Zurich, the European headquartered global re/insurance company, has renewed its catastrophe reinsurance at January 1st, placing more of its aggregate catastrophe treaty for 2026 to provide additional frequency protection, while finding market conditions stable and pricing favourable.The company reported this morning that only minimal changes were made across the Zurich catastrophe reinsurance tower for 2026.Most notable though is the fact Zurich took advantage of market conditions to secure more aggregate catastrophe reinsurance protection, renewing the treaty it first placed in 2025.As we had reported last year, , which the firm’s CFO called “innovative” and explained that it featured alternative capacity from collateralized markets.

We later reported that .It transpires that the aggregate cat reinsurance only ran through the remainder of calendar year 2025, meaning a renewal was required at January 1st if Zurich wanted to continue with that protection for 2026.The company has now confirmed it has renewed this aggregate reinsurance protection for the new calendar year and slightly expanded its protection as well.

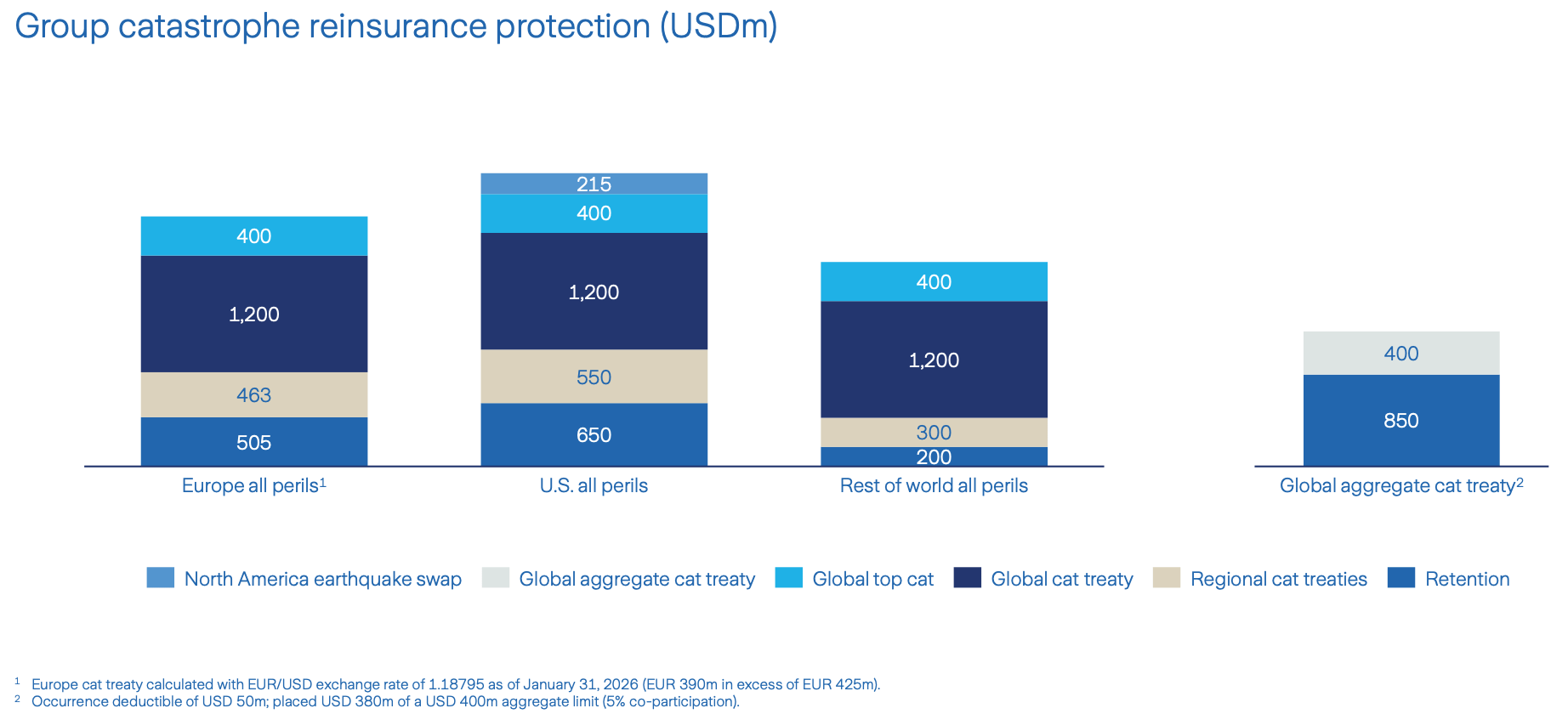

At the January 2026 renewals, Zurich placed the aggregate catastrophe reinsurance treaty with the same $850 million retention and $50 million occurrence deductible, but has now placed $380 million of cover across the $400 million layer that runs to $1.25 billion of losses.Zurich noted that, “Effective Jan 1, we have renewed our Global Aggregate Cat treaty with an increased capacity (95% vs 87.5%) with risk adjusted stable prices.” That provides Zurich with more frequency protection certainty against accumulating losses from small to mid-sized catastrophe events, while its main catastrophe reinsurance towers remain the buffers for larger losses alongside this.In general, the Zurich Group catastrophe reinsurance towers remain largely similar, albeit with some changes to the European catastrophe tower.

The retention for the Europe all perils tower has risen to $505 million, up from $486 million last year, while the European regional cat treaty has expanded above that to $463 million, up from last year’s $446 million.There has been no discernable change to the US and rest of world peril regional catastrophe reinsurance towers, although Zurich did disclose some small additions.The company said that it, “renewed our Global Top Cat XL including an added cyber coverage with a risk adjusted reduction in renewal pricing, reflecting reinsurers strong confidence in our portfolio.” Zurich also added that, “Other treaties such as the Global Surety XOL or U.S.

Liability Quota Share have been renewed without major changes at fairly stable conditions and favorable pricing.” Zurich said that reinsurance renewal conditions were stable and pricing was favourable at January 1st, as evidenced by its ability to expand the aggregate cat treaty.Claudia Cordioli, Group CFO of Zurich, commented during a media call this morning, “Overall, it is a constructive reinsurance market that we are seeing.“We are happy as well to see that reinsurers are disciplined on terms and conditions, because this needs to remain a healthy market for everyone involved.” She further explained, “We are definitely in the risk business, but we want to make sure that we have a predictable, and, as little volatility as it can be in an insurance company, right, in terms of delivery and consistency.

So we use reinsurance in that context and we were happy to be able to reinstate that aggregate last year.“In a market environment like this, we want to retain our strong relationships with reinsurers and we’re happy to see that reinsurers see the progresses that we continue to make on underwriting, happy to support us even more.“We don’t think it is a market context where we should reduce protection, quite the other way around, and we are happy that reinsurers followed us in that.” You can see Zurich’s latest catastrophe reinsurance program disclosure below, with the increased and renewed global aggregate catastrophe reinsurance, as well as the slight changes to the European tower.

For comparison, see the towers after mid-year 2025 with the first disclosure of the aggregate protection ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis