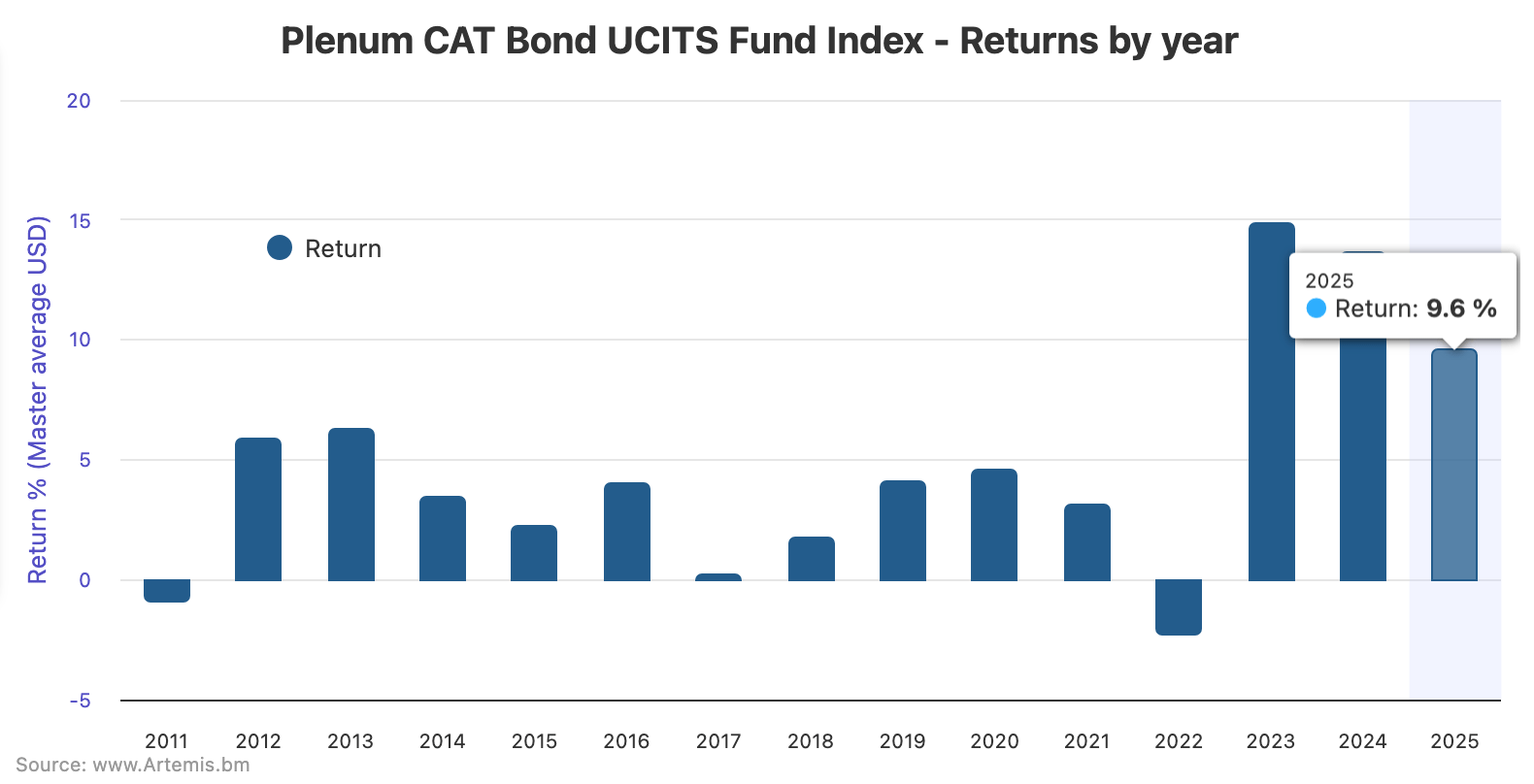

The average year-to-date return of catastrophe bond investment funds in the UCITS format in 2025 reached 9.60% by November 28th, while some strategies in the category of pure cat bond funds have moved into the double-digits at this stage, according to the latest data from the .A month ago, the UCITS cat bond fund sector was running at an average return of 8.88% for the year to October 31st.Cat bond fund performance has accelerated through the last few months, driving a number of cat bond funds into double-digits.

But returns slowed in November 2025, as the latest data for the shows that the UCITS cat bond fund sector only averaged 0.66% for the month to November 28th, a slowdown from .Reviewing monthly performance UCITS cat bond funds for 2025 year-to-date, the Plenum CAT Bond UCITS Fund Indices delivered a 0.40% return for January, 0.32% for February, 0.56% for March, 0.28% for April, 0.52% for May, 0.58% for June, 1.09% for July, 1.34% for August, 1.38% for September up to the 26th, and then 1.51% up to the end of October.Year-to-date the average return of the UCITS cat bond fund sector now stands at 9.60%, which while running behind the last two record years is still the third-highest full-year performance ever for this segment of investment funds in the catastrophe bond asset class.

As a result, a double-digit full-year performance remains in sight for this Index of UCITS cat bond funds, barring any significant catastrophe loss events through the rest of December.As a result, 2025 will be the third strongest year in history by a significant margin for this index.It’s worth noting that the November performance has likely been slightly dented by some funds accounting for the total loss of the Jamaica catastrophe bond following hurricane Melissa’s significant impacts on the island, as we understand some cat bond funds accounted for this positional loss during the month.

Lower-risk cat bonds again fared slightly better, averaging a 0.67% return for November through the 28th, while the higher-risk cohort of UCITS cat bond funds averaged 0.64%.Year-to-date, the lower-risk cat bond funds have averaged 9.63%, while the higher-risk 9.64%, so little between them in performance terms.On a rolling 12-month basis, the average return across the entire UCITS catastrophe bond fund landscape now stands at 10.62%.

Lower-risk funds are running at 10.42% and higher-risk at 10.87%, on a rolling 12-month basis.Which suggests the Index and both lower and higher-risk cohorts of cat bond funds will end 2025 with a full-year performance in the double-digits.There remains a dispersion in returns available, across the catastrophe bond fund sector in its entirety.

There are some cat bond strategies in the market, including UCITS format, that reached double-digits at a 10% or higher return after November results were in, while there are others that were only approaching 9% at that time.Which is good for the investor base, as the sector continues to offer a range of risk-levels within it and is not as uniform in its strategies as some believe.The return levels on offer from catastrophe bond funds remain very attractive, especially with many of the sectors’ strategies heading for what looks like another double-digits annual return in 2025.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis