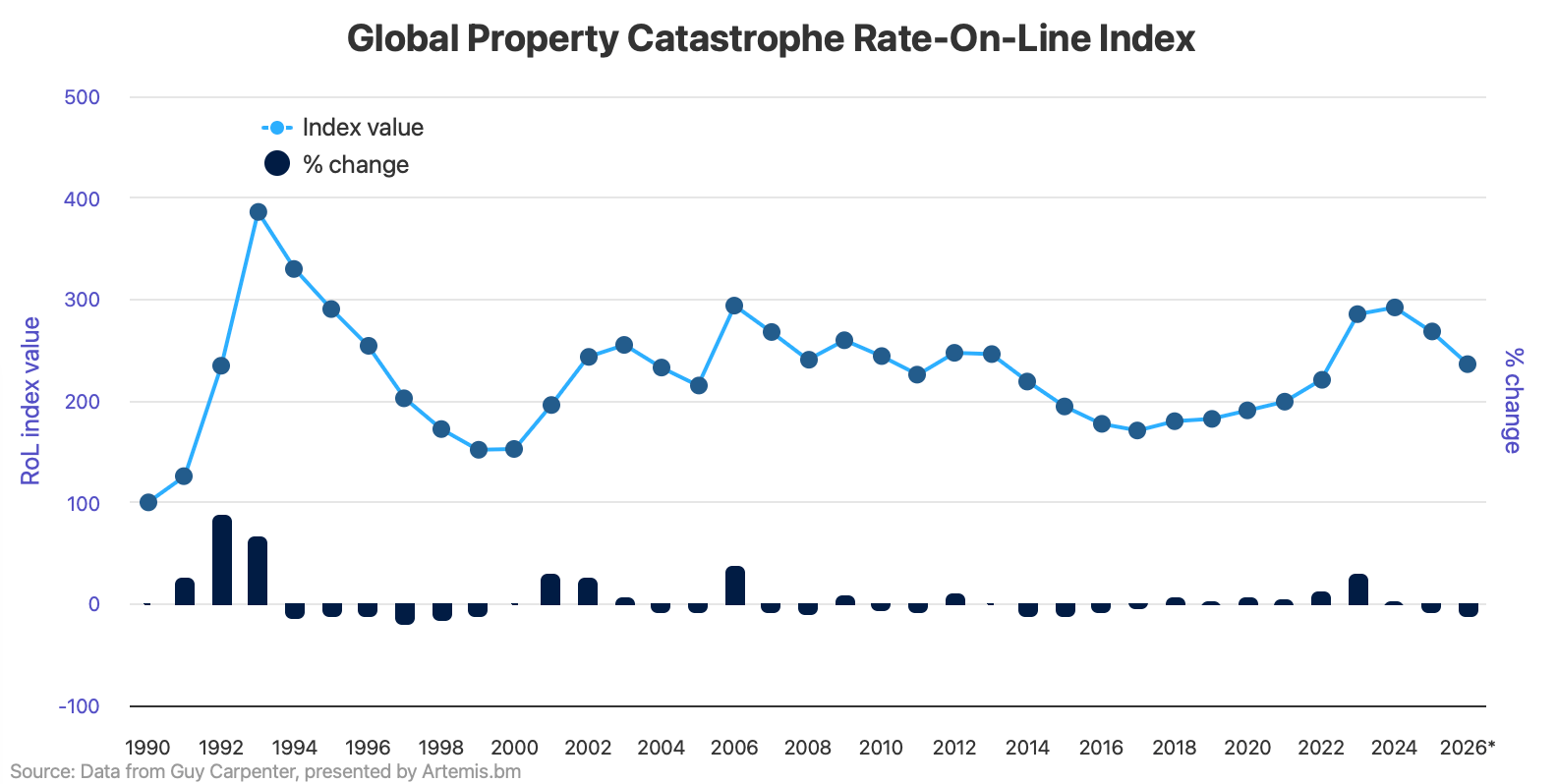

At the January 1st 2026 reinsurance renewals property catastrophe rates were broadly softer around the globe as the weight of capital in the market depressed prices, while broker Guy Carpenter’s indices show that rates-on-line softened fastest in Europe.Reinsurance broker Guy Carpenter has updated its property catastrophe reinsurance rate-on-line indices, which we’ve now reflected in our charts on the Artemis website., resulting in double-digit declines for property catastrophe renewals with investor appetite for insurance-linked securities a contributing factor.

Guy Carpenter’s fell by 12% at January 1st 2026, reflecting rate-on-line decreases across global property catastrophe reinsurance contracts underwritten by reinsurers at the renewals.This is a proprietary index of global property catastrophe reinsurance Rate-on-Line movements, on brokered excess of loss placements, that has been maintained by the broker since 1990.The softening trend accelerated over the prior year at the 1/1 2026 renewals, as this Index had fallen by 6.6% at January 1st 2025 and by 8.1% after the mid-year 2025 reinsurance renewals were completed.

Property catastrophe reinsurance rates-on-line still remain attractive relative to years during the last soft market, with the Global Index level still above all years from 2014 through 2022 inclusive.While the Global Property Catastrophe Rate-On-Line Index now sits some 19% lower than the level it reached at its most recent hard market peak in 2024, it remains more than 38% higher than its last soft market low in 2017.You can : Next, the Guy Carpenter , which measures US property catastrophe reinsurance Rate-on-Line movements, on brokered excess of loss placements, and tracks the data back to 1990 as well.

The Guy Carpenter U.S.Property Catastrophe Rate on Line Index fell by 12% at the January 1 2026 reinsurance renewals, as broad market softening resulted in lower priced protection for ceding companies.Typically, the January renewals see more nationwide focused reinsurance programs renewed, so cedents are often larger than we see at the mid-year’s when the state specific programs are often renewed, such as in Florida.

A year ago, the Guy Carpenter U.S.Property Catastrophe Rate on Line Index fell by 6.2% at January 1st 2025 and the Index decline rose to 6.7% after the mid-year renewals, which took it back from an all-time-high, although it was still sitting above any level achieved prior to 2023.The further now 12% decline in US property catastrophe reinsurance rates at the 1/1 2026 renewals has eroded some more of the hard market gains that reinsurers had made.

However, since 2017, the cumulative increase of this Index remains at around 70%, even after the now two consecutive years of January renewal softening.Historically, the US property catastrophe rate on line Index remains at a high level.But it will be interesting to see how the mid-year 2026 reinsurance renewals affect the Index value.

The most recent low for this U.S.Property Catastrophe Rate on Line Index was in 2017, at the end of the soft market, since when rates have risen consistently each year up to January 2025.Guy Carpenter commented, “Cedents in North America have been aggressive with price selection and continued to diversify their reinsurance panels.

Savings achieved on core placements were utilized to enhance risk transfer programs with additional coverages.” You can : Looking at the Asia Pacific region, Guy Carpenter’s tracks the same property catastrophe reinsurance Rate-on-Line movements, on brokered excess of loss placements, for this part of the world.In Asia Pacific (APAC), property catastrophe reinsurance rates fell by 12% on average at the January 1st 2026 renewals, leaving this index up by only 5% since the market bottomed out in 2018 for this region.Guy Carpenter commented, “APAC experienced double-digit rate decreases on loss-free catastrophe XoL programs, with reinsurers showing flexibility toward clients to meet their pricing expectations in order to secure shares.” You can analyse the Asia Pacific data using : So we’ve seen a 12% average decline in property catastrophe rates-on-line globally, in the United States and for the Asia Pacific region at the January 2026 reinsurance renewals.

But, the steepest decline was seen in Europe this time around, where the rate-on-line index declined a little faster.Continental European property catastrophe reinsurance rates-on-line decreased a little more, falling by 15% at the 1/1 2026 renewals, according to Guy Carpenter.The broker commented, “Europe saw a significant decrease in market breadth, with clients favoring a reduced panel of reinsurers (43 pricing for the January 1, 2026 renewal, compared to 55+ during the January 1, 2025 renewal).

Clients took a more selective approach to the price discovery phase.” The Continental European property cat RoL Index remains up by 40% cumulatively since the soft catastrophe reinsurance market bottomed out in 2017.You can analyse the European data using : Despite the declines property catastrophe reinsurance rates remain adequate in the vast majority of cases it seems, helped by the fact all-important attachment points have not reverted back towards softer market levels.The fact market breadth reduced in Europe is perhaps telling though, as this has been a region where some reinsurance capital providers felt margins were too thin for too long and the softening at January 2026 may have brought rates-on-line back to levels where some felt them less attractive.

US property cat rates remain at relatively high levels historically, but as we said the mid-year renewals may be telling for how appetites change later in the year...All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis