Here are the ten most popular news articles, week ending September 29th 2024, covering catastrophe bonds, ILS, reinsurance capital and related risk transfer topics.To ensure you never miss a thing or get our email alerts for every article we publish.Hurricane Helene coverage Dominating the news and our readers attention last week was hurricane Helene’s approach to Florida and its landfall in the Big Bend as a major Category 4 storm with 140mph winds.

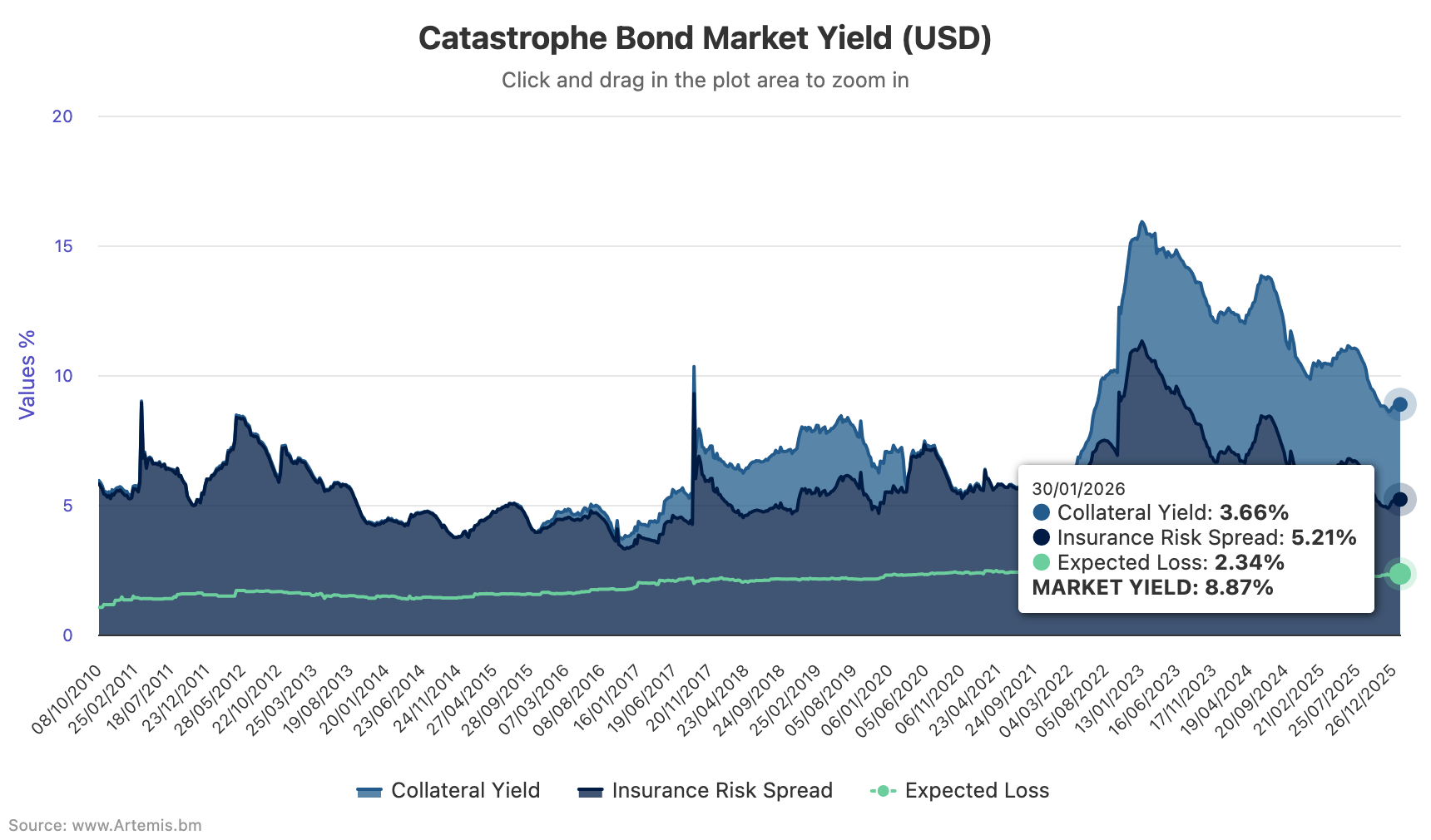

Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic Insured private market property losses from Helene’s winds and storm surge across the US states of Florida and Georgia are initially thought from $3 billion to $5 billion, according to CoreLogic which issued the first post-landfall estimate.Significant share of European flood claims to be covered by reinsurance: S&P S&P Global Ratings has commented on the Central and Eastern European flood event from the second week of September, saying it expects a significant share of insurance claims will be covered by reinsurance capital.Reinsurance and ILS a compelling income opportunity: US Bank Wealth managers at US Bank, the fifth-largest commercial bank in the United States, have highlighted reinsurance and insurance-linked securities (ILS) as diversifying drivers of income for their clients.

Descartes launches new division to expand scope of offerings, including parametrics Descartes Underwriting launched a Strategy & New Business Division with two key hires, as the company looks to expand the scope of its scientific underwriting offering.Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum If hurricane Helene did not deviate from the forecasted path for the storm it was not expected to have significant implications for the catastrophe bond market, according to a Wednesday update from Plenum Investments.Ledger completes $100m casualty sidecar amid growing demand for solutions Ledger Investing funded and launched a new $100 million casualty sidecar for a global reinsurer, financing the company’s casualty reinsurance business over three underwriting years on a quota share basis.

Private ILS interest rising, enhances scope of investment options: Grandi, Twelve Capital Interest in private ILS opportunities, so collateralised reinsurance and retrocession arrangements, has been rising and continues to, Marcel Grandi of Twelve Capital believes.He also thinks these instruments afford an investment manager more scope, in terms of investment options beyond catastrophe bonds and tailoring portfolios.Mexico parametric cat bond safe from hurricane John’s 120mph landfall While the focus was on Helene on the Atlantic side, off the Pacific coast of Mexico hurricane John rapidly intensified and made landfall as a Category 3 storm which has resulted in enquiries from catastrophe bond investors.

Global reinsurers to continue seizing opportunity of hard property cat market: S&P The large global reinsurance companies are expected to continue seizing the opportunity in property catastrophe risks while the market’s pricing remains hard, S&P believes.This is not every article published on Artemis during the last week, just the most popular among our readers over the last seven days..

To ensure you always stay up to date with Artemis and never miss a story ...

Get listed in our ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis