KatRisk, a specialist provider of catastrophe modeling solutions for flood and wind risk, has published an estimate of wind, surge and flood related insurance market losses from hurricane Ian, pegging the total at $46 billion, but that figure could be plus or minus $16.1 billion.KatRisk’s use of a standard deviation around its estimate implies something in a range from almost $30 billion to as high as $62 billion, so puts its figure right around where some of the catastrophe risk modellers currently stand (for example, and Verisk at up to $57bn).What’s interesting about the KatRisk industry loss estimate for hurricane Ian is that the flood component is higher than for other catastrophe modellers.It’s important to note here that KatRisk’s figures include losses it estimates that FEMA’s National Flood Insurance Program (NFIP) will face.

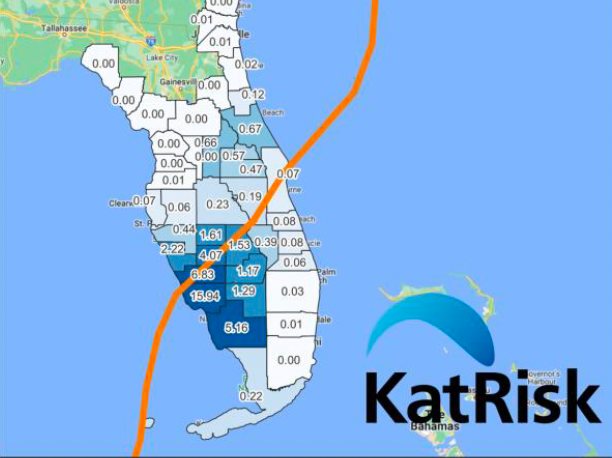

KatRisk is intimately familiar with the NFIP’s exposure, having been the third-party catastrophe modeller on all of the flood insurers .KatRisk’s estimate breaks down as follows: Tropical cyclone wind ground up – $24.1bn +/- $13.8bn.Storm surge ground up – $17.8bn +/- $7.1bn.

Inland flood ground up – $4.4bn +/- $1.6bn.Combined – $46bn +/- $16.1 billion.At the level of storm surge and inland flood insurance industry loss KatRisk estimates, which is including the NFIP, it is a strong suggestion that the NFIP’s share will be significant and that puts its reinsurance tower at-risk.

We’re told the NFIP’s flood insurance losses could well be into the lower layers of its reinsurance tower, which also means some of its FloodSmart Re catastrophe bonds would be likely to attach as well.There still isn’t any clarity as to the level of losses the NFIP faces, but KatRisk’s modelling is well-attuned to the NFIP, given the work it undertakes for its reinsurance buying from the capital markets, so its figures could prove more accurate than other early estimates for water-based damages from hurricane Ian.– .

– .– .– .

– .– .– .

– .– .– .

– .– .– .

– – .– .———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.—————————————

Publisher: Artemis