ILS structures including .You can view information on every catastrophe bond ever issued, totalling over 700 deals, in the .Keep up-to-date with the make-up of the catastrophe bond and ILS market using the , designed to be a simple and effective tool providing key on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis