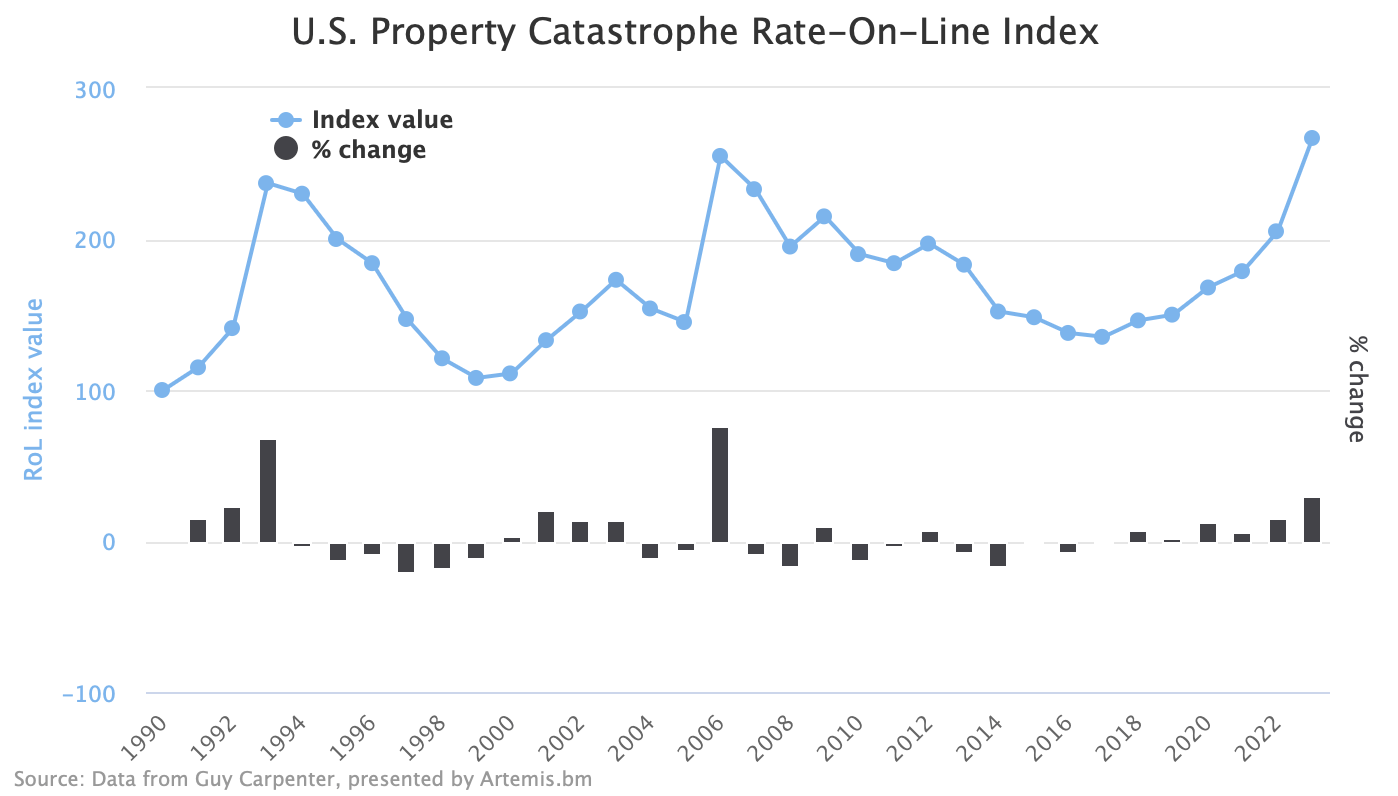

Property catastrophe reinsurance rates-on-line in the United States have reached a record-high, according to the latest data from broker Guy Carpenter.Guy Carpenter’s , a broad measure of catastrophe reinsurance pricing in the key United States marketplace, rose 30.1% at the January 2023 renewals.The U.S.

Property Rate on Line Index from Guy Carpenter is a proprietary index of US property catastrophe reinsurance Rate-on-Line movements.The data is sourced from real, brokered excess-of-loss reinsurance placements.Guy Carpenter has maintained this index since 1990, making it the longest-standing source of insight into US cat reinsurance pricing.

The Index is updated after the January 1st renewals and then again at the July 1 renewals, each year and is calculated by analysing the change in reinsurance rate-on-line (RoL) year on year across the same renewal base.As a result, the current Index level for 2023 is only based on the US property cat reinsurance pricing from the January renewal season, so remains preliminary.For full-year 2022, this Index rose by 14.8%, which took the US property catastrophe reinsurance rate-on-line Index back at its highest level since 2009.

Now, with the pricing from the January 2023 reinsurance renewals also factored in as a 30.1% increase in RoL, the Guy Carpenter has reached an all-time-high.Perhaps more impressive is the cumulative increase in US property catastrophe reinsurance rates-on-line since the bottom of the last soft market, which occurred in 2017.Since then, this Index has risen by approximately 97%, a truly significant reversal of the cheap reinsurance pricing seen at that stage, after the years of softening that preceded it.

At 30.1%, the increase this Index has seen at January 2023’s renewals was not the largest increase ever seen.This Index rose 76% in 2006, in the wake of hurricane Katrina, which remains the biggest annual jump in rate-on-line recorded by Guy Carpenter.But, the significant 97% cumulative increase since 2017 reflects the need for higher returns to be earned in reinsurance, as both traditional and alternative markets realised the softening had perhaps gone too far.

Get a ticket soon to ensure you can attend.

Publisher: Artemis