Hurricane Ian is expected to change the insurance market landscape entirely in Florida and litigation is still expected to be an issue in the claims process despite the attempts at legislative reform, RMS’ Chief Risk Modeling Officer Mohsen Rahnama has implied.Interestingly, Rahnama has cited issues with wind stations as a reason it is taking longer than normal to construct a robust footprint of hurricane Ian.“There is a challenge in reconstructing the wind footprint for Hurricane Ian, as there were multiple failures of wind stations recording results due to high windspeed.Our event response (ER) team is working hard using the available data to finalize the footprint for Florida, including the second landfall in South Carolina,” he explained.

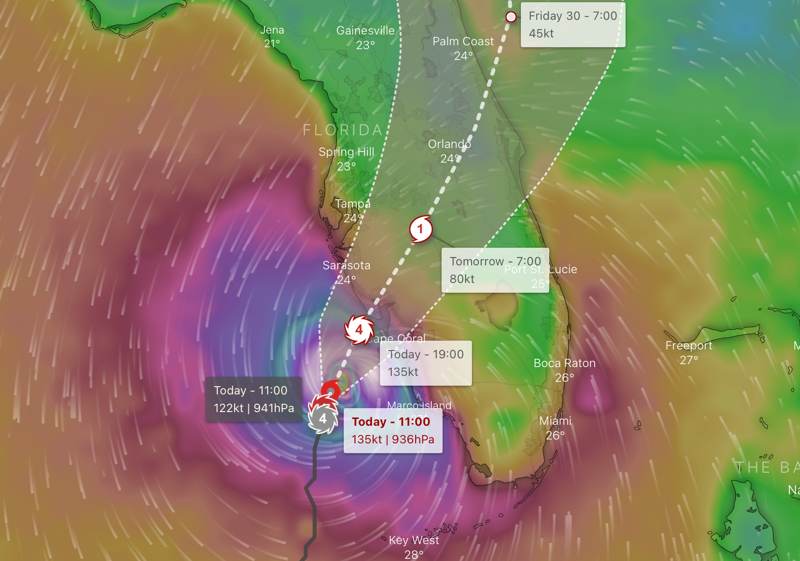

Adding, “Major Hurricane Ian is a historical event and very complex – a Category 4 event with a maximum 150 miles per windspeed and a 50-kilometer radius, massive record storm surge, and inland flood, all points to Ian most likely being one of the costliest events in Florida.” Rahnama highlighted a number of issues that hurricane Ian is likely to raise for the insurance and reinsurance industry as it goes through the claims process from this storm.Rahnama said, “Claims leakage will focus on factors from loss amplification due to constraints in rebuilding supplies and contractors, through to another big wildcard – inflation, which will percolate through the system in several ways.“The current inflation situation pre-Hurricane Ian and any shortage of materials and qualified contractors in Florida will amplify the repair cost.

I believe the repair will be in multiple stages, starting with a quick functional repair followed by the major repair – which requires a permit and qualified contractors.Also, the considerable infrastructure damage from Ian will slow down the recovery and exacerbate the repair time and losses, especially for islands disconnected from the mainland due to bridges and piers damages.We expect the full recovery takes a few years.” The RMS Chief Risk Modeling Officer also pointed to issues in the claims process due to litigation, which he expects will be an issue after hurricane Ian.

“As shown in the recent events, particularly Hurricane Irma in 2017 where many cases ended up in the litigation process, we saw increases in claims cost.For Ian, we expect that some of the claims’ closers will take more than a year due to potential litigation,” Rahnama said.He summed up the current RMS view as, “Basically, I believe this event will change the Florida insurance market landscape.” With questions over how much surplus may be left among Florida carriers after hurricane Ian, whether the FHCF could be entirely exhausted, plus just how do Florida specialist carriers recapitalise and afford their reinsurance after this, Rahnama’s conclusion perhaps underplays the challenges that market now faces.

– .– .– .

– .– .– .

– .– .– .

– .– .– .

– .– – .– .———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.—————————————

Publisher: Artemis