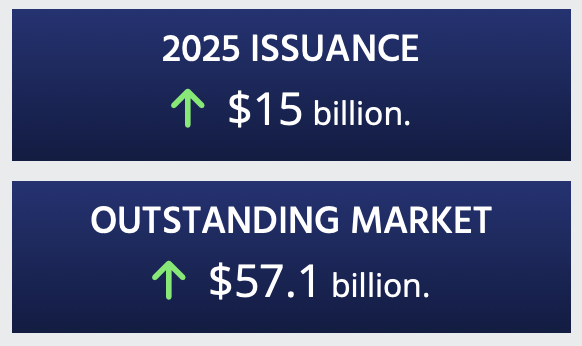

As we continue to through this very busy 2025, total settled issuance analysed by Artemis has already surpassed $15 billion, while the outstanding cat bond market has grown by 15.5% since the end of last year.across Rule 144A cat bonds and the few privately placed deals we have tracked.Impressively, the level of issuance now settled in 2025 has already broken the record for first-eleven month issuance.

Meaning, in every previous year the catastrophe bond market has existed, we hadn’t ever seen that volume of deals settle between January and the end of November.Given we are still at the end of May, with a whole month to run until the middle of 2025, it’s clear the first-half cat bond issuance record is being broken by a particularly significant margin.The previous record for first-half cat bond issuance came in 2024, when just over $12.6 billion of deals were tracked by Artemis.

The chart below shows just how far ahead we are already, with only five months of 2025 almost run..Cat bond issuance settled in the month of May has reached a significant record high of almost $5.9 billion in 2025.

Which beats the previous record for the month by approaching $2 billion.It also makes May 2025 the biggest single month of catastrophe bond issuance in the market’s history, another very notable record that has been soundly broken this year.The rapid rate of catastrophe bond market activity seen in 2025 has also helped to propel the size of the market considerably higher already.

Recall that 2025 has seen the highest level of ever for the first-half, but the market has outpaced that with new issuance, to grow by around 15.5% since the end of 2024.View risk capital issued and outstanding by year in the chart below ().Artemis’ measure for the outstanding cat bond market, which does include some private deals and also may not factor in all principal reductions, or extensions of maturity, as we don’t always receive that data, has now reached just over $57.12 billion.

Which, as we said, represents 15.5% growth in the outstanding catastrophe bond market since December 31st 2024, when the total stood at just under $49.48 billion.It is another record size for the cat bond market, although some shrinkage is to be expected before the middle of the year as .But the pipeline is currently projecting at least $1.1 billion of new cat bond issuance to settle before the end of June, meaning our latest projection for first-half cat bond issuance for 2025 is currently $16.125 billion.

That could, of course, rise further with any additional deals, upsizing, or private cat bonds that come to light before June 30th.We’ve seen than any other half-year so far, which has helped to propel this market expansion and growth.Alongside that, repeat sponsors have been issuing larger deals and growing cat bond’s share of their reinsurance towers, in some cases, while other sponsors have seen an increased need for reinsurance and grown their cat bond coverage proportionally with that.

We haven’t seen any particularly meaningful expansion of diversification options though, meaning the cat bond market remains US focused, in peril terms, with US wind still by far the largest component.But, as the catastrophe bond market once again demonstrates the efficiency of its capital in 2025, it will be interesting to see if that can encourage more sponsors from other regions later this year, or perhaps more diversifying peril class deals to come to market.The catastrophe bond market is well on-course to break the annual issuance record in 2025, as a reminder that stood at almost $17.7 billion by our numbers for 2024.

Whether it is broken will depend on loss activity through the wind season, any other particularly impactful catastrophe losses, or if some kind of disruption to capital markets occurs.However, with only just under $1.6 billion of additional issuance needed to come to market, , it is now hard to think the annual record won’t be broken in 2025.Stay tuned to Artemis for critical catastrophe bond market insights as the rest of 2025 progresses! , .

(use the key of months at the bottom to include and exclude any from your analysis).The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

.We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis