Alternative capital remains a critical source of retrocessional reinsurance capacity for some of the biggest reinsurers in the market, with it seen to increase in importance for some of the top-tier companies over the last year, S&P Global Ratings has said.In one of the rating agencies typical reports timed just in front of the reinsurance Rendezvous meetings in Monte Carlo, S&P Global Ratings has again highlighted that for some reinsurance firms ILS and alternative capital are critically important.S&P explains that major global reinsurers have continued to expand their natural catastrophe business through the harder market pricing.But the pace of growth has now slowed somewhat and is more aligned with general exposure trends, the rating agencies analysis suggests.

S&P said, “Reinsurers’ appetite for catastrophe risk has moderated in 2025 and will likely remain subdued in 2026, as pricing conditions soften.” However, “We still expect global reinsurers will moderately increase their property catastrophe risk exposure over 2025-2026,” S&P explained.Adding that, “We believe the top 19 global reinsurers continue to have sound earnings and capital buffers to withstand severe stress before capital would be affected.” High attachment points and a trend of more frequent but moderate losses over 2024 means that primary insurers have again absorbed a large portion of catastrophe loss activity.In fact, S&P notes that reinsurers share of industry loss remains historically low, given the adjustments to risk-sharing achieved through the hardening phase and tightening of terms such as attachment points.

Impressively, at the global reinsurance sector level, S&P believes the industry now has the capital and resources to “withstand severe annual industry-wide losses above $300 billion.” Key to withstanding this, alongside reinsurers own capital buffers, is also their use of retrocessional protection, some of which comes from the insurance-linked securities (ILS) market and alternative capital sources.Data as of January 1st 2025 suggests that reinsurers have kept their retrocession use relatively steady over the last year, S&P believes, adding that buyer conditions have been improving.“An increase in retrocession capacity, including the availability of third-party capital, is starting to weigh on pricing in a retrocession market that reached record highs in 2024,” the rating agency explained.

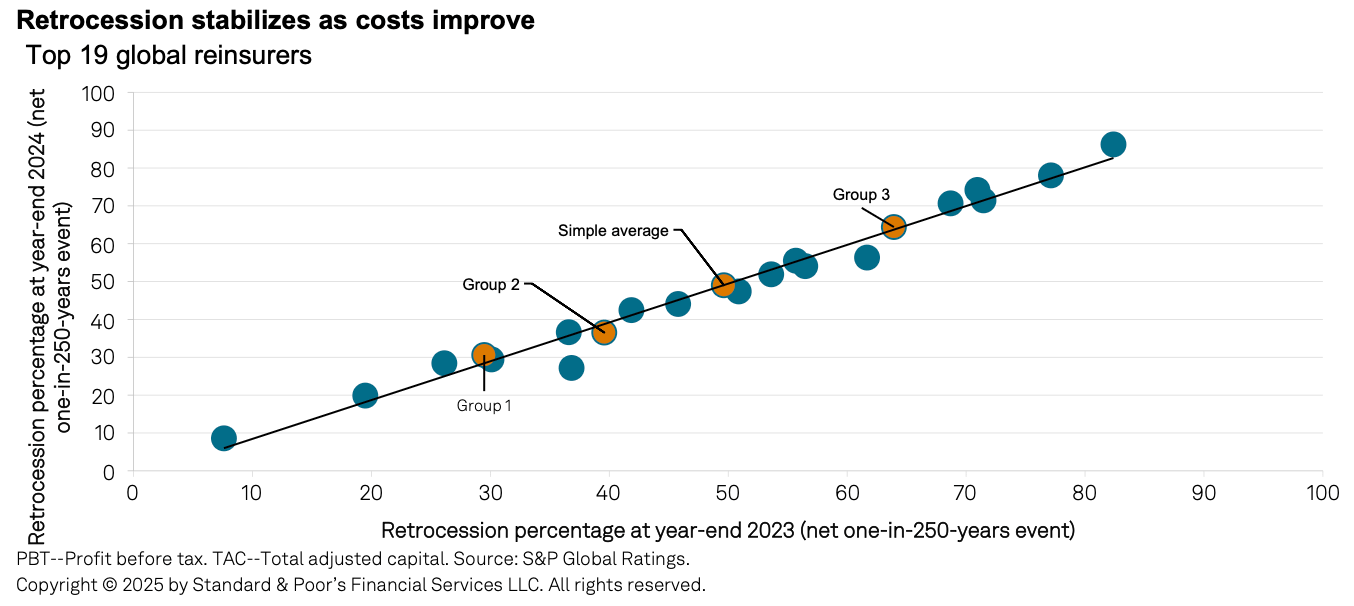

Adding that, “As of Jan.1, 2025, the 19 reinsurers in our sample ceded, on average, about 50% of their exposure to one-in-250-years events.We note, however, that the approach to retrocession varies widely, with large global reinsurers often deciding to retrocede less risk on average than their peers.” But in some cases, reliance on collateralized sources of retrocession has continued to increase.

This could be due to cost-effective retrocession being more available in the ILS market, including in catastrophe bond form.S&P said, “At the same time, we observe that alternative capital continues to be a critical source of capacity and has further increased in importance, particularly for the retro strategies of sample groups 1 and 3.” For reference, Group 1 is the large European reinsurers (Swiss Re, Munich Re, Hannover Re, SCOR and Lloyd’s), Group 2 is large North American reinsurers (Arch Capital, Everest, Fairfax Financial and RenaissanceRe), and Group 3 is other reinsurers (AXIS, Ascot, Aspen, China Re, Convex Re, Fidelis, Hiscox, Lancashire, Markel and SiriusPoint).You can see in the chart below that the increases in collateralized retro usage in those groups has actually increased the total for the entire sample as well.

The increase in use of collateralized retro likely reflects growing capacity in that space, including from ILS sources, more attractive catastrophe bond pricing and the fact cat bond pricing can often front-run the renewals, as well as some new collateralized entrants and growth from existing players.It’s clear that the collateralized markets remain a key and perhaps critical source of additional protection for the largest reinsurance companies in the world.It is also worth noting, that when it comes to identifying collateralized retro, for some of the reinsurers mentioned a portion of it may actually be from the cessions they market to ILS markets via their collateralized fronting activities.

While that capital and collateral is providing protection, it can also be considered growth and leverage capital as well, that helps reinsurers earn fees, deliver larger lines to clients, and effectively have an even more meaningful stature in the market, all while drawing on the appetite of investors to access risk more efficiently.S&P concluded that a disciplined approach prevails in the global reinsurance sector.“Global reinsurers are in a strong position, with capital at record-high levels and healthy underwriting margin prospects.

As conditions have started to soften and volatility remains high, reinsurers will seek to defend their positions.After several years of positive pricing corrections, the property catastrophe book will likely remain attractive for reinsurers in 2026,” the rating agency said..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis