The retrocession renewals for January 1st 2026 were finalised much later than usual.But, with ample capacity available from traditional and ILS markets, buyers achieved price reductions and also re-introduced more frequency protection to their coverage, according to Gallagher Re.The reinsurance broker estimates that, in the non-marine retrocession segment of the reinsurance market, catastrophe loss free accounts renewed down 10% to as much as 20%.Loss impacted retro reinsurance renewals also saw declines, with a range from flat to down 10% seen as the outcome at 1/1 2026.

The retrocession renewals were seen as “very late” to complete, Gallagher Re explained.We’ve been told there are still some retrocession renewals being completed in the first weeks of January this year, as a number fell over into 2026 as buyers continued to seek out price improvements.“As a result of substantial available capacity and modest increased demand, reinsurers had less certainty around the ability to achieve their targeted inwards portfolio growth at January 1.

As a result non-marine retrocessional placements were very late,” the broker explained in its 1st View report on the renewals.But, as orders materialised there was a robust capacity response, with ample capital from both traditional retrocessionaires and the insurance-linked securities (ILS) fund marketplace.Gallager Re called the renewal capacity “robust” and notes that this has also helped retro buyers to enhance their coverage at 1/1 2026.

Notably, Gallagher Re said that, “Frequency covers were reintroduced as a core part of the strategy,” in the retrocession market at 1/1.There was product expansion into aggregate and frequency covers, as capacity in a range of forms responded positively to buyers needs at the January 2026 renewal season.Buyers have been looking to reinstate aggregate and frequency covers for as a core component of their retro programs and this year market conditions were conducive, it appears.

There was both buying of new aggregate or frequency retro covers, as well as expansion of existing ones, Gallagher Re said.The broker also reports increased demand for quota shares and reinsurance sidecars, which were met with “plentiful supply” of capital.With insurance-linked securities capacity particularly abundant, additional pressure was seen on pricing of upper-layer excess of loss and industry-loss warranty (ILW) arrangements at the renewals.

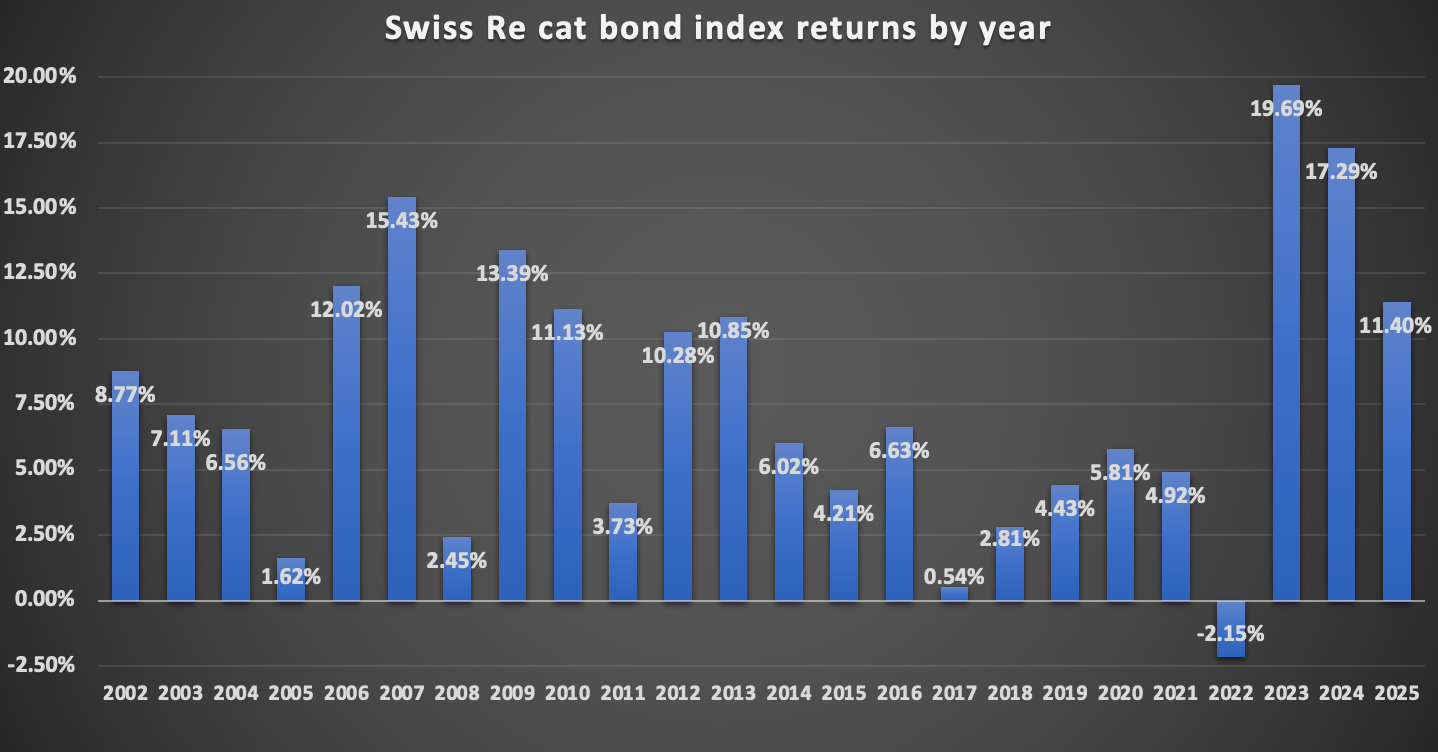

However, Gallagher Re highlights that the largest rate decreases were seen in buyer programs where attachments and coverage dynamics were stable.Commenting on capital dynamics in the retrocession market at the January 2026 renewals, Gallagher Re Non-Marine Retro broking specialist Tom Smart explained, “Another year of healthy returns continued to drive abundant supply of retrocession capacity from both the traditional rated carriers and the ILS market, with buyers experiencing a positive trading environment at 1.1.26.“Market capacity was adequate across the board with increased competition throughout programs as reinsurer growth ambitions combined with increasing confidence in California Wildfire reserves drove increased appetite from incumbent markets.

“Occurrence UNL limit was broadly stable, with a number of aggregate and frequency covers purchased new and/or expanded, with buyers looking to re-introduce frequency covers as a core part of ceded strategy.“Whilst reinsurers continued to differentiate cedants on both price and coverage, the largest rate reductions were available on more remote layers.” Smart also noted that, “This renewal was markedly late compared to recent years, with a large proportion of firm orders received in the last two weeks of the year and we continue to see a continued emphasis from cedants on achieving contract certainty and the timely funding of Trust Accounts when allocating capacity.” ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis