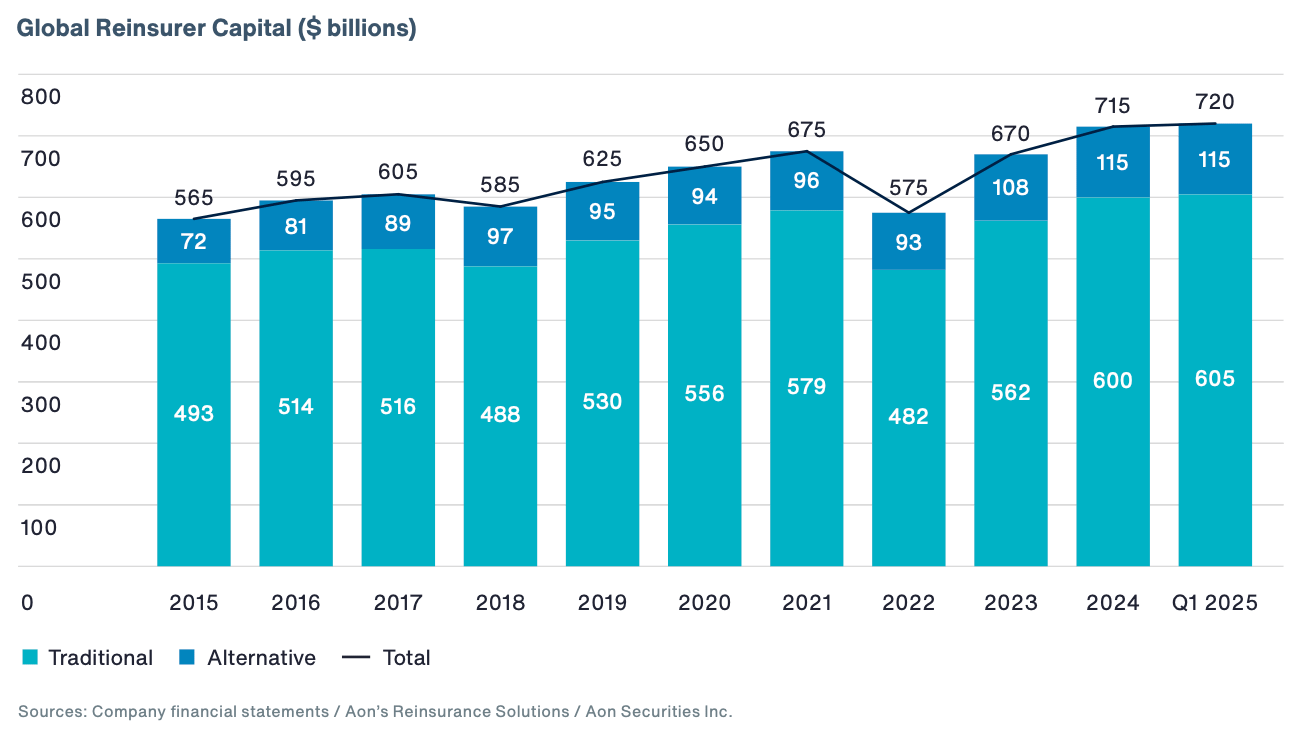

Global reinsurance capital outpaced demand at the 2025 mid-year renewals, fostering a more competitive environment for buyers, according to Aon.The firm also estimated that insurance-linked securities (ILS) capital remained stable at $115 billion as of the end of the first quarter, underscoring the ongoing strength and resilience of alternative capital sources.“Coming at the start of the Atlantic hurricane season, June 1 and July 1 are key renewals for the U.S.

and Latin America, as well as Australia and New Zealand.Despite an active first half for natural catastrophe losses, mid-year renewals experienced a broadly competitive environment as reinsurers, ILS markets and new entrants sought to deploy capacity and grow market share,” Aon explained in its mid-year 2025 renewals Reinsurance Market Dynamics report.Global reinsurer capital rose by $5 billion to $720 billion in the first quarter of 2025, surpassing the previous record of $715 billion set in 2024, despite the financial impact of the California wildfires.

According to Aon, this growth was driven by strong retained earnings among established players, with two-thirds reporting double-digit annualised returns on equity.At the same time, the catastrophe bond market posted record issuance in the first half of 2025 with the two largest transactions in the history of the market, each exceeding $1.5 billion.Florida’s Citizens Property Insurance Corporation secured a then-record $1.525 billion of reinsurance from its Everglades Re II Ltd.

(Series 2025-1) issuance.State Farm then secured a record amount of reinsurance limit from the capital markets in a single visit in cat bond form, as it priced $1.55 billion of multi-peril protection via sponsorship of four Merna Re (Series 2025) cat bonds.Moreover, Aon went on to note that reinsurance capacity was more than sufficient to absorb a near 10% increase in global demand for property catastrophe limit.

“The growth was largely driven by insurers in the U.S., influenced by significant depopulation of Florida’s windstorm insurer of last resort, Citizens.Other factors included inflation, model changes and revised views of natural catastrophe exposure, with recent wildfires in the U.S.and floods in Brazil prompting insurers to evaluate loss potential and protection needs,” the broker explained.

Furthermore, Aon estimates that equity reported by global reinsurers rose by $5 billion to $605 billion in the first quarter of 2025, continuing the recovery seen since 2022.“The primary drivers have been strong earnings, following the market ‘reset’ in 2023, and the reversal of unrealized losses on fixed-income securities, due largely to the “pull-to-par” effect.Growth has been partly offset by increased capital returns to investors, as reinsurers look to reward loyalty,” Aon noted.

The broker added: “Alternative capital is estimated to have remained at a record high of $115 billion, with attractive market conditions encouraging existing participants to reinvest profits and new entrants to commit funds.“Increased investor appetite is allowing many traditional reinsurers to expand their sidecar and/or catastrophe bond programs, enabling the deployment of additional capacity.” .All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis