Artemis has learned of a new $9.525 million private catastrophe bond that has been issued by German reinsurance company Hannover Re’s Bermuda-based structure Kaith Re Ltd., with the deal assumed to be providing privately placed collateralized and securitized catastrophe reinsurance capacity for an unknown sponsor.Hannover Re has facilitated this new transaction from its Kaith Re vehicle, helping an unnamed cedent to access capital markets backed sources of reinsurance capacity.Using its Bermuda domiciled reinsurance transformer and segregated account company Kaith Re Ltd., which was acting on behalf of its segregated account named LI Re, exactly $9.525 million of LI Re 2025-1 private cat bond notes have been issued and placed privately with qualified investors, we have learned.Hannover Re has facilitated the issuance of numerous private cat bonds under its LI Re and Seaside Re programs, all issued using Kaith Re in Bermuda.

Details of which .Since 2017, the Kaith Re structure has only issued a single LI Re private catastrophe bond each year, but has also issued a number of cat bonds under the Seaside Re series of deals of which there have been seven so far in 2025.Last year, the Kaith Re structure issued one LI Re 2024-1 private cat bond, sized at roughly $5 million and with the same maturity date as this new LI Re issuance, so this could be a renewal and upsizing of that arrangement.

This new $9.525 million LI Re 2025-1 private cat bond, transforms and securitizes an underlying reinsurance or retrocession related contract, with the risks contained in the segregated account, and these notes are scheduled for maturity on July 15th 2026.The majority of LI Re private cat bonds issued with the assistance of Hannover Re had provided cover for California earthquake risks.But details became more limited since 2024 and we’re not certain of the exposure, although assume it is property cat risk related.

This new $9.525m of LI Re Series 2025-1 private cat bond notes are now listed on the Bermuda Stock Exchange (BSX) as Section V – Insurance Related Securities, while Ocorian Securities (Bermuda) Ltd.has acted as the listing sponsor, and the notes were sold to qualified institutional investors.Hannover Re regularly assists investors in accessing reinsurance related risk and returns in securitized formats, and cedents to access the capital markets, by using structures to provide risk transformer and facilitation for 144a cat bonds, private catastrophe bonds such as this new deal, and other insurance-linked securities (ILS) arrangements in fronted collateralized reinsurance form.

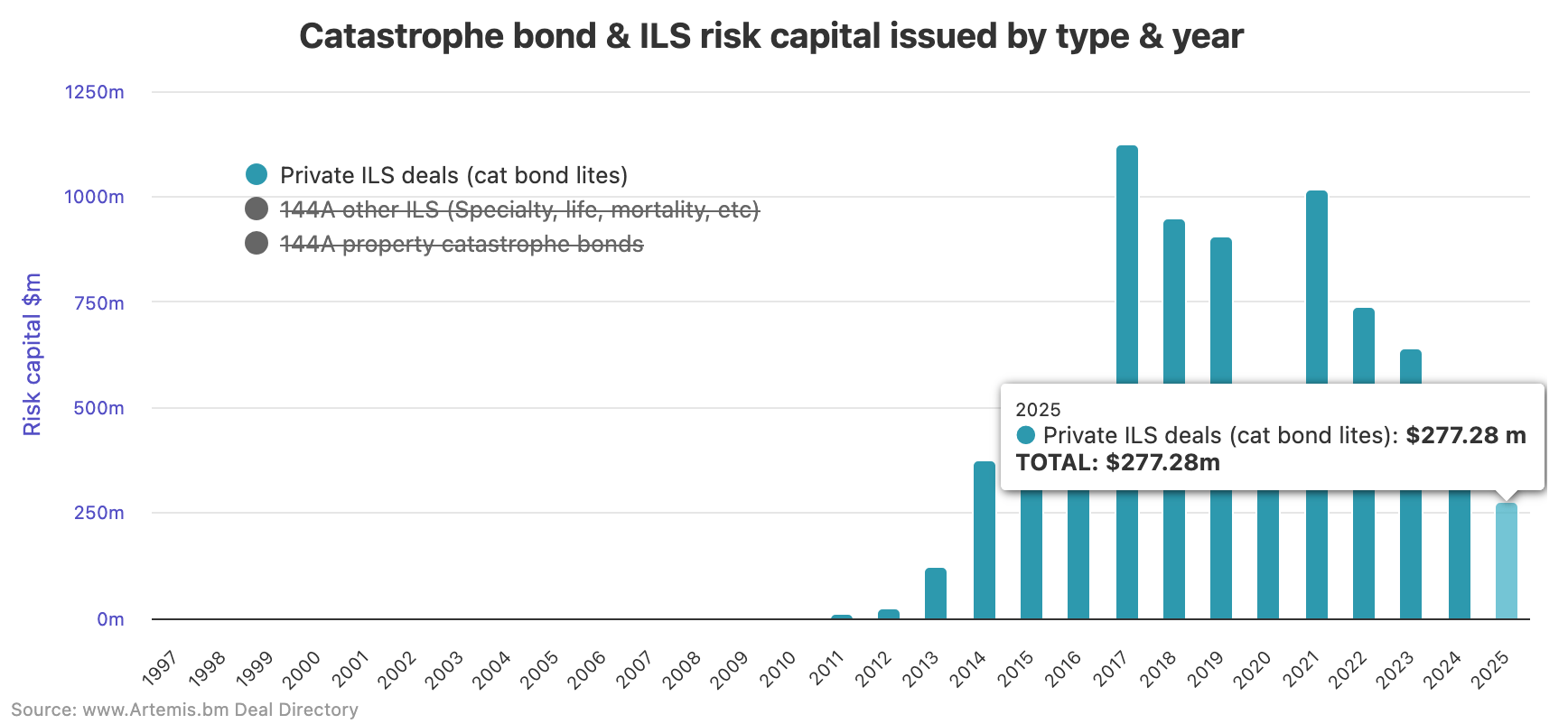

The global reinsurer is a key actor in the ILS market, putting its expertise, balance-sheet and ratings strength to work in helping to expand the ILS market and facilitate the smooth transfer of cedent risk to capital markets investors and ILS funds.Adding this new private cat bond to our market data and analytics, so far this year, according to Artemis’ extensive cat bond market data..

Click on the chart below to access an interactive version: Issuance of private catastrophe bonds remains slower than recent years in 2025.We still don’t see many of these transactions though, so only have data on those where some information has become available to us and assume there are many more that never come to light.2017 remains the record year for private cat bonds that we have tracked, at just .

Read more about this new private catastrophe bond in our extensive cat bond Deal Directory..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis