Agtech leader digitally transforms insurance businesses by pairing field-centric data with intelligent automation and predictive analytics, cultivating new service-driven revenue streams Virden, MB (June 9, 2020) — Farmers Edge, a global leader in digital agriculture, today announced a wave of new insurance agency partnerships with 25 companies in the United States, spanning the Mid-Atlantic to the Pacific Northwest.Farmers Edge is steering the evolution of crop insurance by equipping each agency with access to a vertically integrated farm risk management platform—FarmCommand—that digitizes core insurance services and creates a superior data-driven experience for growers and agents alike.FarmCommand includes a suite of digital tools to enhance data management for growers, giving them the option to share information with their agent to automate acreage reporting and claims.

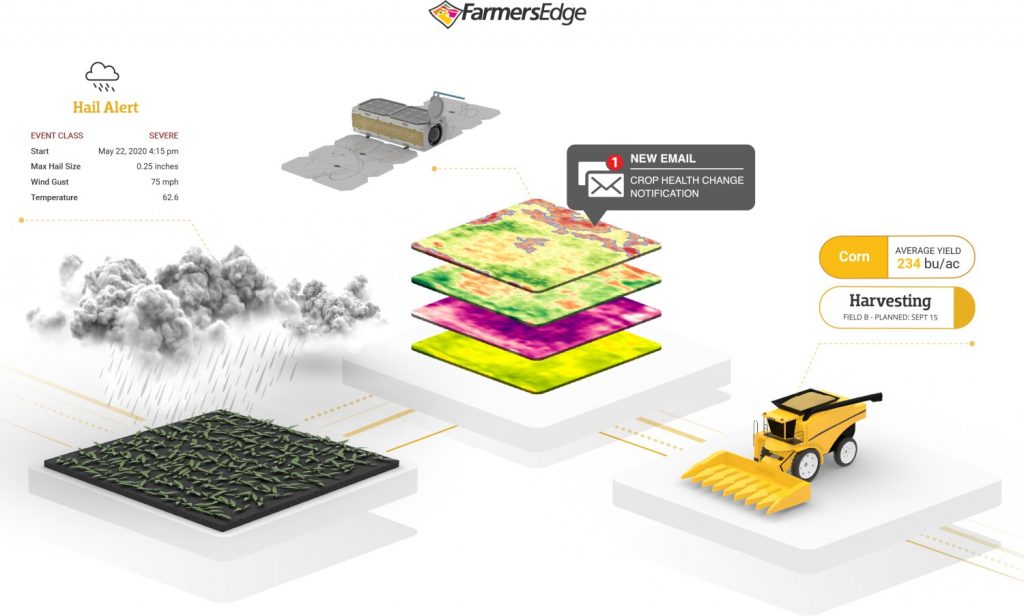

Powered by in-field sensors and artificial intelligence, the platform integrates all data into one place and transforms it into actionable insights.FarmCommand is equipped with severe weather forecasting, hail detection technology, highly accurate predictive crop models, digital scouting tools, Daily Satellite Imagery, and crop health change notifications, enabling users to optimize crop production and easily monitor an unlimited number of fields from anywhere.Additionally, the platform includes Smart Claim and Smart Reporting, bridging the gap between field data collection and reporting.

“Data is the great disruptor in agriculture and by establishing a seamless digital connection between growers and insurance agents, its impact is magnified,” said Wade Barnes, CEO and co-founder of Farmers Edge.“It’s gratifying to see our vision of a fully connected agricultural ecosystem come to life; by working together, we’re creating new opportunities for growers to access premium coverage, and in many cases, help them access coverage for the first time.Our unique digital infrastructure and turnkey approach gives our partners the tools they need to enhance connectivity with their customers and generate new revenue opportunities for their business.” “This partnership is critical to our digital transformation, shifting our agency from selling policies to providing premium insurance solutions,” said Janet Windish, owner of Windish Insurance.

“We’ve built our business by having a deep understanding of our customers’ farms and the wealth of data-driven insights we will gain through FarmCommand will be a game-changer for us.” For insurance agencies interested in learning more about how to leverage the power of FarmCommand, please visit FarmersEdge.ca/risk-management/ or contact [email protected] for more information.About Farmers Edge Farmers Edge is a global leader in digital agriculture that delivers cutting-edge solutions powered by a unique combination of field-centric data, artificial intelligence, and complete integration.Since 2005, Farmers Edge has transformed the industry with disruptive technologies and strategic partnerships designed to enhance connectivity across the entire agricultural ecosystem.

With the most comprehensive data management platform on the market–FarmCommand–Farmers Edge is revolutionizing the way farmers, agricultural professionals, and agri-businesses interact with data.Moving at the speed of digital with an elite team focused on innovation, machine learning, and IoT, Farmers Edge is creating new opportunities for all stakeholders, shaping the future of agriculture worldwide.To learn more about Farmers Edge, visit FarmersEdge.ca or FarmersEdgeUSA.com.

Backgrounder: Farmers Edge Launches First-of-Its-Kind InsurTech Platform for Agriculture InsurTech platform delivers seamless access to field-centric data, automated processes, advanced claim analytics, and cognitive reporting, creating a new digital connection between insurance providers and growers Winnipeg, MB (July 23, 2019) — Farmers Edge today announced the agriculture industry’s first InsurTech platform that combines field-level data, remote sensing, AI-driven models, and secure automation technology designed to deliver new levels of efficiency and transparency for both insurance providers and growers.Connecting automated insurance reporting and claim filing tools to FarmCommand – a leading farm data management platform – Farmers Edge is transforming traditional crop insurance to create a more streamlined, digital experience for all stakeholders.Digital disruption is happening across agriculture; this means growers are demanding digital solutions from trusted partners that can be easily integrated into all systems connected to their farm.

The insurance industry will need to adapt to the demand for customized insurance solutions to stay competitive and retain customers.Adding another layer of value to FarmCommand, the InsurTech platform includes the release of two new solutions: Smart Claim and Smart Reporting to meet these changing needs and bridge the gap between field data collection and reporting.For growers, the platform opens the door for smarter coverage selection, innovative private products, and simplified acreage and production reporting.

Growers will now have the option to share data directly through FarmCommand, saving time and eliminating data losses.For insurance providers, the InsurTech platform offers visibility into each farm operation for better risk management and lowered administration costs through automated claim prediction, detection, estimation, adjudication, and reporting.With over 291 million insured acres in the United States, this enhanced digital connection allows insurance providers to access new revenue streams and improve customer relationships through private, value-added products and personalized protection that matches each farm operation with the right risk mitigation plan.

“The InsurTech platform represents the natural evolution of connected farming and is a landmark milestone for the agriculture and insurance industries,” said Wade Barnes, CEO and co-founder of Farmers Edge.“Since 2005, Farmers Edge has been digitizing the farm and giving growers access to real-time insights to maximize yield and profitability.This same data—which shows when crops were planted, combined, and harvested, or which crops have been damaged during a storm or flooding—is what insurance companies need before they can process a claim.

The InsurTech platform is a pivotal new digital transformation tool for both growers and insurance providers that enables a better experience for all stakeholders.” How it Works: The InsurTech platform uses data from FarmCommand to power Smart Claim and Smart Reporting.FarmCommand is an all-in-one farm management platform powered by unprecedented levels of field-centric data sets.Automatically integrating data from more sources than any other provider, including: daily satellite imagery, advanced field-centric weather, all equipment and operational data, predictive models, analytics, benchmarking and more, FarmCommand is designed to simplify data management and provide timely insights for more informed and profitable decision-making.

Smart Reporting All as-planted, as-applied, and as-harvested machine data from FarmCommand is automatically processed to provide acreage and production reporting, pre-harvest estimates, post-harvest reviews, benchmarking reports, policy change alerts, and enhanced analytics for better fund allocation.Smart Claim Advanced field-centric weather data and Daily Satellite Imagery is transformed in FarmCommand to provide a suite of decision support tools, including: Automated Health Change Maps and Notifications, disease and pest models, severe weather forecasting and detection, nitrogen and growth stage models.This data powers automated claim predictions and notifications, claim adjustments, crop classifications, fraud detection, and simplified record-keeping.

“Connecting digital insurance tools with FarmCommand is an ‘Easy Button’ for growers, enabling them to electronically transfer crop data directly to their insurance agent, in a format that meets industry requirements, instead of manually sorting, compiling, and filing paperwork,” said Ron Osborne, Chief Strategy and Product Officer at Farmers Edge.“For insurance agents, the platform is a powerful digital tool that provides complete, consistent, free from bias, and valid data in one central location, offering a unified 360-degree customer view, enabling agents to provide better customer service, offer customized insurance products, and improve client loyalty and retention rates.” Availability For more details about the InsurTech platform, email [email protected].About Farmers Edge Farmers Edge is a global leader in decision agriculture servicing over 24 million paid product acres worldwide with precision digital solutions.

Integrating field-centric data, easy-to-use software, state-of-the-art processing technology, predictive modeling, and advanced analytics, Farmers Edge provides growers with scalable solutions to produce more with less.Using innovative digital agronomic tools, Farmers Edge solutions focus on the sustainable production of high-yielding, high-quality crops and are designed to optimize inputs, minimize environmental impact, and protect the economic viability of the farm.From seed selection to yield data analytics, Farmers Edge transforms big data into timely and accurate insights to support informed decision-making.

To learn more about Farmers Edge, visit FarmersEdge.ca or FarmersEdgeUSA.com.Tags: automation, Digital Innovation, disruption, Farmers Edge, partnership, Predictive Analytics

Publisher: Insurance Canada