Mortgage insurance companies operating in the United States are in a far better financial position now thanks to heavy use of reinsurance, including their issuance of mortgage insurance-linked securities (ILS), or mortgage insurance-linked notes (ILN), Moody’s Investors Service has said.The rating agency has upgraded a number of the biggest US mortgage insurers and affirmed the ratings on others, with the significant build-up of reinsurance risk capital to underpin the sectors’ exposure a key reason, it seems.The overall credit profile of the mortgage insurance sector has improved steadily since a pandemic related spike in delinquencies, Moody’s notes.But, while macro-economic factors have helped to drive strong financials for these carriers, the reinsurance capital they use has helped significantly to bolster them.

“The significant utilization of excess of loss reinsurance through insurance-linked notes (ILNs) and the traditional reinsurance market also bolsters the credit profiles of the US mortgage insurers,” Moody’s explained.In fact, Moody’s notes that the sector has roughly $14.3 billion of current reinsurance limit available to it.This reinsurance capital “dampens the potential for earnings and capital volatility that has historically impacted the mortgage insurance sector during adverse economic environments,” the rating agency said.

Commenting on each of the biggest US mortgage insurers, Moody’s again references their robust and significantly capital markets-backed reinsurance arrangements.Starting with Arch Capital, whose ratings were affirmed, Moody’s highlights the “leadership position in the US mortgage insurance market” of its Arch Mortgage subsidiaries, saying that it “leverages its strong underwriting and risk management capabilities to innovate in the evolving mortgage credit risk transfer market.” Moody’s added that this is bolstered by a “substantial use of reinsurance to mitigate underwriting volatility in stress scenarios.” Explaining how Arch has leveraged capital markets sources of reinsurance, alongside traditional, Moody’s said, “Since July 2015, Arch Mortgage has transferred more than $8.7 billion of risk to the capital markets through 18 Bellemeade Re insurance-linked note (ILN) transactions, and has also sourced additional risk transfer protection through excess of loss and quota-share coverage in the traditional reinsurance market.Through these arrangements, Arch Mortgage has reinsurance covering nearly all of its business written between January 2017 and December 2021, providing more than $4.6 billion of current excess of loss reinsurance coverage to absorb losses during periods of elevated mortgage credit losses.

As of March 31, 2022, Arch Mortgage reported a PMIERs sufficiency ratio of 205%, which is the highest among the peer group.” .Next, National Mortgage Insurance Corporation (NMIC), whose ratings were upgraded and Moody’s said, “Has transferred approximately $2.1 billion of risk to the capital markets through 7 Oaktown Re ILN transactions, and has also sourced additional risk transfer protection through excess of loss and quota-share coverage in the traditional reinsurance market.Through these arrangements, NMIC has reinsurance covering nearly all of its business written between January 2017 and March 2022, providing almost $1.6 billion of current excess of loss reinsurance coverage to absorb losses during periods of elevated mortgage credit losses.” .

Next Enact Mortgage Insurance and its subsidiary Genworth, whose ratings were also upgraded, and on which Moody’s explained, “Since Q4 2019, Enact has transferred approximately $1.8 billion of risk to the capital markets through 5 Triangle Re ILN transactions, and has also sourced additional risk transfer protection through excess of loss and quota-share coverage in the traditional reinsurance market.Through these arrangements, Enact has reinsurance covering nearly all of its business written between January 2018 and Q2 2021, providing almost $1.1 billion of current reinsurance coverage to absorb losses during periods of elevated mortgage credit losses.” .

Radian Group also received an upgrade and on this company Moody’s commented, “Since November 2018, Radian has transferred nearly $3 billion of risk to the capital markets through 6 Eagle Re ILN transactions, and has also sourced additional risk transfer protection through excess of loss and quota-share coverage in the traditional reinsurance market.Through these arrangements, Radian has reinsurance covering nearly all of its business written between January 2017 and mid-2021, providing more than $2.2 billion of current excess of loss reinsurance coverage to absorb losses during periods of elevated mortgage credit losses.” .MGIC Investment Corporation and its subsidiary Mortgage Guaranty Insurance Corporation (MGIC) were also subject to upgrades, on which Moody’s said, “Since Q4 2018, MGIC transferred nearly $2.3 billion of risk to the capital markets through 6 Home Re ILN transactions, and has also sourced additional risk transfer protection through excess of loss and quota-share coverage in the traditional reinsurance market.

Through these arrangements, MGIC has reinsurance covering nearly all of its business written between Q3 2016 and Q4 2021, providing more than $1.9 billion of current reinsurance coverage to absorb losses during periods of elevated mortgage credit losses.” .The final US mortgage insurer of note is Essent Guaranty, whose ratings were affirmed by Moody’s, on which the rating agency commented, “Since March 2018, Essent has transferred approximately $3.1 billion of risk to the capital markets through 7 Radnor Re ILN transactions, and has also sourced additional risk transfer protection through excess of loss and quota-share coverage in the traditional reinsurance market.Through these arrangements, Essent has reinsurance covering nearly all of its business written between January 2015 and Q3 2021, providing almost $2.6 billion of current excess of loss reinsurance coverage to absorb losses during periods of elevated mortgage credit losses.” .

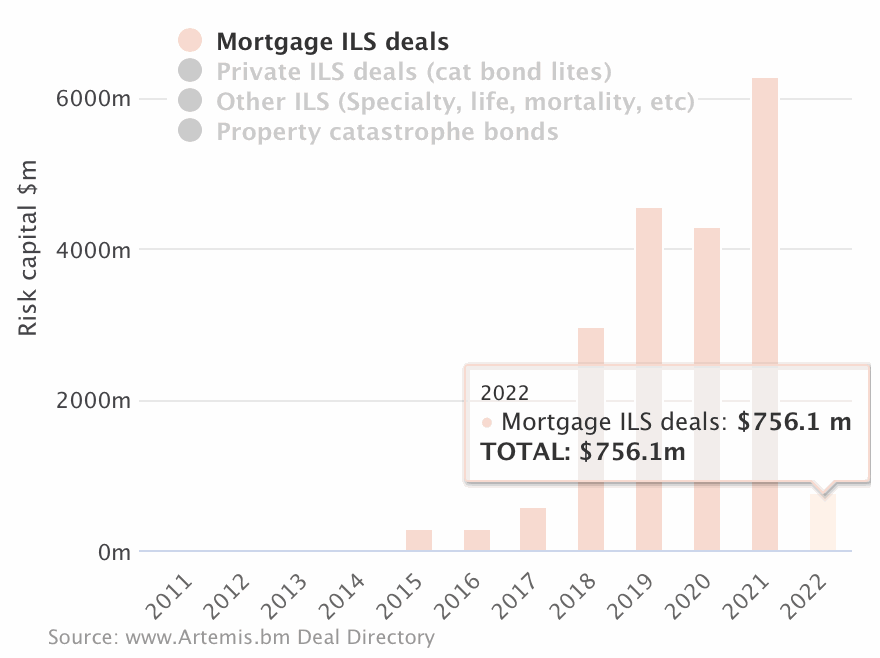

There’s a common theme here, that the rating agency sees the use of capital markets and securing of significant reinsurance capital as very positive for these mortgage insurance giants.Mortgage ILS issuance in 2022 has now slowed to a halt due to the broader financial market macro-environment, not least of which is the rising interest rates and how they affect mortgages at this stage of the economic cycle.But with significant mortgage reinsurance capital secured, these carriers have protected their books using the most efficient capital possible, putting them in good stead for continued profitability, even when the mortgage market itself is likely to be more challenged.

In our chart, below for which , you can see just how much mortgage ILS issuance has tailed off so far in 2022.Right now the mortgage ILS market is on-hold, while these carriers establish how macro-economic conditions will affect their businesses going forwards and what the right use of capital is to manage their PMIERs.We’re aware of special purpose vehicles having been registered earlier in the year but not used yet for mortgage ILS deals, suggesting there could be a flurry of activity, perhaps later in the year, if the forward-expectation for rates eases at all.

.———————————————————————

Register soon to ensure you can attend.—————————————

Publisher: Artemis