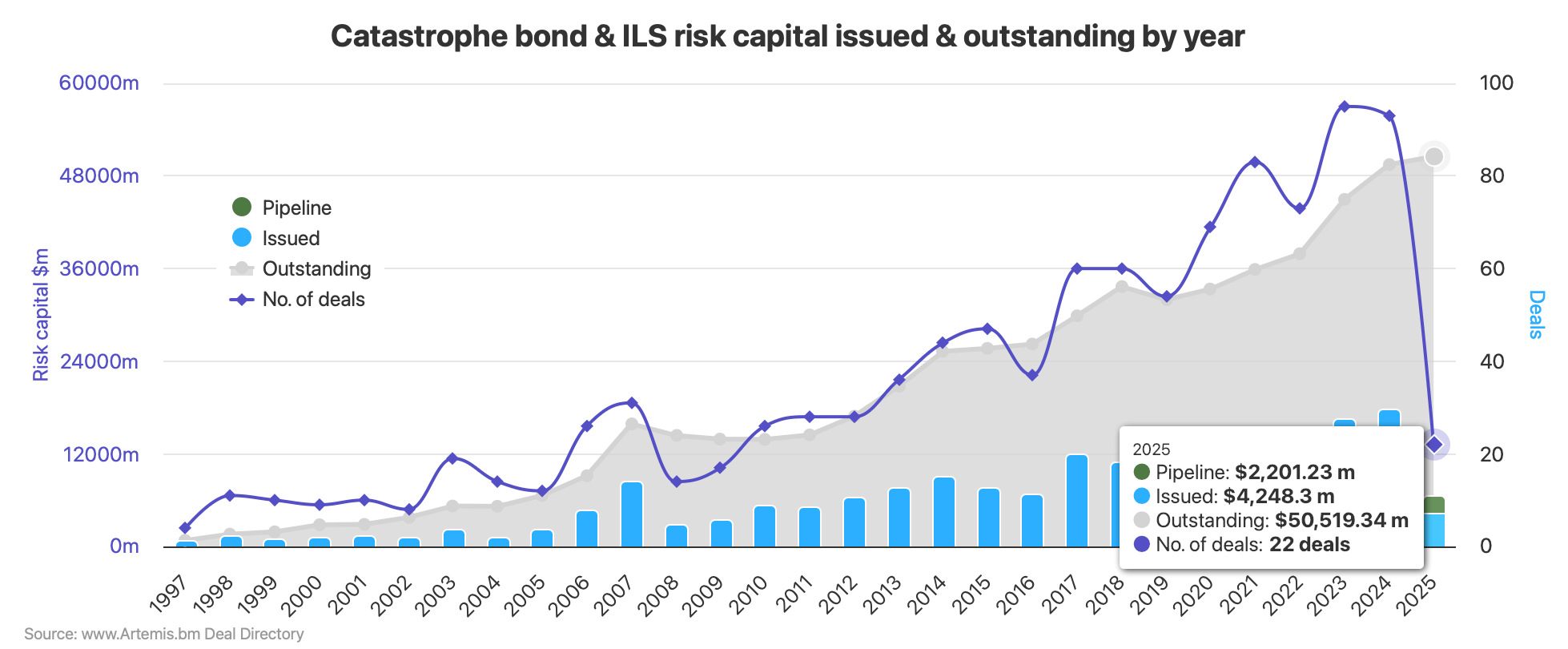

The catastrophe bond market is on-track for a stunning first-quarter of activity in 2025, with the Q1 issuance record already broken and the three-month period now projected to see more than $6 billion of cat bond risk capital issued, Artemis’ data shows.The previous first-quarter catastrophe bond issuance record was set last year at $4.233 billion, with this figure already beaten and set to be eclipsed in 2025.So far, up to this week, already nearly $4.25 billion of new catastrophe bond issuance tracked by Artemis has completed and settled, setting a new Q1 issuance record.

Helping the cat bond market keep on this record-setting pace, January 2025 was the second busiest ever for new cat bond issuance at just over $1.4 billion, while February 2025 broke the record for issuance in that month, as almost $2.59 billion of new cat bonds settled.March is looking particularly busy as well and so far Artemis has tracked over $1.41 billion of new and settled catastrophe bond issuance for this month, in just a matter of days.But, it’s the still-building pipeline that really drives home just how buoyant the catastrophe bond market is and we now project a significant record will be set for new cat bond issuance that gets settled during the first-quarter of 2025.

In fact, at this time there are another over $2.2 billion of catastrophe bonds that could settle before the end of March.Although, one of those deals, the Gateway Re Series 2025-2, may spill over into April as its settlement date is not yet defined, sources said.But, even if that does happen, it only accounts for $125 million of the pipeline, meaning that unless there are cat bonds that fail to be issued or get delayed, right now the market is on-track to eclipse $6 billion of issuance in the first-quarter of 2025, setting a significant new record for the period.

Adding up would bring the total to almost $6.45 billion by the end of March, or over $6.32 billion if that latest Gateway Re deal slips into early April.Which means, first-quarter issuance for the catastrophe bond market in 2025 is currently projected to beat the previous record from last year by at least 49%, based on Gateway falling into April, or by as much as 52% if that deal settles by month-end.Either way, beating the previous quarterly issuance record by approximately 50% is a stunning record for the catastrophe bond market, further underscoring the robustness of activity levels, the appetite of cat bond fund managers and investors, and importantly the desire to tap the capital markets for reinsurance that is being shown by the cedent and sponsor community.

Also, yes we include some private cat bonds in our numbers but in the first-quarter there have only been $84 million that we’ve tracked so far.Which means the remainder is made up of only 144A catastrophe bonds, both pure nat cat deals and any covering other lines of business we’ve seen.So the $6 billion projection also stands for 144A issuance in Q1 2025.

Meanwhile, the outstanding cat bond market, by Artemis’ measure, remains above ., .(use the key of months at the bottom to include and exclude any from your analysis).

The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list..

We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis