The catastrophe bond market has shown increasing confidence in assuming wildfire risk even after the major disaster that struck the Los Angeles region of California at the start of this year, with already over $3.375 billion of cat bonds issued in 2025 that have an exposure to the wildfire peril.2025 began with the most costly wildfire event ever to hit the global insurance and reinsurance industry, with the estimated $40 billion of market losses also having an impact on some insurance-linked securities (ILS) funds.For the cat bond fund segment, direct losses from the wildfires were small, given their relatively low absolute exposure to the wildfire peril on a per-occurrence basis.

The only occurrence cat bond to suffer a loss .But, outside of per-occurrence impacts, the wildfires did also contribute to the accumulated aggregate loss burden for a number of cat bonds, which has driven some additional cat bond losses as the year progressed and leaves some calendar year aggregate deals with eroded attachments for the rest of 2025.The wildfire event exposed the challenges California’s property insurance market has faced in recent years and drove home the need for efficient reinsurance risk capital to support underwriting operations there.

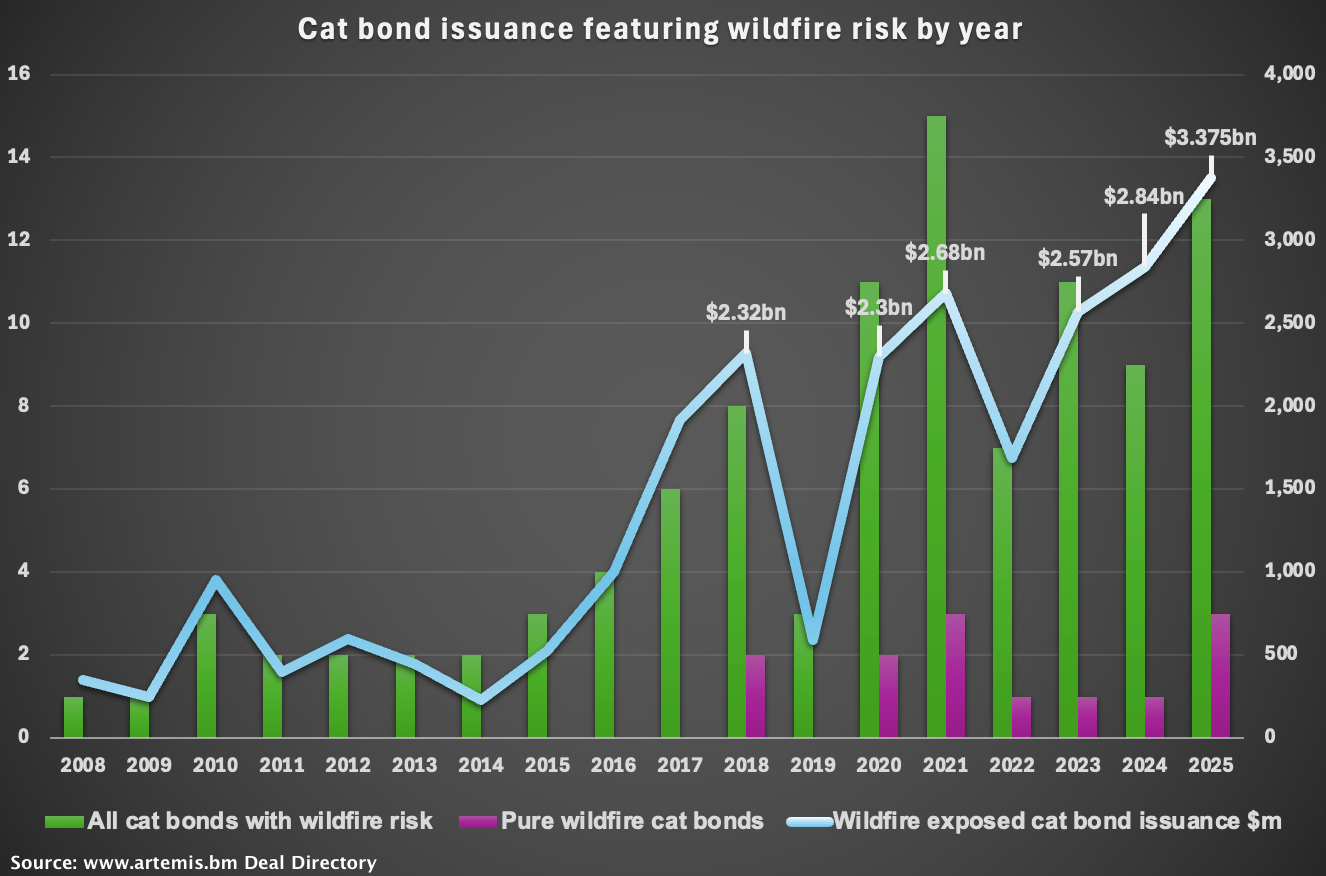

So it is encouraging to note that, so far in 2025 we have tracked more wildfire exposed catastrophe bond issuance than we’ve recorded in our extensive for any previous year.Year-to-date, we’ve tracked and analysed some $3.375 billion of new catastrophe bond issuance that has an exposure to wildfire risk, which beats the previous highest full-year total of $2.84 billion of wildfire exposed cat bonds tracked by Artemis in 2024.Notably in 2025, $350 million of this issuance came from three pure California wildfire 144A cat bonds, the most issued in any year.

2021 also saw three pure wildfire cat bonds come to market, but one was the aforementioned Mercury private deal that was triggered by the recent fires and the volume issued was far lower.As is typical the rest of the wildfire cat bond limit issued comes from multi-peril issuances, where the wildfire peril is one of those covered.We thought it might be helpful to show how wildfire exposure has come to the cat bond market over the years, in the chart below.

It’s worth noting, this is not weighted in any way, it purely shows the total number of wildfire exposed cat bonds issued, the number of pure wildfire cat bonds issued, and the limit of protection secured across all of those deals: While the 2025 LA wildfires were a particularly significant loss event, they also served to further demonstrate how risk-sharing between different constituents in and tiers of the insurance, reinsurance and ILS industry has been adjusted in recent years, providing a valuable test of current reinsurance and retrocession market structures.Had a California wildfire loss of this magnitude occurred back in 2017 or 2018, we would likely have seen a meaningfully larger proportion of the resulting financial impact flowing to the global reinsurance and retrocession market, with cat bond and ILS investors taking their share.In discussions with some sources in the cat bond fund space, this recent test of structures has been viewed as a valuable input that has raised interest in wildfire exposure in some parts of the market.

But, just as important has been the advancement in catastrophe risk models for wildfire risks, which have improved in recent releases and become far more effective for ILS fund managers, in helping to define their risk appetite for the wildfire peril.Of course, we’re also in a record year for the catastrophe bond market.So, abundant capital and the desire to deploy it may also have helped to raise fund manager appetites for the wildfire exposed cat bonds that have come to market in 2025 so far.

So the dollar value of catastrophe bonds issued that have some exposure to the wildfire peril is already running at a record level in 2025, compared to any prior year.The number of wildfire exposed cat bond that have come to market is currently running second only to 2021, but with the potential for a lot more issuance through the rest of 2025 this could also rise to a new high.For pure wildfire cat bonds, 2025 is already at a record level of 144A wildfire cat bond issuance.

All of which serves to demonstrate an increased appetite for the risk, likely driven in the main by the enhanced view of the peril now available through catastrophe models, as well as the improved situation surrounding attachments and terms.Resulting in the cat bond market supporting an increased in provision of wildfire focused reinsurance capacity, which is welcome support for insurers and policyholders in exposed areas such as California...

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis