USAA is back with the 45th catastrophe bond issuance we have tracked that the company has sponsored, initially targeting $400 million of annual aggregate reinsurance protection from a new deal, Artemis can report.USAA continues to be the most consistent of catastrophe bond sponsors, augmenting and diversifying its sources of catastrophe reinsurance protection using the capital markets, a strategy it has been following since 1997.As said, this new Residential Re 2025-1 cat bond is the 45th transaction we have tracked from USAA, with now .USAA tends to sponsor two catastrophe bond issuances each year, one cat bond that provides the insurer with aggregate reinsurance protection in May, and a cat bond to provide per-occurrence coverage in November.

This issuance is the regular May aggregate cat bond deal from USAA and it sees the military mutual insurer looking to secure $400 million or more in multi-year and multi-peril catastrophe reinsurance from the capital markets.Using a new Residential Reinsurance 2025 Limited special purpose vehicle, USAA is bringing three tranches of Series 2025-1 catastrophe bond notes to investors, we are told.Each of the three tranches of Series 2025-1 notes will be sold to investors and the proceeds used to collateralize underlying reinsurance agreements between the issuing vehicle and sponsor USAA, as is typical.

The three tranches of notes will provide USAA with roughly four years of annual aggregate and indemnity based reinsurance protection against losses from the usual perils that feature in its catastrophe bond deals, being U.S.tropical cyclones, earthquakes (plus fire following), severe thunderstorm, winter storm, wildfire, volcanic eruption, meteorite impact, other perils (all including auto & renter policy flood losses), we understand.All three of the Series 2025-1 tranches of notes feature a $50 million event deductible, meaning that loss events must cause an equivalent or higher ultimate loss to USAA before they can be counted for annual aggregation purposes.

Unlike recent years, all three tranches of this Residential Reinsurance 2025-1 catastrophe bond issuance are set to be coupon bearing notes, where as the insurer has typically featured a zero-coupon tranche in many of its more recent cat bond deals.A Class 13 tranche are targeted as $50 million in size for the issuance and have an initial attachment point at $3.625 billion of qualifying losses to USAA, exhausting their coverage at $4.425 billion.Which gives them an initial attachment probability of 3.38%, an initial base expected loss of 2.25% and these notes are being offered with price guidance of 12% to 13%.

A Class 14 tranche are targeted to secure $150 million in reinsurance for the sponsor and have an initial attachment point at $4.425 billion of qualifying losses to USAA, exhausting their coverage at $5.525 billion.Which gives them an initial attachment probability of 1.44%, an initial base expected loss of 0.99% and these notes are being offered with price guidance of 7.5% to 8%.The final Class 15 tranche of notes are targeted to secure $200 million in reinsurance for USAA and have an initial attachment point at $5.525 billion of qualifying losses to the sponsor, exhausting their coverage at $5.975 billion.

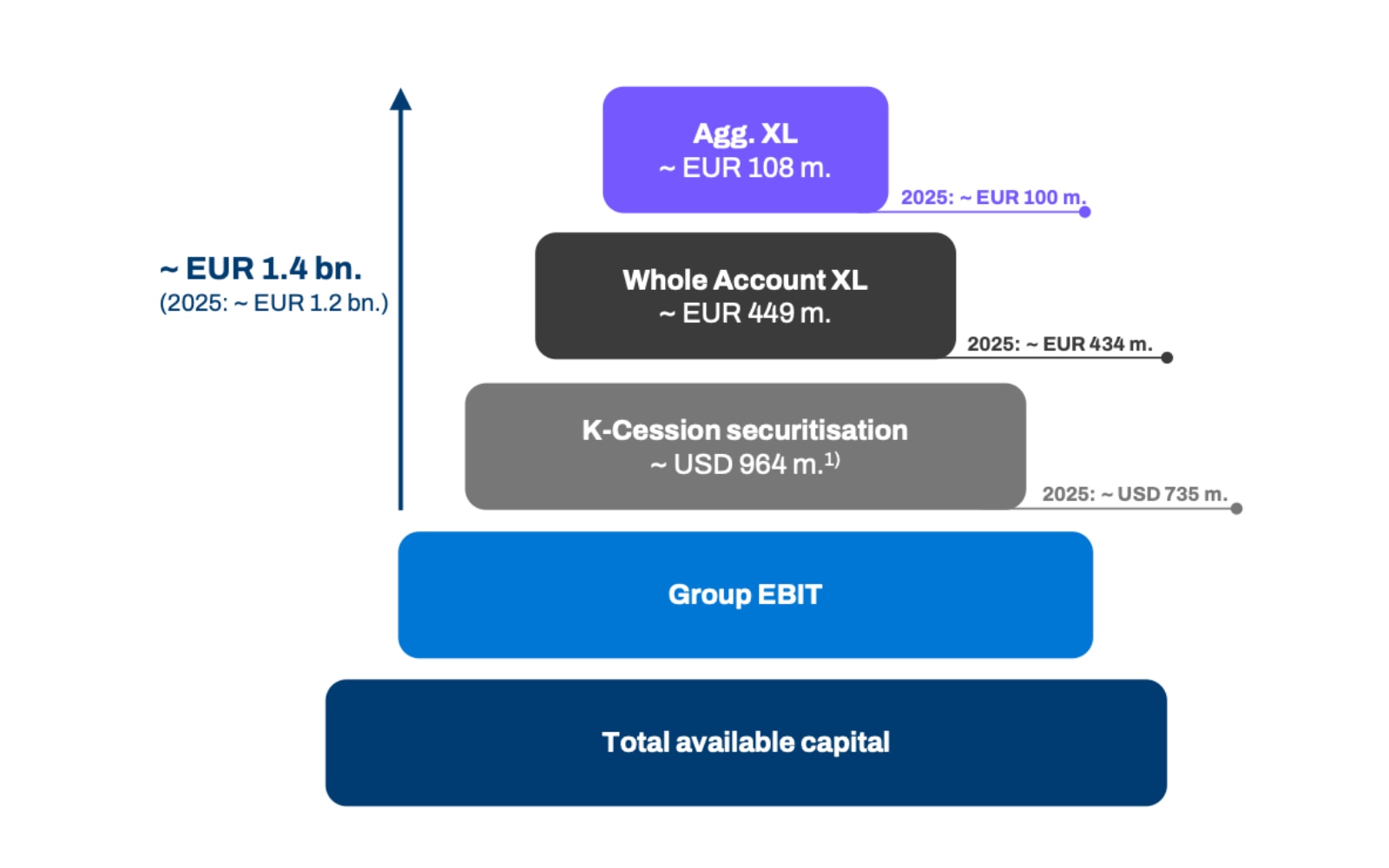

Which gives them an initial attachment probability of 0.69%, an initial base expected loss of 0.61% and these notes are being offered with price guidance of 5.5% to 6%.As a result, all three tranches of Residential Re 2025-1 catastrophe bond notes are set to sit on top of each other in the USAA reinsurance tower and it will be interesting to see what size this deal completes at, given there will be significant room to upsize it, should investor appetite allow.The multiples of expected loss on offer appear higher than the previous year’s deal for the riskier layers, while the lowest risk Class 15 notes seems relatively aligned although slightly higher perhaps as well.

Remember that USAA estimated its losses from the California wildfires in January 2025 at $1.8 billion and a number of its outstanding aggregate catastrophe bonds have been marked down as a result.So it is encouraging to see the long-standing cat bond sponsor return, with spread price guidance that appears to recognise that fact and which may prove conducive to generating investor support for its latest aggregate catastrophe bond deal.With are the most prolific sponsor and program in the marketplace, a regular and consistent feature since the cat bond instrument was first developed.

You can read all about this new catastrophe bond from USAA and view details on almost every other cat bond ever issued in our extensive Artemis Deal Directory..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis