A reasonable amount of the ultimate insurance market loss from hurricane Ida is expected to be shared with reinsurance capital, which rating agency AM Best believes will provide further momentum to already rising reinsurance pricing at renewals.The rating agency warned in a report that some of the more thinly-capitalised primary carriers are likely to share a significant proportion of their losses from hurricane Ida with reinsurers.Louisiana was hard-hit by hurricanes in 2020 as well, so some carriers there are still recovering, or have increased their reinsurance protection in 2021.On the reinsurer side, most are very well-capitalised at this time, plus have ample retrocessional reinsurance in place should it be required to support their payment of hurricane Ida claims.

In addition, the quota share market is expected to take a proportional slice of hurricane Ida’s loss, including via reinsurance sidecars.With losses flowing to reinsurance capital, including the ILS market through collateralised excess-of loss and quota shares, , AM Best expects that these losses, added to those from events through the year will help to add momentum to reinsurance pricing come renewal time.Other analysts had said that .

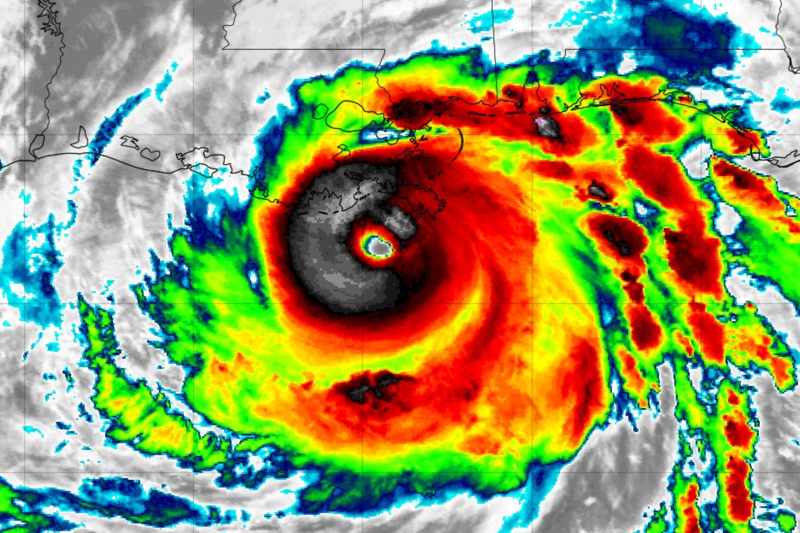

We’d agree in isolation, but when you take hurricane Ida alongside the other loss activity this year, including recent impactful events like the European floods, it is now clear 2021 will likely see above average catastrophe losses for the industry and a reasonable hit to reinsurers from those losses.At the same time, the increasing focus across the industry on ensuring risk adequate pricing in the face of climate change is also steeling reinsurers resolve, when it comes to setting rates.Given Ida’s rapid intensification and other factors related to the storm, there could also be some uncertainty that drives loss creep, which can also be another driver for further reinforcing the need for catastrophe risks to be priced adequately, which can also help add momentum.

AM Best commented that, “For the industry, Ida will likely be more of an earnings hit as opposed to a capital event.Because a number of Louisiana writers are regional players with lower levels of capital, a sizeable amount of losses is likely to be ceded to reinsurers.“However, reinsurers should be able to absorb the magnitude of losses without impacting their capital positions.

“Hurricane Ida will add to uncertainty about the growing frequency of weather events and provide momentum to reinsurance pricing.” Some reinsurers could come under pressure though and AM Best adds that, “Hurricane Ida could pressure reinsurers, whose natural catastrophe budgets had already been increased following the Texas freeze, as they must contend with potentially high claims activity during the rest of 2021 Atlantic hurricane season.” Overall though, the message that hurricane Ida’s industry loss will be manageable continues, as largely the industry is adequately capitalised to absorb this catastrophe event.We’re hearing from sources that there could be some outliers for who hurricane Ida proves a significant capital event though, as the most thinly-capitalised primary carriers may require some injections of new capital to help them sustain their businesses after another major catastrophe loss.– .

– .– .– .

– .– .– .

– .———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis