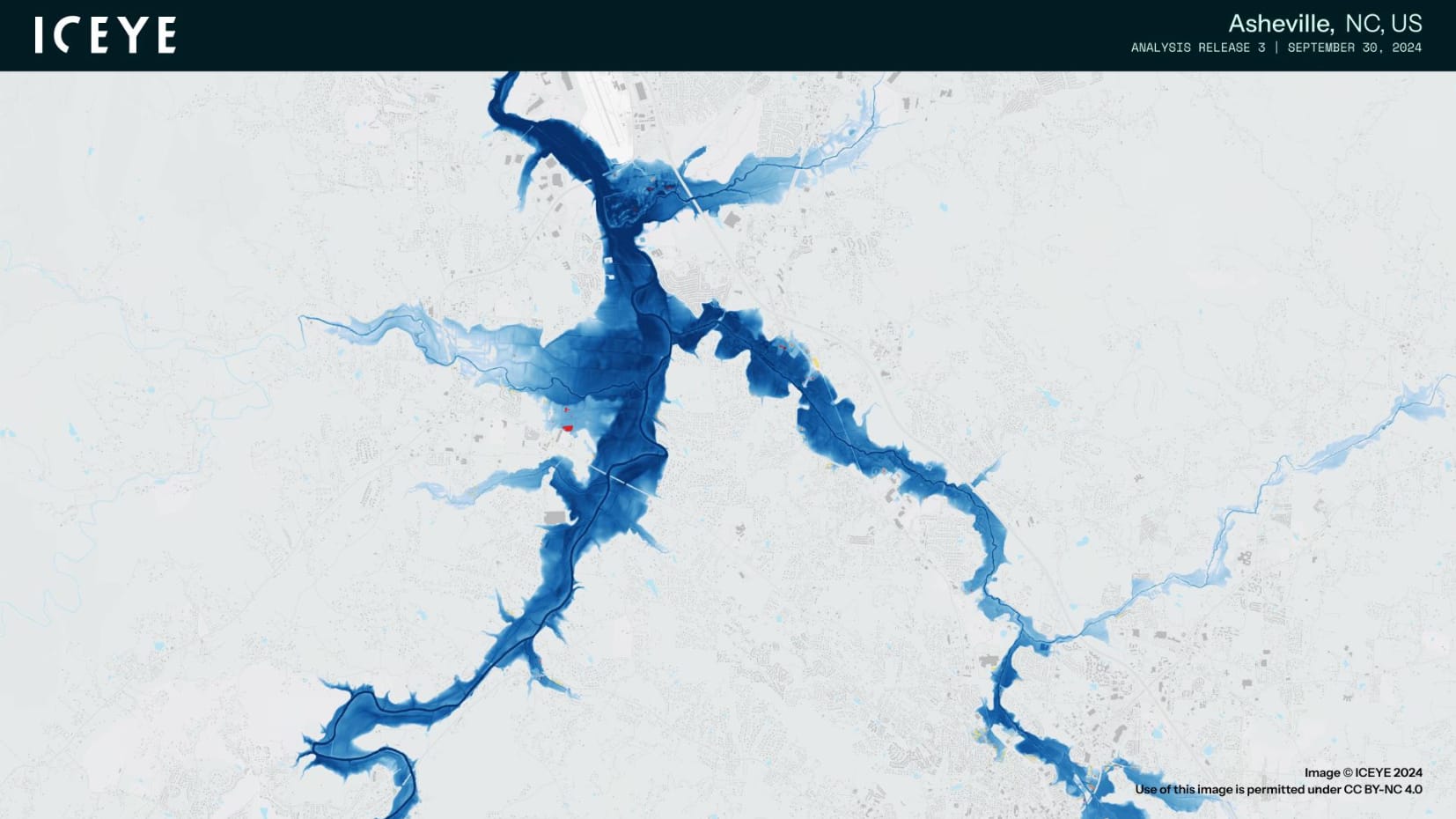

According to analysis from ICEYE, the provider of satellite data and services to inform decision-making and analysis, hurricane Helene’s flooding saw over 100,000 buildings impacted, with more than 10,000 of those being inundated to flood depths of greater than 5 feet.Hurricane Helene’s flood related impacts extended from the wide-spread storm surge along the Florida Gulf coastline, right the way through the rainfall-related impacts to the states of Georgia, South Carolina, Tennessee and North Carolina, with particularly catastrophic damage in the northwest of the region.ICEYE said it has been monitoring the hurricane and its impacts since its formation, then acquiring more than 350 SAR satellite images of the impacted areas through thick storm clouds and even at night.“We delivered the first flood extent and depth analysis on September 28th, focusing on the west coast of Florida.

Two more releases of our flood analysis have been produced since, covering additional areas in the Florida panhandle, Georgia, and the Southern Appalachians,” ICEYE explained.Adding that, “Based on our latest data, over 100,000 buildings have been impacted across Florida, North Carolina, Tennessee, Georgia, Virginia, South Carolina, and West Virginia, with at least 10,000 buildings inundated by over 60 inches (over 5 feet; 152 centimeters) of water.” ICEYE continues to provide near real-time flood extent and depth data and analysis to emergency management organisations, public authorities, and insurance companies on the impacts of hurricane Helene’s flooding.ICEYE’s flood extent imagery helps to provide some insights into the extent of damage, how many properties are affected and based on the depths also how seriously, which is helpful information for insurance and reinsurance market constituents.

At more than 5 feet of flood waters, properties can be severely damaged, take months to dry out and recover, resulting in significant financial costs and insurance claims where they are covered, by private insurance or a National Flood Insurance Program (NFIP) policy., the significant damage footprint associated with hurricane Helene, from landfall and along the Florida coast with wind and surge, through southeastern states with hurricane force wind gusts, and then the devastating flood impacts seen up into Tennessee and North Carolina, there is the potential for a high cost from water-related damages.Which has brought the NFIP’s reinsurance and catastrophe bonds somewhat into focus, although at this stage we understand that the FloodSmart Re cat bonds had not been marked down in Friday’s pricing sheets and so far are not seeing any trading activity in the secondary market, suggesting most holders feel them likely to be safe.

But, the aggregate costs of the flooding associated with hurricane Helene will be very high and at this stage there is no clarity over the NFIP claims burden, so it will be some time before a clearer picture on the public and private insurance market losses caused by Helene’s impacts are understood and the NFIP’s reinsurance tower and cat bonds can be deemed definitely safe from attaching.– .– Florida reinsurance dependency in focus after Helene, with $5bn+ loss expected: AM Best.

– .– Hurricane Helene private insurance loss seen mid-to-high single-digit billions: Bowen, Gallagher Re.– .

– Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic.– .– Hurricane Helene landfall at Cat 4 140mph winds, Tampa Bay sees historic surge flooding.

– .– Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis