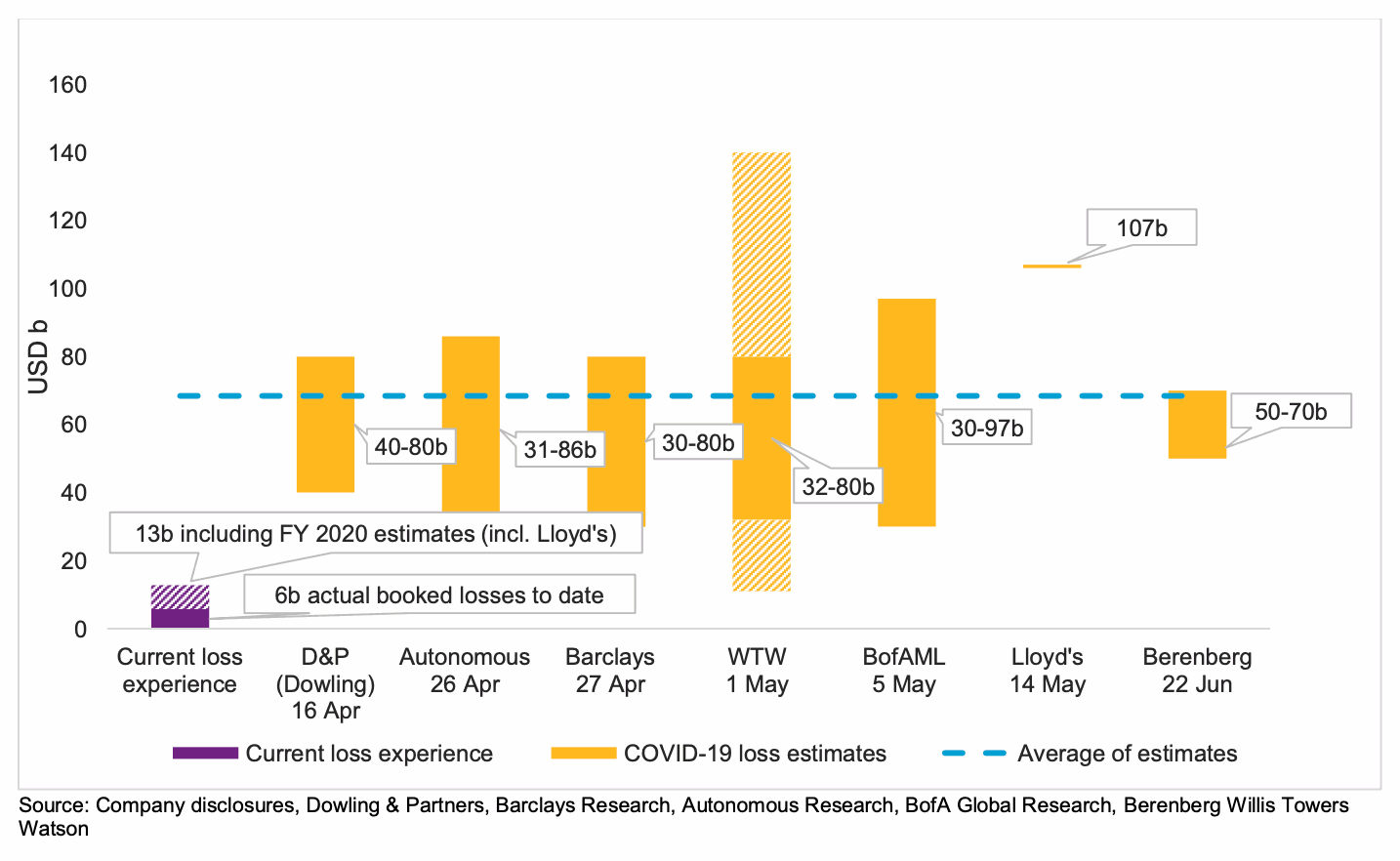

Currently, bottom-up Covid-19 pandemic loss announcements from insurance and reinsurance companies stand at only around $6 billion, some way short of the wide ranging $30 billion to $100 billion industry loss estimates and broker Willis Re warns it will likely take years to catch up which has ramifications for the ILS market.Reinsurance broker Willis Re said it estimates the bottom-up Covid-19 losses are around $13 billion, if insurer and reinsurer projections of full-year losses are included in the tally.That’s still a long way short of the industry loss estimates and .

Willis Re warns that current loss pronouncements, at $6 billion or $13 billion, are “a long way from top-down industry loss estimates of $30-100b, and we expect the bottom-up versus top-down gap to take a long time (likely years not months) to close.” Willis Re pegs the average estimate as roughly $70 billion currently.That has ramifications for the insurance-linked securities (ILS) market, as .While insurance and reinsurance companies currently have little clarity over their own potential ultimate losses from the Covid-19 pandemic, it is likely to motivate them even more to hold onto whatever reinsurance capital they can.

As a result, the Covid-19 pandemic has the potential to be the loss event with the longest tail for the ILS sector, where exposure is perceived as likely with sufficient grounds for trapping potentially exposed capital and ILS collateral.As we’ve said before, this , given some of those structures contain exposure to the types of policies where significant uncertainty over potential business interruption claims from the pandemic may lie.Willis Re highlights that the announced and forecast losses so far are “only small fractions of the top-down insured loss estimates” published by commentators and industry bodies.

“We maintain the view that, whatever the ultimate insured loss, loss recognition, not to mention actual payments, will emerge only very slowly.We expect it will take years, not months, for the bottom-up versus top-down gap to close,” the reinsurance broker warns.The slow pace of loss realisation associated with the coronavirus pandemic, as well as the threat of further losses as rates of cases rise in many regions of the world, while second waves are evident in some parts of even major economies like the U.S., all suggests the rate of loss booking will be particularly slow.

The uncertainty that creates could amplify the desire to hold back collateral and reinsurance coverage, perhaps prolonging the retention as well, all of which means exposed ILS positions could face trapping for particularly prolonged durations, which may be challenging for some of the most exposed managers and funds.It’s important to remember though, that the most affected segments of ILS are likely to be those .For some though, .

While a lot of the collateral trapped later this year is likely to eventually be returned, we believe, the fact it’s held for a long duration may present operational challenges to some structures.———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis