According to Howden Re, the reinsurance broking arm of Howden, risk-adjusted property catastrophe reinsurance rates-on-line fell in a range from flat to down 20% at the June 1st renewals.The firm noted that risk-adjusted rate-on-line changes varied depending on loss experience and attachment point.However, the general trend was clear: a softening compared to the historic highs seen in recent years.“Risk-adjusted rate-on-line changes ranged from flat to down 20%, depending on loss experience and attachment point,” Howden Re said in its commentary.

Adding: “Despite pricing pressures, programmes generally attracted subscriptions above 100%, enabling cedents to negotiate against the stringent terms and conditions that defined mid-year placements in recent years.” Reinsurers modestly expanded their appetite, showing renewed interest in core relationships while maintaining underwriting discipline.Capacity returned selectively, aided by both traditional markets and a more active insurance-linked securities (ILS) sector, which helped offset reduced allocations from some conventional reinsurers.“The property-catastrophe XoL reinsurance market continues to recalibrate following several years of dislocation.

Capital inflows have rebounded, with newly formed reinsurers and syndicates deploying meaningful capacity into mid-year placements,” Howden Re added.The reinsurance broker also highlighted that remote-attaching cat XoL layers were among those that saw the steepest rate reductions, typically in the 10% to 20% range.Still, the firm stressed that this wasn’t a wholesale return to soft market conditions.

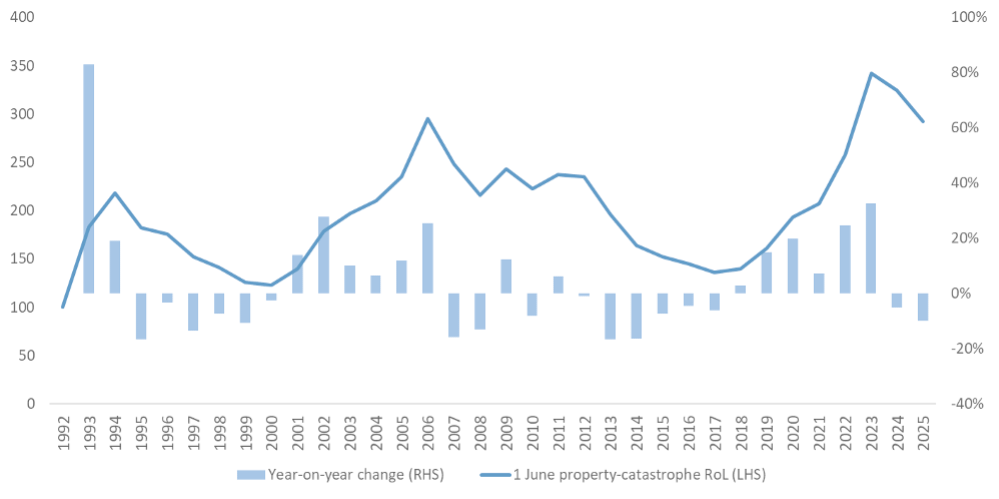

“The dynamic this year was neither a continuation of 2023’s dislocation nor a broad softening.Rate levels remain historically high but are now outpacing loss trends in many areas – This is drawing more interest from markets, including Lloyd’s syndicates with previously cautious balance sheets looking to grow incrementally,” said Kyle Menendez, Managing Director, Howden Re, North America.The chart below, provided by Howden Re, is the risk-adjusted property catastrophe reinsurance rate-on-line index at June 1st since 1992.

Reinsurers also showed growing willingness to provide support across full programme structures, particularly when cedents purchased multiple products with concurrent inception dates.“Outcomes were mixed across towers,” the commentary stated.“Top layers experienced the most competitive pricing, with some rate reductions greater than average as a result of surplus ILS capacity.

This mirrored trends seen earlier this year in other peak zones.” “One distinct feature of this renewal was the strategic cohesion observed across programme placements.Cedents purchasing multiple layers or products on a concurrent basis found greater support from reinsurers willing to underwrite holistically rather than transact tactically.” The broker also went on to note that reinsurer support extended to property per-risk XoL placements, alongside a resurgence in aggregate or second and third event covers.“In addition to traditional occurrence protection, cedents are evaluating, and increasingly attracting, capacity for sideways and aggregate structures, as reinsurers respond to heightened cedent demand for coverage that addresses the frequency of catastrophe events,” the broker explained.

“Reinsurers are being deliberate.We’re seeing evidence of measured growth, especially from those carriers that had stepped back in recent years.More reinsurers support full programme structures, especially where multiple property products are purchased at the same inception date, in the hope of influencing catastrophe occurrence signings,” commented Brian McKeon, Managing Director, Howden Re.

Furthermore, Howden Re noted that the Florida market also saw selective improvement, buoyed by legal reforms and increased buyer demand.The broker reported that reinsurers were showing growing confidence in the state’s evolving legal and regulatory environment, including the restriction of Assignment of Benefits (AoB) and broader litigation reform.“A 20% increase in retention levels from the Florida Hurricane Catastrophe Fund (FHCF), projected at $11.3bn for 2025 , drove cedants to seek private market solutions for lower layers.

However, pressure on rates at these levels was largely mitigated by increased appetite from traditional reinsurers who now view them as attractive after years of caution,” Howden Re said.“Capital is now more abundant and increasingly diverse, yet it’s being deployed with discipline, especially below the FHCF where pricing remains firm – At the top of towers, ILS are providing flexibility and competitive tension, marking a shift from crisis to calibration.This is a function of a stabilising market,” added David Flandro, Head of Industry Analysis and Strategic Advisory, Howden Re.

Howden Re concludes: “The 1 June 2025 renewal reflects a market transitioning from disruption to disciplined recalibration.Whilst rate moderation continued, underwriting rigour persisted, especially in structurally challenged layers.A stabilising legal and regulatory framework in Florida, combined with increased FHCF retention levels, has helped to support this evolution.

“The result is a more balanced reinsurance environment characterised by selective engagement, structural discipline and capital re-deployment aligned with long-term returns.” ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis