More wildfires broke out in the Los Angeles area of California over night meaning the property damage has continued and early estimates from some of the insurance industry focused equity analyst teams suggest a potential industry loss in the $6 billion to as high as $13 billion range.At the same time, forecaster Accuweather has come out with an economic loss estimate for the wildfires that continue to burn out of control in Los Angeles suburbs, saying the total could be between $52 billion and $57 billion.We have to stress, these wildfires are a developing situation and clarity over the number of structures destroyed and damaged remains limited., the LA fire chief said in a press conference that more than 1,100 structures had been destroyed by the wildfires that continue to burn out of control in the Los Angeles, California suburbs.

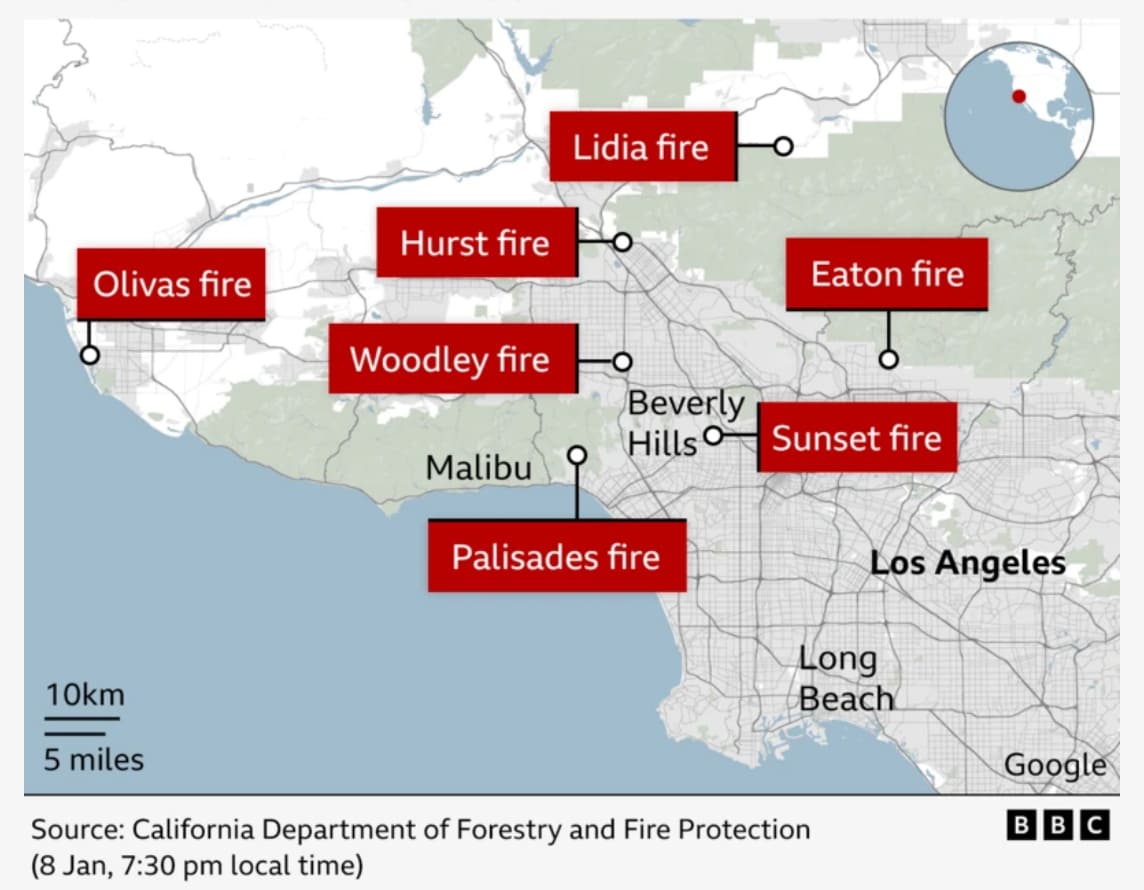

Overnight, the Los Angeles Times newspaper has increased the figure to now more than 2,000 homes, businesses and other buildings having been damaged or destroyed by the fires, while at least five deaths have been reported.Now, seven named fires have broken out, with new blazes in the Hollywood Hills and other areas around the city and the main Palisades fire has continued to burn without containment.On the weather front, forecasters say there could be a period of lower winds today for a time, which might allow firefighters to gain more control of the wildfires, but later the winds are expected to pick up again which will make firefighting conditions challenging again.

On the economic loss front, forecaster Accuweather said its, “preliminary estimate of the total damage and economic loss from devastating wildfires in California is $52-$57 billion.” “This is already one of the worst wildfires in California history.Should a large number of additional structures be burned in the coming days, it may become the worst wildfire in modern California history based on the number of structures burned and economic loss,” AccuWeather Chief Meteorologist Jonathan Porter commented.The company added that, “The worst of the fires are burning in an area from Santa Monica to Malibu, impacting some of the most expensive real estate in the country, with median home values over $2 million.” Analysis of Zillow pricing for real estate in the region shows a roughly $3.5 million average home value in the area of the Palisades fire and $1.25 million around the Eaton fire.

Accuweather puts its estimate into context by comparing to the wildfires in Hawaii in 2023, saying, “the total damage and economic loss from the wildfires in Maui in 2023 was $13-$16 billion.” That Maui wildfire was estimated to have driven insurance industry losses of up to $4 billion.Onto the analyst estimates we have seen, which suggest a costly multi-billion dollar industry loss event for the insurance and reinsurance industry from these wildfires in California.Evercore ISI analysts compared it to the Maui fire as well, saying, “The Maui fire had insured losses of $3-4b and damaged >2,200 structures (the average home value in Maui was $1.25m and we suspect the reconstruction costs were likely elevated given the location).

Adding, “With half that many structures already damaged in the current CA fires and given how quickly they are spreading (still 0% contained), we think the insured loss could easily be double the Maui fire loss (~$6-8b) but we will continue to monitor the situation.” So that gives an initial baseline for a potential loss quantum, based on the 1,100 structures reported damaged yesterday and the fact many of those are in an area with higher value homes than the Maui fire.But, with more fires having sprung up overnight and others still spreading uncontrolled, the tally of structures destroyed is likely higher already, as implied in the LA Times estimate of more than 2,000 homes, businesses and other buildings having been burned.It seems safe to assume the toll will continue to increase, as firefighters continue to be challenged.

Meanwhile, BMO Capital Markets analysts said that at around the $3.5 billion level of insurance industry loss they believe these fires would put downward risk on their EPS estimates for Q1 for covered re/insurers in their universe.At an industry loss above $7 billion, the fires would begin to put earnings per share at-risk for first-quarter results across the insurance and reinsurance industry.They explained that 2017 and 2018 were the worst wildfire loss years on record, when wildfire insured losses totaled over $16bn and $14bn respectively.

BMO analysts also said that, based on the data from late yesterday, of a combined 1,100 structures having been destroyed, it already implied an estimated low single digit billions insurance market loss.Finally, analysts from Autonomous commented that US catastrophe losses may be heading for a significant and costly start to the year in 2025.“With a cluster of critical wildfires currently burning in the Los Angeles area and a winter storm threatening Texas with snow and ice, 2025 is off to an active start on the catastrophe front.

We estimate the California wildfires could approach a $13bn insured loss, while the Texas snowstorm could easily result in several billions of additional losses if conditions worsen and result in a lengthy freeze and/or widespread power failures,” they explained.They provided context for this, estimating that the Palisades fire could result in as much as an $8 billion insurance industry loss, the Eaton, Hurst and Woodley fires combined up to $2.5 billion and additional commercial risk exposure could add around $2.5 billion more.They based these figures on an analysis of property values at-risk from the fires, while taking a residential structure loss rate of 17.5%, a 1.55x average loss multiplier, which gave them over $7.7 billion of insured losses for 1,246 properties destroyed at a ~$4m average value.

It is a particularly high estimate for this early in the day, but with damage continuing overnight the financial cost of these fires will clearly be well into the single digit billions at least, potentially now with double-digit billion industry losses in sight.All of the analysts warn that high-net worth specialist insurance companies are likely to take a significant toll from these fires, with names such as AIG and Chubb mentioned, while the California FAIR plan has around $6 billion of exposure in the Pacific Palisades area alone.The Autonomous analysts also point to the impending Texas freeze that is forecast, saying that could add a further multi-billion loss risk for the industry over the coming days.

For further context, according to Aon data, the Camp Fire of 2018 which damaged or destroyed around 23,000 structures was the largest wildfire insurance industry loss event in history, at over $11.5 billion.The Tubbs Fire of 2017 was next at around $8.9 billion, followed by the Woolsey fire in 2018 at closer to $5 billion...

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis