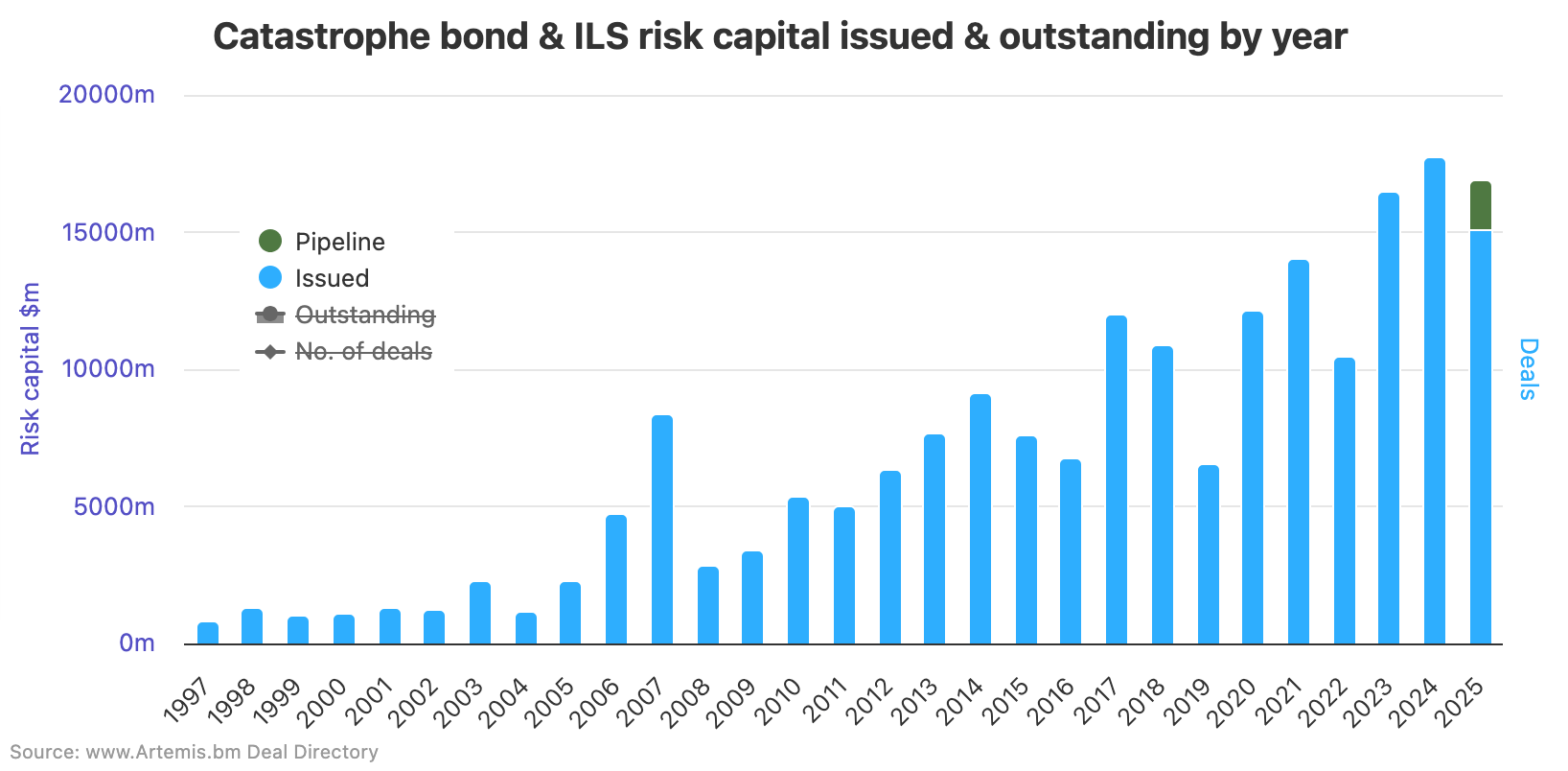

Catastrophe bond issuance in 2025 has continued at record pace and already this year is on-track to be the second biggest ever for cat bond issuance, once the current pipeline has settled, with only a further $815 million required to break the annual market record as well, according to Artemis’ data.We’re not even at the half-way point of 2025 and Artemis has now tracked almost $15.06 billion of new issuance across 144A catastrophe bonds and the few private cat bond deals seen year-to-date.There are currently a further $1.825 billion of catastrophe bonds in the market pipeline, if all deals still to settle that we know of achieve their current top-end target issuance sizes.Of course that could also increase, if any further cat bond upsizing occurs.

Which leaves us with a new projection for $16.88 billion of cat bond issuance to settle before the end of June 2025.While full-year 2024’s record cat bond market issuance was just over $17.69 billion, 2025 is now on-track to become the second biggest year ever before the first-half is over, beating the next biggest full-year of issuance which was almost $16.45 billion in 2023.The chart below shows settled issuance and the pipeline yet to complete this month for 2025 is already above the 2023 figure and now only $815 million behind the record full-year total from 2024.

.The incredible rate of activity in the catastrophe bond market continues and with still six new series of notes yet to finalise in terms of their issuance sizes and pricing, all detailed in our , the first-half record that will be set in 2025 could even increase further.While the cat bond market has not yet reached the end of June in 2025, fully settled new cat bond issuance tracked by Artemis already stands above any level in the market’s history for the first eleven months of each prior year, so January through November.

Which means the cat bond market is now running over five months ahead of any previous year, in terms of the run-rate of new catastrophe bond issuance.You can analyse this using .The image below shows this chart with December deselected from the analysis.

So, with a new annual record for the amount of catastrophe bond issuance tracked by Artemis, across Rule 144A and private cat bond or cat bond lite deals, now standing at just $815 million below the annual record from 2024, it is very hard to think 2025 will not beat that.In fact, the $20 billion annual issuance market is now clearly in sight, if the market remains as robust as it has been so far in 2025.We believe it would take either a truly historic insured catastrophe loss, or series of large loss events, or a major disruption to capital markets, to derail the catastrophe bond issuance train from exceeding $20 billion for the first time ever in 2025.

In terms of .Which now represents cat bond market expansion and growth of almost 16% since the end of 2024, at this time, or growth in dollar terms of almost $7.7 billion in 2025 at this stage.The market does still look set to shrink a little by the middle of the year, .

But, as the pipeline stands at a potential $1.825 billion (if all cat bonds settle at their top-size targets) and some of those could upsize, while there is still time for a few more deals in June, the market will not shrink dramatically and so first-half cat bond market growth could still be around the 15% level.It is testament to the sophistication of the market and its cat bond and ILS fund managers, as well as the burgeoning interest in the asset class from investors, that this record level of issuance has been absorbed already before the end of the first-half in 2025.With the catastrophe bond market executing at attractive price levels for sponsors as well, that has helped to keep the pipeline flowing and at this stage we see no sign of anything hindering activity levels to remain strong through the rest of the year, once hurricane season is out the way.

Stay tuned to Artemis and we’ll keep you updated., .(use the key of months at the bottom to include and exclude any from your analysis).

The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list..

We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis