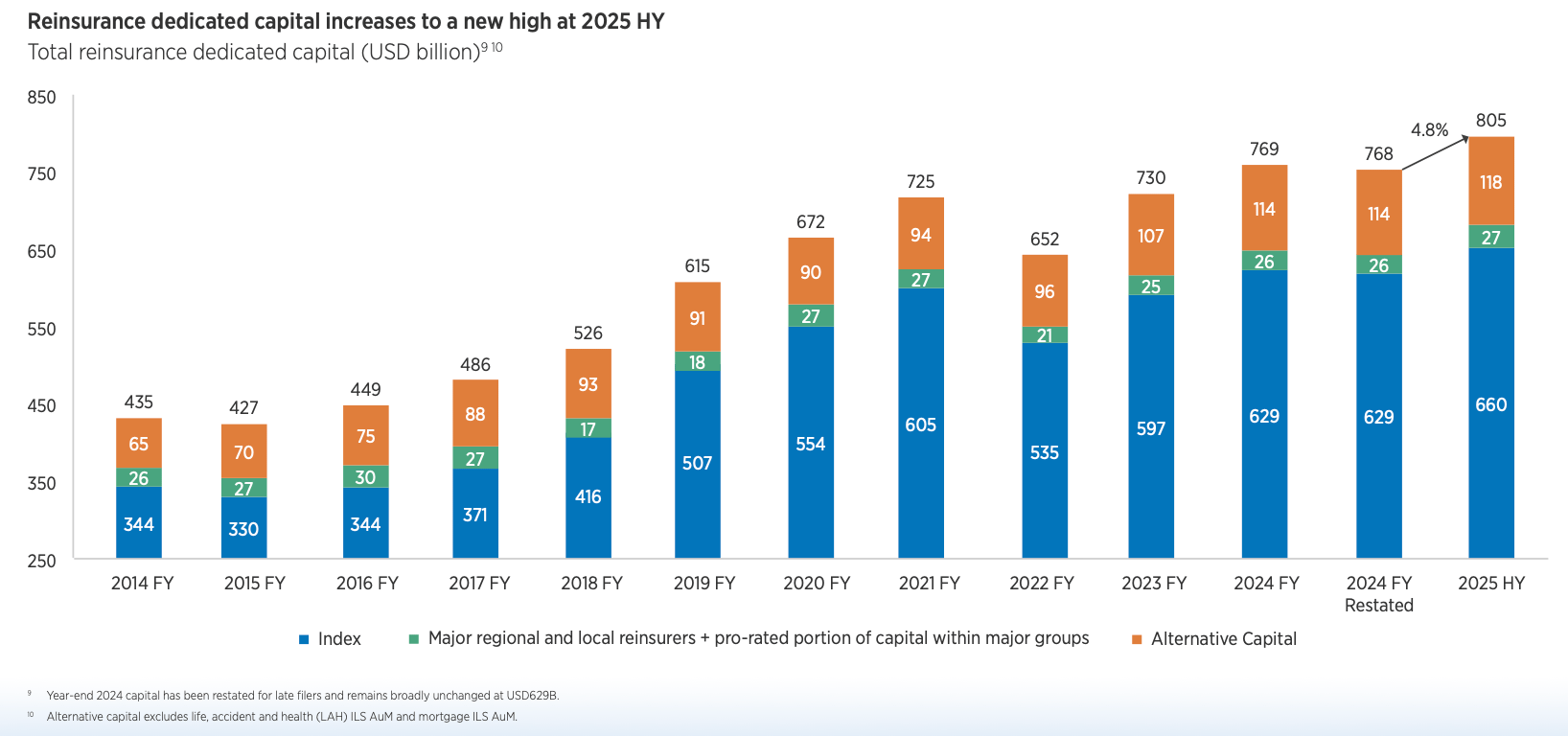

According to reinsurance broker Gallagher Re, non-life alternative reinsurance capital grew by USD $4 billion, or 4% over the first half of 2025 to reach $118 billion, with the broker also noting that traditional reinsurance capital is growing at a faster rate.As per the broker’s latest Reinsurance Market Report, global reinsurance industry capital reached $805 billion by the middle of this year, representing an increase of 4.8% from full-year 2024.This growth was supported by strong retained earnings as global reinsurers continued to build capital during the period, Although return on equity’s (ROEs) declined compared with the prior period, they remained strong on both a reported and underlying basis, comfortably above the cost of capital, the broker explained.At the same time, capital for the INDEX companies, which contribute 82% of total reinsurance dedicated capital, was up 5% to $660 billion.

“Taking into account the industry’s profit outlook for the full year and considering capital returns, we estimate that 2025 FY traditional reinsurance capital will increase by about 8% (USD >57B),” Gallagher Re said.Gallagher Re’s 8% forecast is slightly higher than its previous 6% projection, as a result of strong financial markets and FX movements seen during the first-half of 2025.Moreover, shows that the catastrophe bond market grew by around 15% just in the first-half of the year.

during Q2 2025, roughly $5.9 billion in deal volume matured, but as Q2 issuance was so strong at $10.5 billion, the outstanding cat bond market size managed to grow by around $4.6 billion to a new end of quarter high of $56.7 billion.Therefore, the size of the outstanding cat bond market at June 30th, 2025, was 15% larger than it was at the end of 2024, despite $10.3 billion of maturities during H1 2025.Given this, Gallagher Re’s projection of a $4 billion increase in ILS capital for H1 2025 seems very low at this stage.

Michael van Wegen, Head of Client & Market Insights International, Gallagher Re Global Strategic Advisory, commented: “Global reinsurers are well positioned to maintain strong profitability in 2025.“We expect an underlying ROE of 13 -14% and a headline ROE of approximately 17-18% (assuming a ‘normal’ level of catastrophe losses in H2) for the full year, both of which remain significantly (1.5-2x) above the industry’s cost of capital.Supported by continued strong profitability, we expect traditional reinsurance capital to increase by roughly 8% in 2025.”.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis