The collateralized reinsurance market is estimated to have grown to around US $50 billion by the end of the first-quarter of 2021, with capacity having increased slightly following a more challenging period, according to AM Best.The rating agency believes that collateralized reinsurance capacity returned to growth, helped in large part by the fact those deploying it have remained disciplined.In its latest reinsurance market report, AM Best noted that collateralized capacity appeared to have dropped in 2020, with a number of factors driving that decline.

First, the shift in investor priority to the catastrophe bond market, as investors sought out more transparent and predictable insurance-linked securities (ILS) structures to invest in after a few challenging years of losses.Second, the issues related to trapped collateral had dented market capacity, but this had subsided as we moved into 2021.Third, the fact losses have been above average across the last few years, which pushed a share of those via reinsurance and retrocession contracts into the collateralized reinsurance market.

And, fourth, the potential for losses to collateralized reinsurance because of the COVID-19 pandemic.This resulted in a dip in collateralized capacity in 2020, but this segment’s capacity seems to have increased slightly in early 2021, leading AM Best to its estimate for a $50 billion market after the first-quarter of this year.One of the drivers of a resurgence has been the fact many of the losses affecting collateralized reinsurance funds had been realised or begun to be realised, leaving those ILS funds in a better position to start to accept new capital again.

Also assisting this is the fact that, as AM Best notes, the collateralized reinsurance market has been pushing for more favorable terms related to collateral trapping and the release of collateral, in the wake of the heavy loss years.“Much like traditional reinsurers, collateralized reinsurers have had to tighten their contractual terms and conditions,” AM Best explained.This has positioned ILS funds that allocate to collateralized reinsurance and retrocession in an improving position, with portfolios that were more defensively positioned and set to earn out better, dependent on loss activity.

Also positioning these ILS funds better and making the ILS funds that invest in private deals and collateralized contracts more attractive again, is the fact they have proven disciplined managers of investor capital.ILS funds have held the line on reinsurance and retro pricing, and AM Best noted, “Firm pricing discipline in the collateralized reinsurance market.” As a result, in 2021, “The collateralized reinsurance space has also seen some renewed interest,” AM Best said.Commenting on the price environment for collateralized reinsurers and ILS funds, AM Best explained, “Rate increases during the June renewals were attractive for the collateralized reinsurers, building on the prior rate increases achieved at the January renewals.

This market maintains pricing discipline, achieving the same rate increase as traditional reinsurers.“However, the rate increases in June were less than anticipated, due to an influx of new capital from existing and start-up reinsurers, as well as ILS fund managers moving to provide coverage in more remote layers and new players aiming to write business offering protection for the lower layers.” One side-effect of this is that there has been a divergence of sorts, between catastrophe bond and collateralized reinsurance pricing, as we’ve documented related to cat bond softening through recent months of issuance.AM Best continued to say, “Cat bonds are relatively liquid and provide more clarity into potential losses because they involve clearly defined risks and the use of named perils.

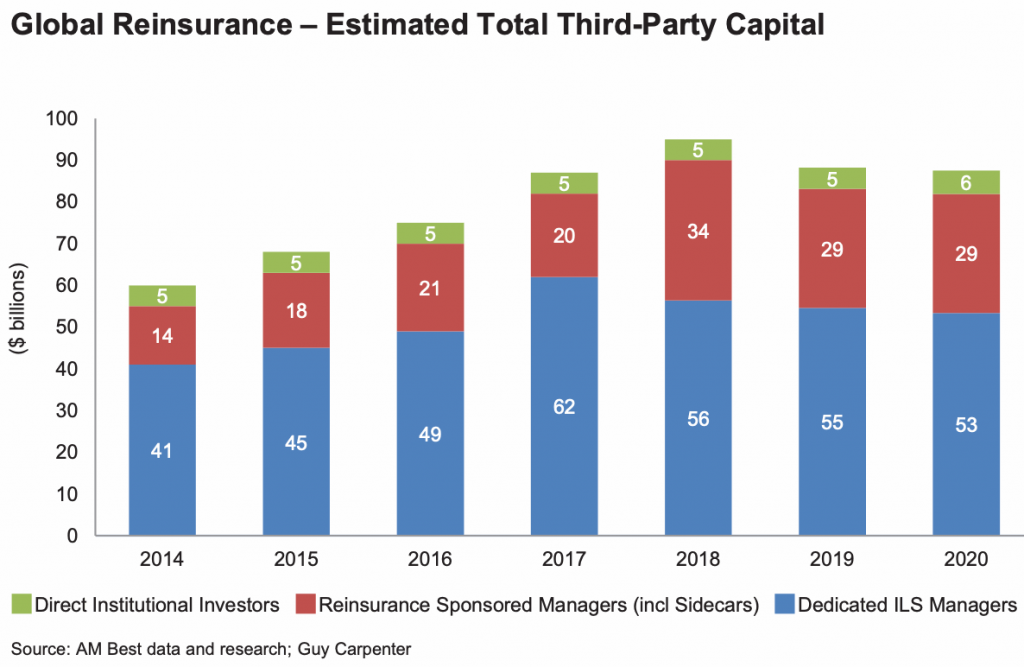

However, the collateralized reinsurance market is still haunted by loss creep and trapped capital associated with prior catastrophe events, as well as potential COVID-19-related losses.“Despite all of the issues the collateralized reinsurance market faces, investors remain interested in this ILS segment.” Driving the collateralized reinsurance market forwards continues to be the dedicated ILS funds and the reinsurer linked ILS management units.By the end of 2020, AM Best and reinsurance broker Guy Carpenter’s data shows that dedicated ILS fund manager capacity had shrunk slightly, but by now, in 2021, we expect that $53 billion may already be heading back towards the $55 billion from 2019, perhaps even a little higher.

Growth of the collateralized reinsurance market segment will help dedicated ILS fund managers lift their overall contribution to the global reinsurance market again.Of course this will also drive growth for reinsurance sponsored ILS managers, as an increasing number of global reinsurers put greater emphasis on managing third-party capital alongside their own balance-sheet in fund and sidecar like structures.Guy Carpenter executives recently clarified collateralized reinsurance as $47 billion, with collateralized quota shares and sidecars at another $11 billion, of global ILS capacity.

———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis