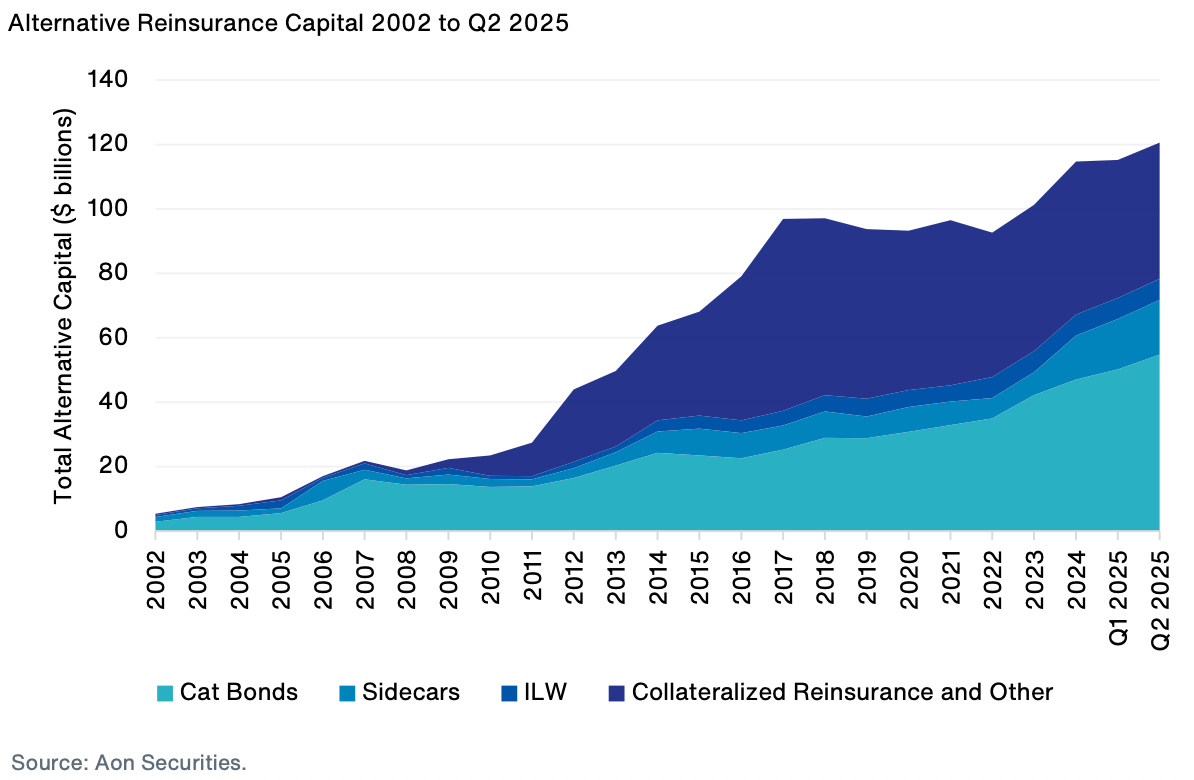

The amount of alternative capital in reinsurance supplied by insurance-linked securities (ILS) strategies and structures has reached a new high of $121 billion as of the middle of 2025, which Aon Securities notes was driven by strong catastrophe bond growth and supported by ongoing expansion of the sidecar sector as well.Aon Securities, the specialist investment banking and ILS broker-dealer unit of the global insurance and reinsurance broker, found that 12-month catastrophe bond issuance over the period to June 30th 2025 reached $21.7 billion, a record high., the 12-month run-rate for catastrophe bond issuance could be even higher if you looked at a different period, as we counted just slightly under $23 billion of issuance between August 2024 and July 2025.

The cat bond market has been driving growth of alternative reinsurance capital over the last year, but Aon Securities also notes that a continued resurgence in the sidecar space is also building investor-backed reinsurance capital further.Aon Securities estimates that sidecar capacity increased to an estimated $17 billion across both property and casualty lines by the middle of 2025.“The heightened catastrophe bond activity was representative of growth in the broader ILS market, where alternative capital had reached a record $121 billion by June 30, 2025.

“Sidecars continued to grow due to their relatively high underlying margins and the advent of the casualty sidecar product, which now accounts for approximately eight percent of the overall sidecar market,” Aon Securities explained.Impressively, that is just over 5% growth in alternative capital since the end of the first-quarter .So $6 billion in capital added, even during a period of very high deal maturities.

Richard Pennay, CEO of Aon Securities, commented, “Driven by higher building costs, evolving weather trends and the push to close the protection gap, cedents are increasingly seeking coverage beyond what is available in the traditional reinsurance market.“With the uncorrelated nature of catastrophe bonds, and investors achieving double digit returns, the space continues to demonstrate its value and outpace growth in other areas of the insurance industry, an outcome stakeholders can take pride in.” Pennay continued to explain, “A successful and healthy capital raising climate, robust reinvestment of capital from maturing bonds and coupon payments, and attractive risk spreads on the outstanding catastrophe bond portfolio, has fueled ongoing investor demand for the product.”.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis