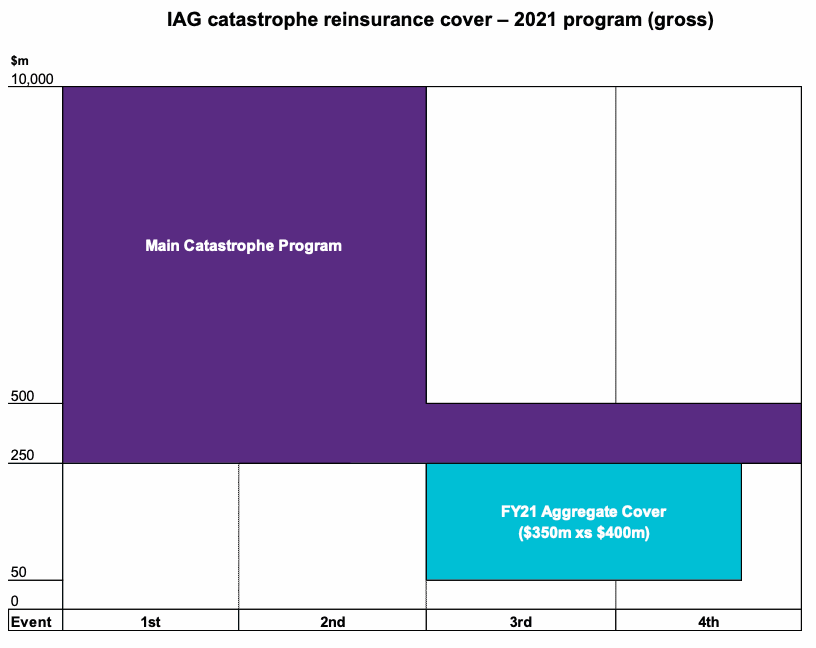

Australian primary insurance group IAG has successfully renewed its catastrophe reinsurance tower to provide it with the same $10 billion level of occurrence coverage as it had for the prior year, citing only “modest” increases in rates at the renewals.IAG enters the new calendar year with a $10 billion main catastrophe reinsurance cover, placed to 67.5% to reflect the insurers existing quota share reinsurance arrangements.It features one prepaid reinstatement for losses of up to $10 billion, while IAG retains the first $250 million of every loss, the same as the prior year.On the lower layers of the reinsurance tower, $250m xs $250m, IAG has again secured three prepaid reinstatements.

In addition, the company has its aggregate catastrophe reinsurance tower in place as well, .The aggregate reinsurance runs for 12-months to June 30th 2021, providing $350 million of cover attaching at $400 million of qualifying losses to IAG.Qualifying events are capped at $200 million excess of $50 million per event, from Jan 1 2021.

IAG said that it “experienced a modest increase in reinsurance rates during the renewal process, with the overall expense outcome in line with expectations.” But roughly 65% of the main catastrophe reinsurance tower is now secured on various multi-year terms, giving greater certainty and security over pricing.Around 90% of the reinsurance tower has been placed with A+ or better rated reinsurers, which does mean there could be some collateralised participation in the remaining 10%.In addition, ILS fund capital has likely played a role on a rated or fronted basis in the program as well.

When including the effects of IAG’s quota share, the retentions drop to $169 million for Australia (NZ$169 million for New Zealand) for the first and second events, but retentions drop to $34 million (NZ$34 million) for a third loss event.IAG also has secured stop-loss reinsurance protection for any retained natural perils, aligned with its financial year.The stop-loss reinsurance offers IAG $100 million of cover excess of $1.1 billion ($68 million in excess of $743 million, after the quota share) for the 12 months to June 30th 2021, with an attachment point close to the FY21 natural perils allowance of $975 million ($658 million post-quota share).

.———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis