No matter what type of work you do, you probably need at least one piece of equipment to complete your day-to-day tasks.Bob the Builder needs his tools to fix things.Bob Belcher needs a commercial griddle to cook his famous burgers-of-the-day.

Peter Parker needs his camera to take pictures of Spider-man, who’s a menace to society! Similarly, every business owner needs equipment to keep their business running smoothly.Because of this, it’s important to ensure you have the proper insurance coverage to protect your equipment in the event of a loss.Your commercial property insurance includes equipment insurance that will cover your business equipment in many scenarios.

However, certain scenarios may require additional coverage called equipment breakdown insurance.Understanding the differences between equipment insurance and equipment breakdown insurance can help you protect your small business from costly repair or replacement costs when your equipment gets damaged.What is the difference between equipment insurance and equipment breakdown insurance? Equipment insurance: Commercial property insurance for small businesses is designed to protect both the building you operate your business out of and the contents inside, including your equipment.

This type of insurance coverage can protect items in your building, including inventory, furniture, and tools.It can also provide protection for things outside of your building, including outdoor signs, fencing and landscaping.Commercial property insurance will typically provide coverage for your equipment if it has been damaged by external sources.

For example, if a fire breaks out in Bob the Builder’s workshop and it damages his equipment, he could look to his property insurance policy for coverage.Some other examples of external sources of damage typically covered are: Flood damage Severe weather damage Theft Vandalism Unfortunately, your commercial property policy may not cover another common problem: the sudden, accidental breakdown of your company’s equipment caused by internal sources.To be covered for this, you would need equipment breakdown insurance, not just equipment insurance.

Equipment insurance protects from damage resulting from external causes, equipment breakdown insurance helps with damage caused by internal issues.tweet Equipment breakdown insurance: Equipment breakdown insurance is a form of additional coverage that goes above and beyond your commercial property policy.If your equipment requires repairs or replacement due to internal issues, your equipment breakdown coverage can help mitigate some of those costs.

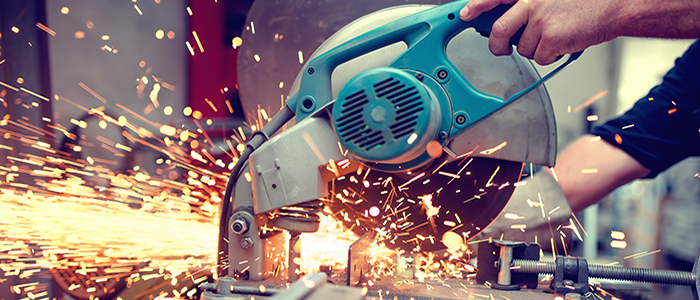

Some forms of damage typically covered by equipment breakdown insurance include: Explosion damage from boilers and piping containing steam or water under steam pressure Explosion damage from other pressure vessels Mechanical or electrical breakdown, derangement or centrifugal force Mechanical and electrical breakdowns are common for small business owners.For example, Bob the Builder’s electric saw might short circuit and stop working.Can he fix it? Well, without proper coverage, it would cost him a lot of his own time and money before he can get his business up-and-running again.

Here’s another example: Bob Belcher requires lots of equipment to runs his restaurant, Bob’s Burgers.What would he do if an unexpected power surge damaged his air conditioning on a hot summer’s day? What if his griddle stopped working? Sweaty and hangry customers are a recipe for disaster.Furthermore, Bob’s property policy may not cover these damages, and without equipment breakdown coverage, he could face costly repairs.

Do you need equipment breakdown insurance? Small business owners rely on new technology and equipment more than ever.In addition, newer technology may be less durable than traditional equipment, making equipment breakdown insurance a key coverage type to consider.If you’re a retailer, you may rely on an electronic register to process customer purchases and store customer information.

What would you do if it broke down suddenly and without warning? Without proper coverage, you’d have a hard time getting your business back up-and-running, which could impact your bottom line.Retailers aren’t the only ones who could be impacted though.Here are some other businesses that should consider additional equipment breakdown: Bakeries and restaurants that rely on electrical kitchen equipment Contractors and other skilled tradespeople who require equipment on jobsites Professional or creative service providers who rely on computers, networks or other electrical systems for their day-to-day operations Basically, if you use any type of equipment to operate your equipment, you should consider getting additional equipment breakdown insurance.

If an internal issue causes your equipment to break down and you’re not properly covered, you’re going to have a bad time.Think equipment breakdown insurance is what your small business needs? Learn more about how equipment breakdown insurance can protect your business.

Publisher: TruShield Insurance