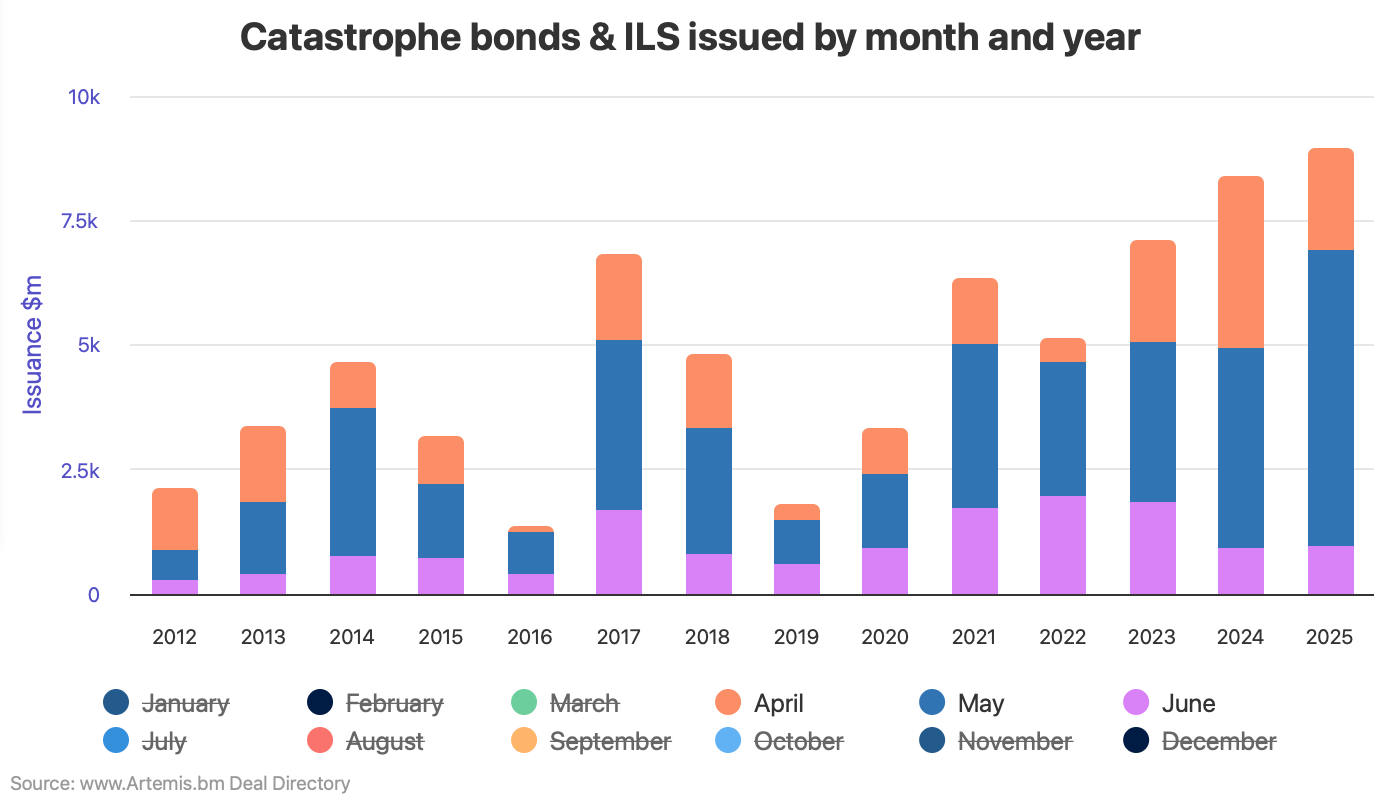

Catastrophe bond issuance in the second-quarter of 2025 now looks set to exceed $10 billion, marking the period as the first where new cat bonds issued have reached that milestone in any official quarter, as activity this year continues to propel the market to new heights, Artemis’ data shows.We’ve been documenting the accelerated pace of catastrophe bond issuance in 2025 and you can .We track every catastrophe bond through its offering phase so you can , to give a projection for issuance as this year progresses.

Catastrophe bond issuance, across full Rule 144A cat bonds and the few private cat bond lites we’ve tracked, has now reached more than $16 billion of settled deals so far in 2025, a new first-half record by a considerable margin.Impressively the $10 billion of issuance milestone is now likely to be reached in the second-quarter of 2025 alone, setting a new high bar for official quarterly cat bond market activity.The first-quarter of 2025 saw issuance of new cat bonds and private cat bonds surpassing the $7 billion mark for the first-time ever in that period.

That $7 billion marker for a single quarter has only been surpassed twice before in the market’s history, which was in Q2 of 2023 and 2024.Now, Q2 2025 is likely to set a new and higher quarterly catastrophe bond issuance record, with over $10 billion of new cat bonds now expected to settle before the end of June.Q2 2025 issuance of cat bonds that have already settled stands at over $8.93 billion, which is now a record for the second-quarter by more than half a billion dollars.

But, if the current market pipeline of deals, scheduled to settle before the end of June, all achieve their upper-target sizes, the total for cat bond issuance in Q2 2025 is now projected to reach just above the $10 billion level.where you can select which months to include for comparative analysis.Completed issuance in the second-quarter of 2025 has already broken the record set for the period from one year ago and Q2 2025 is already the biggest single quarter of cat bond issuance ever.

It’s yet another catastrophe bond market record that has been broken in 2025, as this year’s issuance continues to support ceding company needs for efficient reinsurance and retrocession, while feeding cat bond investor appetites.Another interesting cat bond market record has also fallen in 2025, as there has never been a three month period with as much completed issuance as March through May 2025.The total for those three months reached an incredible just over $11 billion, making it the busiest three month period for the cat bond market ever seen, with March nearing $6 billion on its own.

Stay tuned to Artemis and we’ll keep you updated., .(use the key of months at the bottom to include and exclude any from your analysis).

The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list..

We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis