One of the data points we track related to catastrophe bond issuance is .We’ve created a new chart to allow our readers to visualise and analyse this trend in the cat bond sponsor-base.The entry of new and first-time sponsors into the catastrophe bond market has been accelerating in recent years, which will come as no surprise given it is one of the keys driver for .

Aligned with the strong primary issuance of new catastrophe bonds and accelerating growth of the market, the sponsor-base has been becoming increasingly diversified given the entry of new market participants.In the main, new sponsors remain largely primary insurance and reinsurance companies, with the catastrophe bond becoming an increasingly supportive source of capital markets backed reinsurance and retrocession.While other sponsor types have also entered in recent years, these corporate and sovereign cat bond sponsors remain a relatively smaller component of the overall cat bond market.

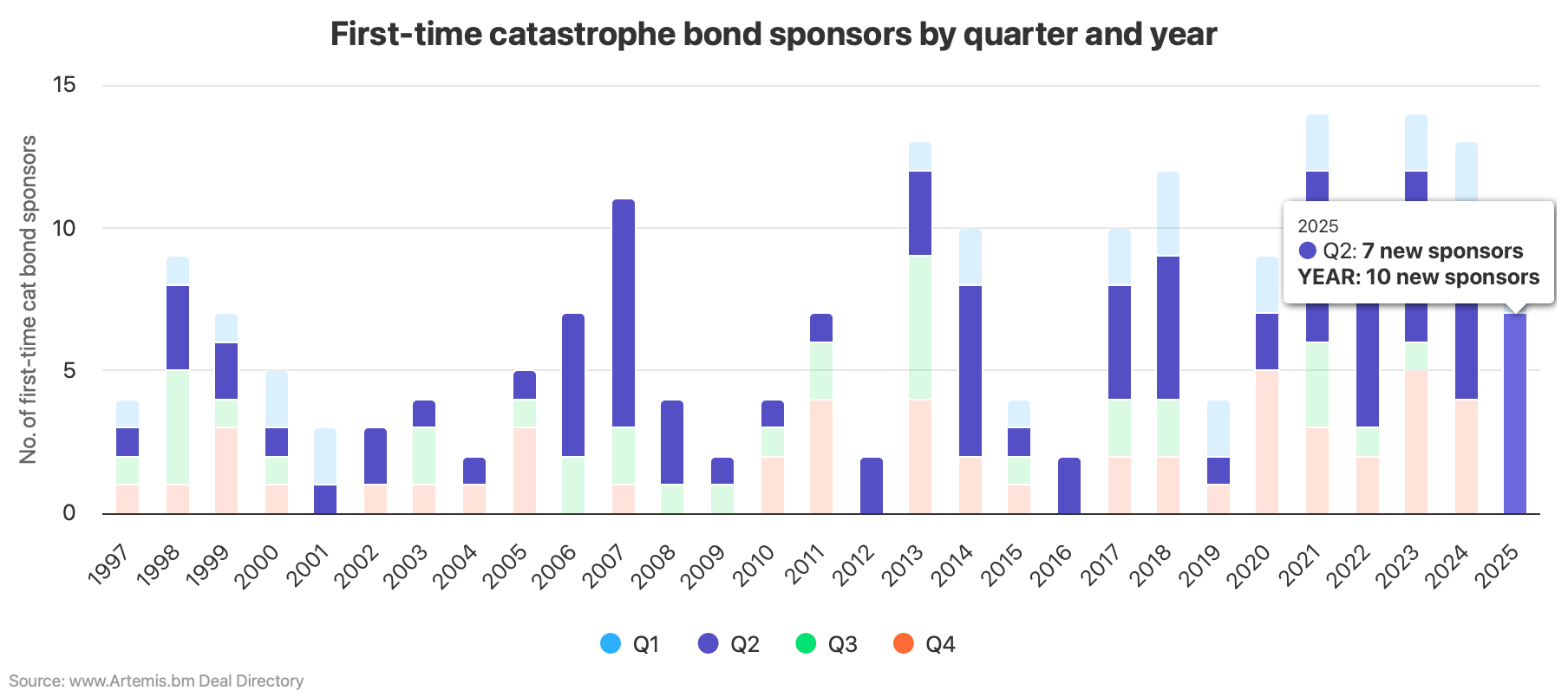

In 2025, the entry of new sponsors to the cat bond market has accelerated again, with so far 10 new ceding entities participating in the catastrophe bonds we have analysed and tracked year-to-date.You can analyse this data and the historical tend in first-time cat bond sponsors by quarter and year in .Being , our new first-time catastrophe bond sponsors by quarter and year chart allows you to analyse the data by quarter, half-year and full-years.

Simply use the quarter categories (Q1 through Q4) at the bottom of the chart and click/tap them to exclude or include periods in your analysis.By excluding the third and fourth quarter categories (at the bottom of the chart) you can quickly see that 2025 is already setting a record pace for first-time cat bond sponsors, with 10 new sponsors entering the cat bond market for their debut issuances so far this year.The continued expansion of the cat bond market sponsor-base is a good indicator for future market growth, as so many turn into repeat-sponsors over the years, embedding and layering multi-year, staggered catastrophe bond backed reinsurance protection from the capital markets into their risk management arrangements.

The expansion of the catastrophe bond sponsor-base is testament to the growing popularity of cat bonds as a mechanism for insurance and reinsurance risk transfer, to the work of brokers in educating the re/insurance market about the potential of securitized capital markets instruments, as well as to the ILS fund manager and investor base in bringing more capital to support market growth.With still two months to run in the second-quarter of the year, we understand there could be more first-time cat bond sponsors to come during the period and so Q2 2025 has the potential to feature the most new cat bond sponsors of any quarter in the market’s history.Remember, , showing who are the most prolific sponsors of catastrophe bonds at this time.

We hope you find a useful addition., .(use the key of months at the bottom to include and exclude any from your analysis).

The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list..

We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis