The insurance-linked securities (ILS) market is exerting growing influence on global reinsurance market dynamics according to broker Gallagher Re, who reports property catastrophe pricing as down between 10% and 20% at the key January 2026 renewals.But, the influence of the insurance-linked securities market and alternative reinsurance capital is increasingly evident outside of property catastrophe risks as well, with Gallagher Re estimating that alternative capital activity in longer-tailed lines of reinsurance business has roughly doubled over the last year.The January 1st 2026 reinsurance renewals saw cedants presented with options and opportunities, as increased available reinsurance capacity resulted in “a renewal characterized by choice, change, and opportunity for cedants”, Gallagher Re explains in its 1st View report today.The January 2026 renewals saw reinsurance capital partner relationship quality and consistency of terms front of mind, and concurrency in price and coverage was both “achievable and prioritized”, the reinsurance broker said.

Gallagher Re is the latest to forecast that global reinsurance capital has reached new highs at the end of 2025, with traditional capital expanding roughly 8% to US $710 billion and alternative capital rising 12% to US $128 billion by a September 30th estimate, for a total reinsurance capital base of US $838 billion.That glut of capital in the reinsurance market resulted in pricing pressure and improved outcomes for broker’s clients at the renewals.Gallagher Re reports that, “Risk-adjusted property catastrophe pricing decreased 10 to 20% on average driven by material movement in all geographies.” The global property reinsurance market was “dynamic” with many buyers prioritising price reductions.

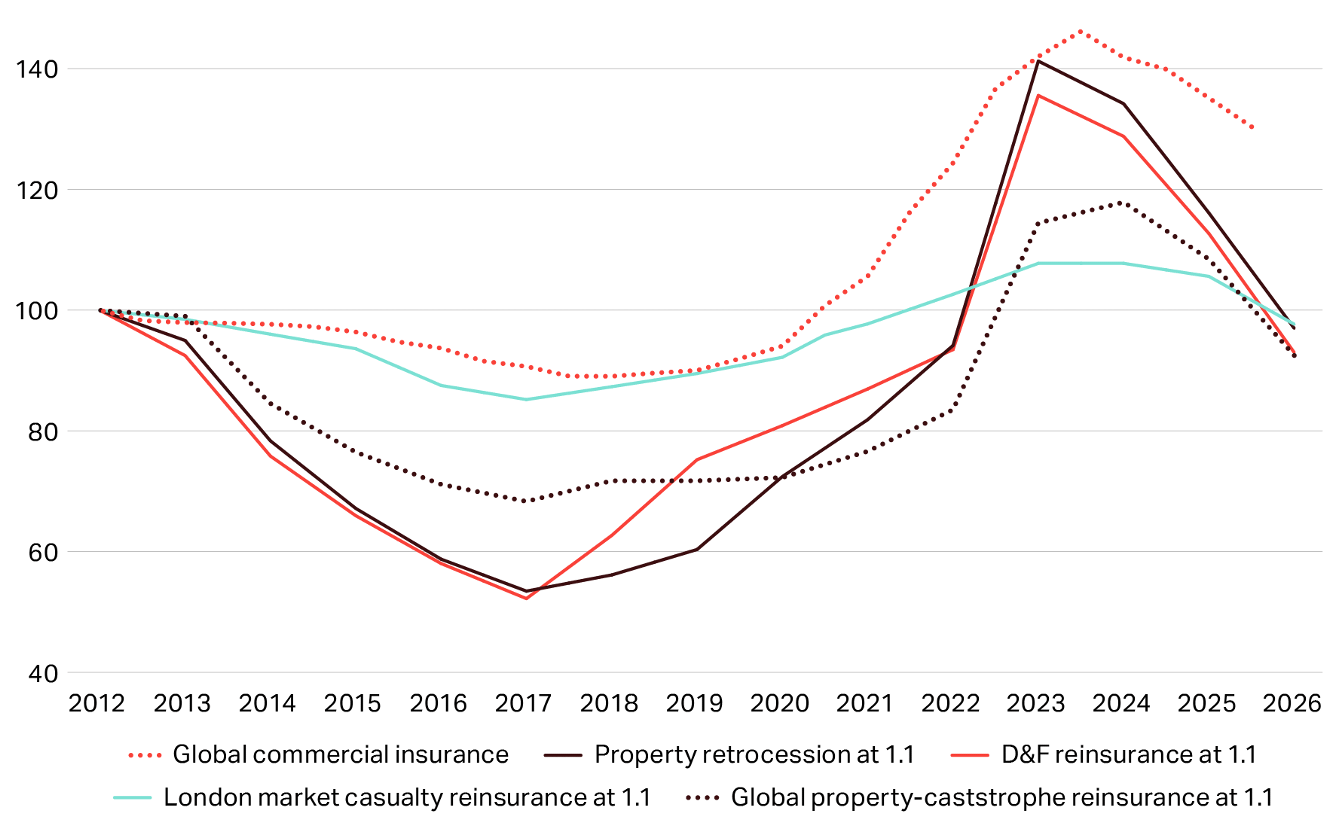

However, some cedants sought out improved coverage instead, notably in reducing volatility that Gallagher Re says they “never elected to reassume.” The broker said that is a trend it expects to accelerate through the coming year, which perhaps gives a hint at where it sees the April and mid-year reinsurance renewals trending.Gallagher Re tracks risk-adjusted property catastrophe rate-on-line data in indices and reported the following declines: Global – 15%; North America – 15%; Germany – 12%; United Kingdom – 20%; France – 15%; Australia – 15%.All of these remain priced well-above the soft market trough of 2018 except for the UK, where notably property cat rates are now just 1% above their previous soft market lows.

For the others: Global 50% up; NA 70% up; Germany 60% up; France 40% up; Australia 23% up.Despite the rate declines in property catastrophe reinsurance being ahead of many expectations once the renewals were signed, Gallagher Re says that “catastrophe market returns are still largely viewed as adequate.” Notably, Gallagher Re acknowledges the rising influence of insurance-linked securities (ILS) capacity at the reinsurance renewals.Explaining that, “The influence of ILS on reinsurance market dynamics continued to grow in 2025 with covered classes, perils, and structures all expanding – putting further qualitative and quantitative pressure on so-called traditional reinsurance markets.” , but ILS capacity is also expanding beyond property catastrophe risks at a rising pace.

“In long-tail lines alternative capital activity has roughly doubled over the last 12 months, adding to the available capacity at 1.1,” Gallagher Re said.Adding that, “Investors’ specific appetite for long duration liabilities and general appetite for risk as an asset class remains elevated.” At the January renewals, ILS investor appetite helped reinsurance buyers achieve strong price execution.Gallagher Re noted, “Property neared all-time lows, particularly at the top end of programs.

Coupled with expanded appetite for new perils and structures, ILS options were an increasingly valuable complement to traditional capacity at the renewal.” Tom Wakefield, Global CEO for Gallagher Re, commented, “The 1.1.26 renewal represented further price reduction and structural flexibility.Technical pricing, geography, loss history, and line of business all influenced how much programs changed.“Our top priority for the year ahead is working with our clients to tailor their reinsurance buying strategies at a moment of abundant capacity across all lines of business.

There are plenty of options and opportunities to improve reinsurance coverage, and we intend to explore all of them.” Read all of our ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis