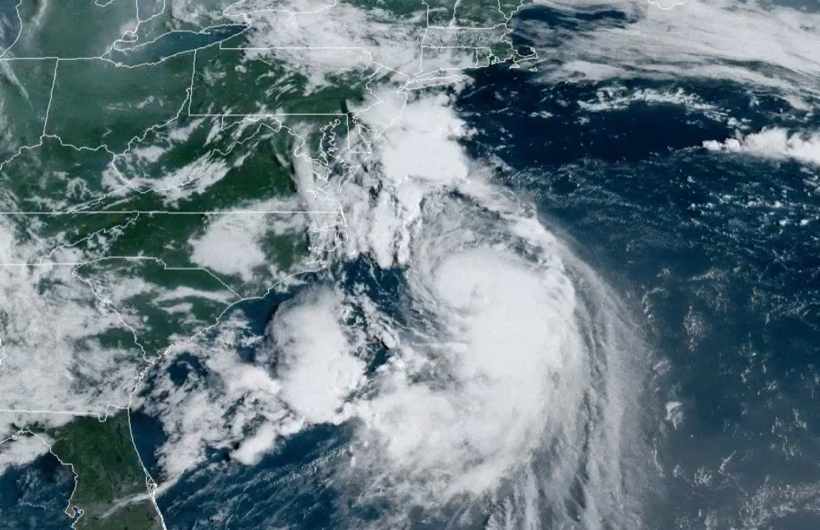

In an update today, specialist catastrophe bond, insurance-linked securities (ILS) and reinsurance investment manager Twelve Capital said that, as hurricane Henri weakened prior to making landfall, it now doesn’t expect any impact to positions in its ILS funds., rather than wind related as a result of the weakening.Twelve Capital had said prior to landfall, when Henri was expected to be stronger at landfall, that .But now that the landfall impacts are becoming clearer, Twelve Capital’s latest update on Henri explains that the threat of ILS position impacts or losses had been reduced by the storm’s weakening.

“As the storm approached the mainland it weakened from a category 1 hurricane to a tropical storm, and continues to weaken into a tropical depression as it moves through New England and east into the Atlantic,” the investment manager explained today.Adding that, “Given the weakening of the storm and its landfall location Twelve Capital does not expect any impact on its positions.” It continues to look like industry losses may actually come out below the billion dollar mark, as the impacts from tropical storm Henri in the Tri-State area increasingly appear to be rainfall and flood related, rather than wind or surge damage.The insurance, reinsurance and ILS industry may have dodged a larger industry loss thanks to Henri’s slowing down over cooler waters north of the Gulf Stream, which allowed the storm to weaken more than anticipated prior to landfall.

This weakening also shrank the size of the storm’s wind field, meaning impacts were less widespread from wind gusts than would otherwise have been the case, while the storm surge did not materialise at the heights forecast either.In addition, the fact that Henri eventually came ashore in Rhode Island also reduced the loss potential of the storm, as a further west scenario could have had far higher economic impacts.The rainfall and related flood impacts remain significant however, but as ever that leads to questions over whether losses will be covered by insurance at all, as well as whether they will be covered by the NFIP, or fall to private insurance and reinsurance markets.———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis