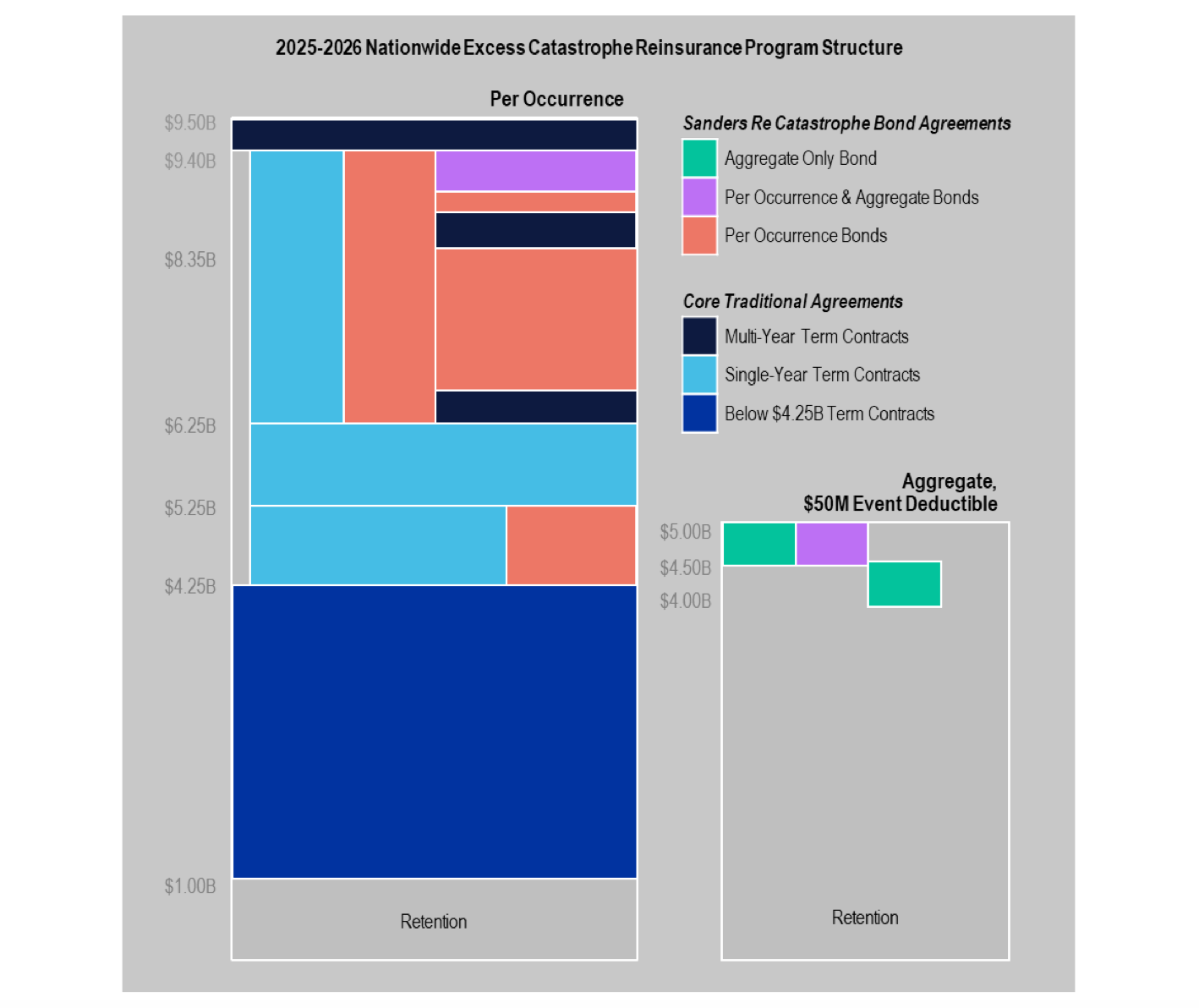

US primary insurer Allstate has lifted the top of its main occurrence Nationwide Excess Catastrophe Reinsurance Program to a new high of $9.5 billion at its recent renewal, with catastrophe bond coverage a growing component, while its retention has also increased to now $1 billion across the tower.It’s also notable that for the annual risk period running from April 1st 2025, Allstate’s aggregate catastrophe bonds will now only attach for any losses above $4 billion, higher than last year’s $3.6 billion attachment level.Last year, , Allstate lifted the top of its Nationwide excess catastrophe reinsurance tower to just over $7.9 billion on the occurrence side, which was almost a $1 billion increase from the prior year and with catastrophe bonds filling out much of the upper-layers.At the April 1st 2025 renewal, Allstate has continued the trend of lifting the top of the reinsurance tower higher, with the occurrence side now extending to $9.5 billion, another significant increase.

It’s not quite a $1.5 billion increase given differences in retention, but certainly close to.Allstate’s executives said during an earnings call today that its catastrophe reinsurance renewal priced slightly down, on a risk-adjusted basis compared to the prior year.Once again, per-occurrence coverage from the Sanders Re catastrophe bond program remains a meaningful contributor, especially in the upper-layers of the reinsurance tower at $4.25 billion for one cat bond, but the majority sitting above $6.25 billion this year.

Notably though, Allstate is set to retain a little more in catastrophe losses over the next year, for an occurrence event, with a $1 billion retention across the bottom of the entire tower, where as .You can see the new Nationwide catastrophe reinsurance tower for 2025 into 2026 below and compare with last year’s .With currently over .

Some of those are providing protection for its Florida reinsurance tower that renews at the mid-year, but at this time there are $2.7 billion of outstanding Sanders Re catastrophe bonds that provide protection for the Nationwide occurrence and aggregate reinsurance towers for Allstate..Of that, $500 million provides aggregate reinsurance protection for Allstate.

However, after that ended March 31st, a $66 million portion of the lowest Class C tranche of the Sanders Re III Ltd.(Series 2022-1) cat bond is now marked for possible recovery.Remember, the rest of is set to come from the $150 million Class B tranche of notes from the Sanders Re II Ltd.

(Series 2021-2) issuance that are now on an extension of maturity, but off-risk for future loss events.So Allstate has continued to grow its nationwide occurrence reinsurance protection, while the aggregate limit has shrunk slightly with just three tranches now set to provide aggregate protection of $500 million this year, compared to four tranches that provided $650 million of aggregate protection for the recently ended annual risk period.Also notable is the fact Allstate’s annual aggregate cat bond coverage will only attach above $4 billion of losses for the coming year, compared to the $3.6 billion attachment of last year.

The $50 million per-event deductible remains the same for 2025 into 2026.Finally, from the latest disclosure by Allstate, the insurer has already renewed its Kentucky earthquake excess-of-loss catastrophe reinsurance for the next year, securing $28 million excess of a $2 million retention that provides one-year of cover to May 31st 2026.For the coming year this seems to be fully-placed, where as last year’s contract was only 95% placed.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis