At the January 2026 reinsurance renewals reinsurance broker Howden Re estimates that risk-adjusted pricing for property catastrophe treaty business declined by 14.7%, marking the largest year-on-year reduction since 2014, while property retrocession pricing fell further by 16.5%.In its 2026 renewal report, Howden Re explained that most areas within the market recorded price decreases at 1/1, bringing pricing back to levels last seen around four years ago, albeit with comparatively higher attachments and tighter terms.“Market performance remained strong across the value chain in 2025, with insurer and reinsurer returns exceeding costs of capital, even after the Los Angeles wildfires, one of the largest (re)insured losses on record.

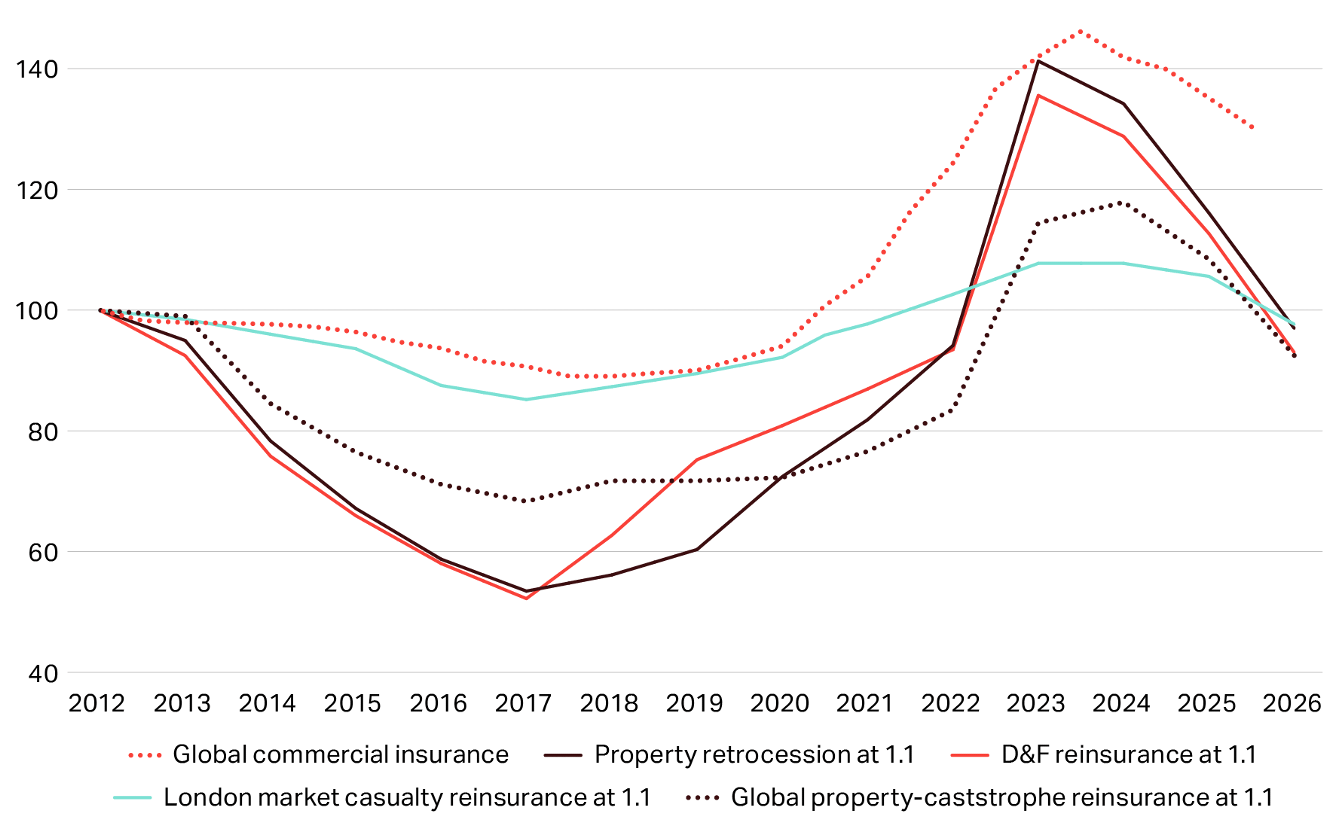

Buyers benefitted from ample supply and intense competition, creating opportunities for cedents to secure broader coverage at discounted pricing,” the broker explained.The broker also shared its latest Howden pricing index for primary, reinsurance and retrocession markets, which illustrates a narrative of decreasing prices during the January 2026 renewal season.In the chart below, you can see that risk-adjusted price reductions recorded at the January 1, 2026 reinsurance renewals were steepest in direct & facultative where rates-on-line fell 17.5%, which was followed by retrocession which was down 16.5%, then global property-catastrophe renewals which fell 14.7%, and London market casualty excess-of-loss which was down 5-10%.

Focusing on global property catastrophe reinsurance, Howden Re observed that despite another year of elevated catastrophe activity, highlighted by the largest insured wildfire loss ever in Los Angeles, placements continued to complete with sizeable rate decreases and improved terms.As previously mentioned, risk-adjusted global property-catastrophe reinsurance rates-on-line declined by 14.7% on average, In the United States, Howden Re explained that cedents benefitted from strong supply and reinsurers were “willing to deploy capital at what remained attractive margins despite rate reductions.” As a result, the programme-wide decreases generally ranged between 10% and 20% on a risk-adjusted basis, the broker noted.However, in Europe, Howden Re said that low loss activity, an oversupply of capital, and reinsurers’ desire to defend top lines shaped renewals, with programmes recording rate decreases of between 10% and 20% on average.

The broker also outlined that renewals in the Asia Pacific region were competitive at 1/1 as cedents built on mid-single-digit reductions in 2025 to capitalise on abundant capacity.Risk-adjusted pricing for loss-free non-proportional programmes generally fell by 10% to 20%.Howden Re’s estimates for property catastrophe rates at the 2026 January renewals vary from broker Guy Carpenter’s indices.

, with both US and Asia Pacific property catastrophe rates also falling by 12%, while the steepest decline was seen in Europe, which fell by 15%, according to the broker.Within property retrocession, Howden Re’s report explains that capacity at the January 1 2026 renewal comfortably exceeded demand, even as market dynamics became more balanced, with buyers considering up to $800 million of additional limit.“Favourable supply dynamics were supported by retained earnings from several years of strong performance, as well as new entrants and ILS inflows.

The loss environment remained manageable, with the Los Angeles wildfires affecting only a small number of programmes and impacts mitigated by expected subrogation recoveries,” Howden Re’s report explained.Adding: “A combination of these dynamics drove price softening at 1 January 2026, with risk-adjusted pricing falling by between 12.5% and 21%, although outcomes varied widely depending on coverage scope, attachment points and underwriting profitability.There was more limited movement on terms, with retrocessionaires typically unwilling to broaden coverage to include non-natural perils such as SRCC and terrorism.” Switching attention to casualty, Howden Re noted that the January renewals were marked by improved supply dynamics.

Within the US in particular, outcomes were described as performance-driven against a backdrop of persistent long-tail loss development, ongoing reserving concerns and sustained demand for protection.The broker also said that the expanding role of casualty ILS and sidecars was an additional important factor in the US renewal process.The casualty ILS market particularly experienced substantial momentum throughout 2025, with a number of transactions in the second half of the year suggesting a trajectory of potential exponential growth, Tim Ronda, CEO of Howden Re, commented: “Healthy supply dynamics and increased competition, particularly in property-catastrophe, created a genuine re-balancing of the market at this renewal.

This, in turn, created meaningful opportunities for Howden Re clients in securing broader coverage, improved structures and attractive pricing, even as risk remained structurally elevated.Howden Re’s role at this renewal was to help clients navigate a more competitive, but still disciplined environment.The best outcomes were achieved through working with markets and capital providers to execute holistic, data-led programme solutions that balanced pricing, structure and risk transfer across portfolios.” David Flandro, Head of Industry Analysis and Strategic Advisory, Howden Re, added: “The 1 January 2026 renewal confirms that pricing momentum has turned decisively, with risk-adjusted reductions across most major lines bringing rates back towards levels last seen around four years ago.

The shift has been driven by strong retained earnings and record ILS issuance, increasing capacity and competitive tension.This is not a return to the underwriting practices of the last soft market.Attachments remain elevated by historical standards, terms and conditions are tighter; capital is being deployed selectively.

The result is a market that is softening but still rational – one that continues to price volatility appropriately and create economic value for investors.” David Howden, Founder & CEO, Howden, noted: “The message coming from our analysis of (re)insurance markets is clear: this is a rare moment where everyone stands to benefit.We’re in the midst of a softening market where prices are falling despite elevated political and economic volatility.By doing more to harness data, anticipate future risks, and innovate to respond to the needs of clients, (re)insurers can stay ahead of the curve and continue to be profitable.

This will mean that clients will have even greater choice to better protect themselves from unexpected shocks – whether political, cyber-related, litigation-driven or property-based.So 2026 will be a year of enormous possibilities.It’s up to both businesses and (re)insurers to take advantage.” ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis