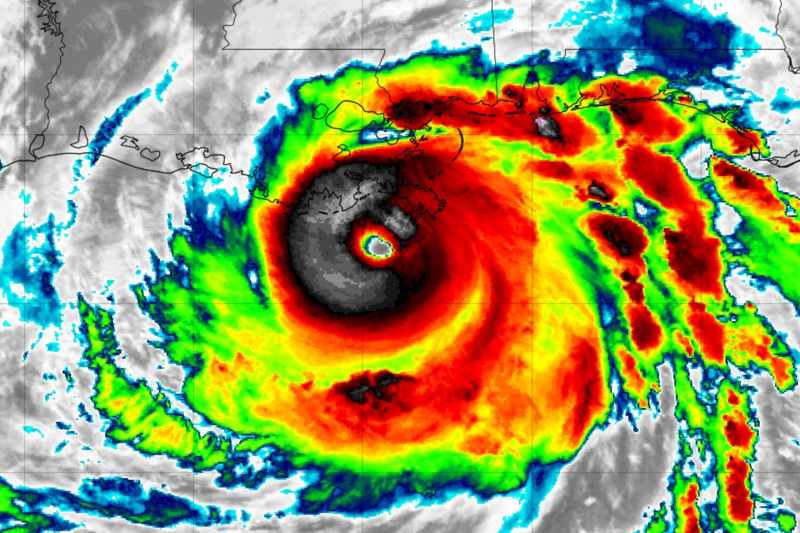

As hurricane Ida moves closer to making landfall in Louisiana today, as a strong Category 4 storm with sustained winds of around 150 mph, Plenum Investments has said that minor impacts to its range of catastrophe bond funds are expected if Ida continues on the forecast track.Plenum Investments AG, the Zurich based specialist insurance-linked securities (ILS) and catastrophe bond investment manager, is one of the ILS managers known for its transparency around major catastrophe events, providing insights to help its investors understand the possible exposure Plenum’s cat bond funds may be facing and making those insights publicly available.Hurricane Ida may be the biggest threat of loss that the reinsurance and insurance-linked securities (ILS) markets have faced this year.So it’s no surprise that some impact to catastrophe bonds, other private ILS and collateralised reinsurance positions is anticipated.

.Plenum Investments is a largely cat bond focused investment manager, so the investment manager’s comments are focused on that specific segment of the insurance-linked securities (ILS) product range.Plenum noted that , with hurricane Ida just hours from striking the Louisiana coast and tropical storm or hurricane conditions already spreading across the region.

As ever, the impact to the catastrophe bond market, as well as broader ILS and reinsurance markets, is by a hurricane and the insured values exposed.Plenum notes that, “If the current predicted track is maintained, the strongest winds are likely to reach the greater New Orleans area, but not in full force.” This means that, “According to the modelling based on the preliminary estimated storm parameters, we expect only minor impacts on the portfolios we manage, because the affected region has a relatively lower density of insured assets,” Plenum said.How badly hurricane Ida impacts New Orleans seems to be an important deciding factor in the quantum of losses faced by the ILS market, particularly for catastrophe bonds, given the concentration of insured value in the city and likely higher wind-related damages as a result.

Plenum provided some specific forecasts for its range of cat bond and ILS funds, based on the latest forecast data and modelled analysis.“The expected losses are 0.12% for the Plenum CAT Bond Fund, 0.08% for the Plenum Insurance Capital Fund and 0.60% for the Plenum CAT Bond Dynamic Fund,” the investment manager explained.The Dynamic Fund targets higher returns, hence the expectation of a more significant impact from hurricane Ida is no surprise.

The Insurance Capital Fund also allocates to private insurance debt investments, so again it’s not a surprise this is forecast to be the fund with the least impacts.Plenum’s flagship CAT Bond Fund is a relatively low-risk strategy, as pure cat bond funds go.Plenum explained how this data should be considered, “These figures are preliminary estimates and subject to uncertainty and serve only as an initial indication, as these figures do not contain possible temporary market price fluctuations, especially of aggregate structures, which we fundamentally underweight in general.

“Overall, our portfolios are underweight the affected region, which is also due to the relatively low density of insured assets.” The insights shared by Plenum are very useful, as they show that some catastrophe bond market impact is now expected from hurricane Ida, albeit relatively minor for Plenum’s cat bond focused funds.Cat bond funds with a more aggressive risk and return target would be expected to see bigger impacts than this.Meanwhile, ILS funds focused on private ILS transactions, collateralised reinsurance and retrocession, as well as reinsurance sidecars, could all experience more significant impacts than this, depending on their portfolio construction, hedging arrangements and exposure to the affected region.

Impacts can still change, with a few hours to landfall.Hurricane Ida continues to track roughly north-west and if the eye moves north further away from New Orleans than expected, that could reduce the impact to catastrophe bonds and the ILS market.———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis