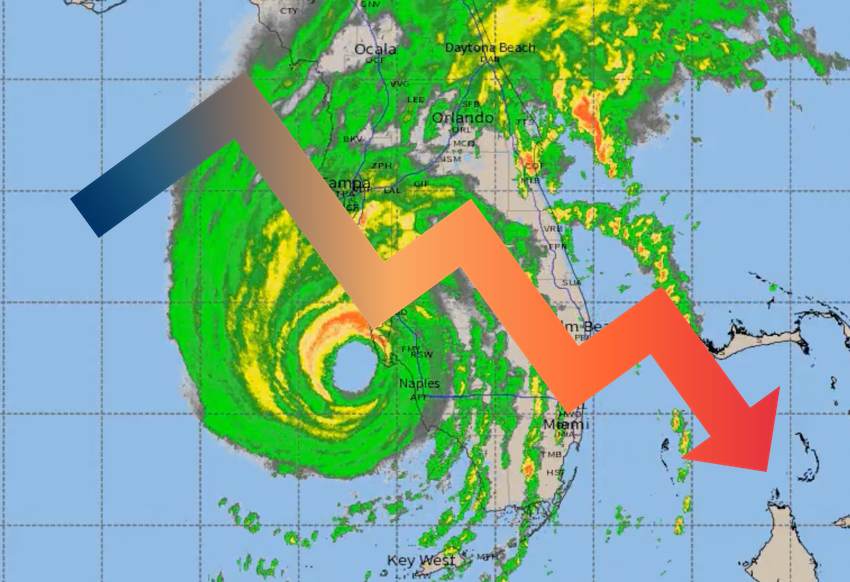

The catastrophe bond market index calculated by Swiss Re Capital Markets, the insurance-linked securities (ILS) specialist arm of the global reinsurance firm, plummeted when priced on Friday, due to the potential impacts and losses cat bonds face after Hurricane Ian.Swiss Re Capital Markets has been tracking catastrophe bond market performance with its cat bond indices since 2007.These catastrophe bond indices were the first available to track the cat bond market and so have become a bellwether for those looking for a way to analyse performance of the current set of outstanding 144a catastrophe bonds.They provide a total return indication on a weekly and monthly basis, and so offer valuable insights into the ramifications of recent major hurricane Ian for cat bond funds and cat bond market investors.

Given hurricane Ian has caused significant damage across the western Florida region it impacted hardest last week, with industry loss estimate ranges seeming to rise all the time, potentially wide-reaching catastrophe bond market losses are anticipated.Insurance and reinsurance industry loss expectations have now seemingly risen to a range of $45 billion to $65 billion, or perhaps even more (), with a good deal of uncertainty embedded in the estimates still and no idea at this stage how much loss amplification could be seen due to Florida’s unique insurance market challenges.It’s no surprise then that the Swiss Re Global Cat Bond Index dropped considerably, by 10% on Friday.

This is the cat bond index tracking the entire outstanding market, so provides a rough approximation for what a broadly diversified cat bond fund may be expecting in terms of initial hit to net asset value after hurricane Ian.For comparison, Plenum Investments said Friday that they anticipate a 4-6% impact to its lower-risk cat bond fund strategy, but 9-12% for its more dynamically focused cat bond fund.However, driving home the severity of hurricane Ian’s loss potential, Swiss Re Capital Markets also tracks the basket of outstanding catastrophe bonds with exposure to US Wind and this Swiss Re US Wind Cat Bond Performance Index has plummeted roughly 32% on Friday, a particularly significant decline.

The Swiss Re US Wind Cat Bond index tracks the aggregate performance of USD denominated cat bonds exposed exclusively to US Atlantic hurricane, the company says in its methodology for the cat bond indices, meaning this is a relatively small subset of the overall marketplace.We shouldn’t extrapolate from this that the overall cat bond market faces a 10% loss of outstanding principal, nor that the market is facing a 32% loss of US wind cat bond principal, as these are largely mark-to-market based at this time and the US Wind index is solely focused on Atlantic hurricane risk.But the declines to this cat bond index show the seriousness of the situation following hurricane Ian and that wide-reaching cat bond market losses in value and likely of principal too are coming.

There will be a good deal of uncertainty embedded in the indices at this time, given it’s far too early for loss notifications to have been made.The pricing in the secondary market for cat bonds, which drive some of the index methodology, will have declined across the board for any potentially exposed bonds, so there is a good deal of this decline that can be considered mark-to-market at this stage of proceedings.It’s not possible to forecast how much could be recovered, nor what the actual cat bond market loss will be.

But these numbers from Swiss Re’s cat bond indices provide a first glance at the significance of hurricane Ian for cat bond funds and investors..The decline in the Swiss Re indices shows this is exactly what occurred.

Also, our unscientific poll of ILS focused readers provides further insight, as it found that .We’ll bring you more data points on the cat bond market over the coming days, as information becomes available from industry sources.– .

– .– .– .

– .– .– .

– .– .– .

– .– – .– .———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.—————————————

Publisher: Artemis